APY in Banking: What is it, and How Does it Affect Your Savings?

Long gone are the times when people kept their hard-earned money under mattresses or in jars. Despite all the economic turmoil of the last two decades, a bank is still a much safer place to store your cash. Moreover, entrusting your money to a solid financial institution also allows you to earn some passive income along the way. How much and how quickly? It depends on your bank's annual percentage yield (APY).

This article answers the question “What is APY in banking?”, discusses its importance, explains how to calculate APYs, and describes the difference between annual percentage yield and annual percentage rate (APR).

What does APY mean in Banking?

APY stands for Annual Percentage Yield — a benchmark index that shows how much money you can make per year if you open an interest-bearing account at a bank. Wait a minute, isn’t it just an interest rate under a different name? Not really.

Two distinct kinds of interests apply to your balance. The first is usually referred to as simple interest, a fixed percentage of the money you keep in the account. But there is also compound interest — a sum that you earn both on your savings and on the simple interest they generate. APY includes not just simple interest but also compound interest. Moreover, depending on your account type, APY can be compounded not only annually, but also monthly or even daily.

Now that you know the answer to the question “What is APY in finance?”, let’s figure out why it is so important.

Why APY Matters for Your Savings

How does APY work on savings accounts? It is obvious: the higher the annual percentage yield on a savings account, the faster your savings grow (unless you decide to withdraw the funds). And this rate applies not only to savings accounts, by the way. Some banks extend it to other financial products they offer, such as market accounts, checking accounts, and certificates of deposit (CDs). So, you can use this index to compare the profitability of different account types and understand which deposit will give you the greatest return on your investment.

When choosing a deposit, you should always keep in mind these two facts:

- APY can be fixed or variable. The former will stay the same for a long period, whereas the latter can rise and fall as the economy changes. Fixed APY usually applies to certificates of deposit, while APY on a savings account is typically variable.

- APYs also differ across banks. Many of the largest traditional banks still pay very low savings APYs (around 0.01%), while the national average for savings accounts is about 0.6% APY. In contrast, online and high-yield savings accounts commonly offer rates upwards of 4% APY and, in some cases, close to 5% APY, many times higher than both big-bank rates and the national average.

How to Calculate APY

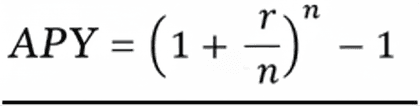

The basic formula for calculating APY is as follows:

The two variables in the formula are the annual rate presented as a decimal (r) and the number of compounding periods per year (n). Let’s see how the calculation process goes.

Suppose you deposited $1,000 to open a savings account with a monthly compounded interest rate of 3%. Then, r equals 0.03 (3% in decimal expression), and n equals 12 (for 12 months in a year). The values can now be used in the formula.

APY = (1 + 0.03/12)^12 – 1

After doing the math, we get 0.0304. To get the final picture, the decimal should be converted back to a percentage, which gives us 3.04%.

What does this APY mean for you? At the end of the first year, your $1,000 will turn into $1,030.41. In five years, you’ll get to $1,161.53 (if you don’t add any more money yourself). How much would you get without compound interest? Only $1,150. The difference is not that impressive, but the greater your deposit is, the more significant it will become.

There’s one more index used in banking operations alongside the annual percentage yield — the annual percentage rate (APR). Are they the same?

APY vs. APR: Highlighting Key Differences

In short, both indices are used to describe the amount of interest. However, APY refers to the percentage you earn, whereas APR denotes the rate you pay.

As we have seen, annual percentage yield is the total interest you will earn on your deposit in a year. The annual percentage rate describes the total interest, including simple interest and various fees, that you will pay per year when borrowing money via a loan product (credit card, auto loans, student loans, mortgages, etc.).

So, knowing APY is useful when considering an investment and comparing different accounts and banks. And when you plan to borrow money from a bank or any other lending organization, APR is the first metric you should discover, since it shows how much the loan will cost you.

In banking, you should always look for the maximum APY and the minimum APR.

Epilogue

Annual percentage yield (APY) is the basic index that all individuals should take into account when depositing money into a bank or other financial institution. It describes the total earnings (known as compound interest) you will receive after your money has been kept for a year. APY can be fixed or flexible, and varies by account type and bank (neobanks typically offer a significantly higher APY than traditional banks).

The annual percentage rate (APR) is another baseline metric used to measure a client’s interactions with a bank. It denotes the total amount you would have to pay over a year if you borrow money. In basic terms, APR is the annual cost of the loan.

When dealing with banks, a wise customer looks for the highest APYs and the lowest APRs.