Best Business Checking Accounts (2024)

Contents

- Where Can You Open a Business Account in 2024?

- 1. Chase Business Complete Banking

- Monthly fees

- Minimum balance requirements

- Transaction limit and fee

- Interest rate and APY

- Other features and benefits

- Pros:

- Cons:

- How to open an account?

- 2. Axos Bank Basic Business Checking

- Monthly fees

- Minimum balance requirements

- Transaction limit and fee

- Interest rate and APY

- Other features and benefits

- Pros:

- Cons:

- How to open an account?

- 3. Bluevine Business Checking

- Monthly fees

- Minimum balance requirements

- Transaction limit and fee

- Interest rate and APY

- Other features and benefits

- Pros:

- Cons:

- How to open an account?

- Final Thought

- FAQ

- Where Can You Open a Business Account in 2024?

- 1. Chase Business Complete Banking

- Monthly fees

- Minimum balance requirements

- Transaction limit and fee

- Interest rate and APY

- Other features and benefits

- Pros:

- Cons:

- How to open an account?

- 2. Axos Bank Basic Business Checking

- Monthly fees

- Minimum balance requirements

- Transaction limit and fee

- Interest rate and APY

- Other features and benefits

- Pros:

- Cons:

- How to open an account?

- 3. Bluevine Business Checking

- Monthly fees

- Minimum balance requirements

- Transaction limit and fee

- Interest rate and APY

- Other features and benefits

- Pros:

- Cons:

- How to open an account?

- Final Thought

- FAQ

Active business accounts refer to accounts in financial institutions designed for legal entities or individual entrepreneurs to manage their finances. Their key advantages include:

- Short-term storage of corporate funds

- Convenient fund management

- High transaction speed

You can seamlessly allocate corporate and personal finances by obtaining one of the best business bank accounts. This will also help you avoid confusion when it comes to company-related expenses or conducting financial transactions with clients, partners, and suppliers.

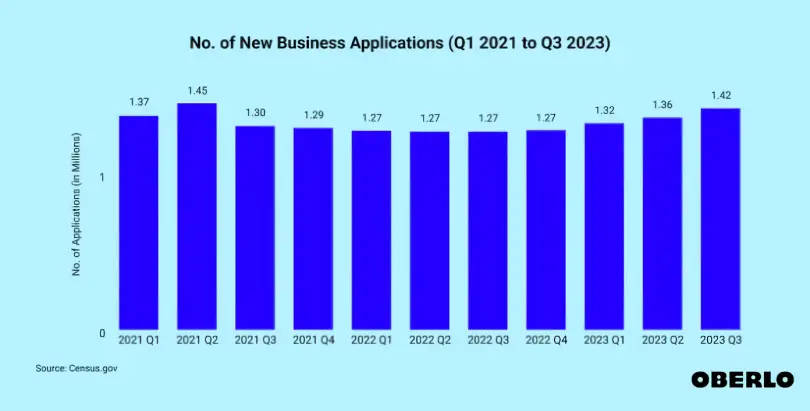

Statistics from Oberlo showed that during the third quarter of 2023, 1.42 million applications were submitted to open a new business. This is 11.7% more than in a similar period in 2022.

Source: Oberlo

With such a huge number of new enterprises on the market, the need to open checking accounts is also growing. Both individual entrepreneurs and companies require stable banking services to properly conduct their business. Therefore, in the article, we will share where to find the best business checking account and discuss the procedure for obtaining it. We will also discuss terms of use, limits, advantages and disadvantages, and other features of such accounts.

Where Can You Open a Business Account in 2024?

Rates experts have researched the top three banks that offer account opening services for individual entrepreneurs and small, medium, and large businesses.

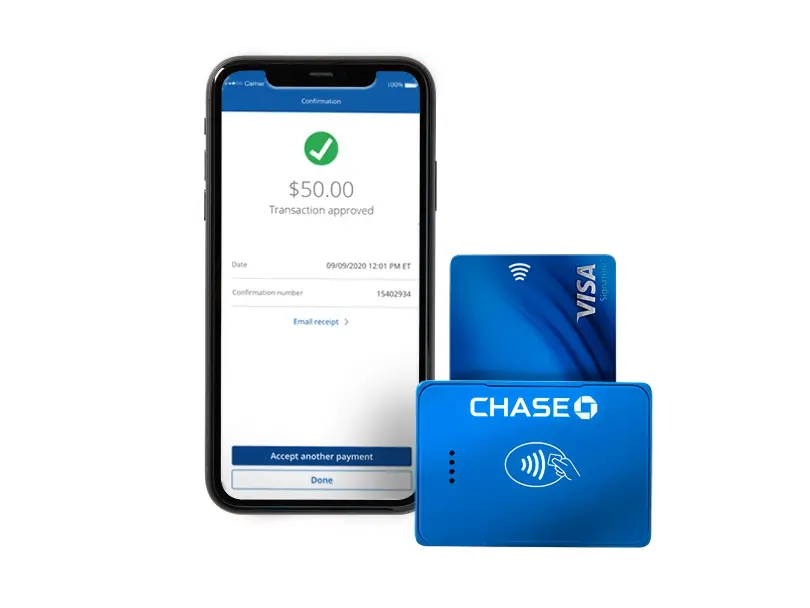

1. Chase Business Complete Banking

Chase is considered the best bank to open a business account, as it provides services for entrepreneurs regardless of the size of their company.

Monthly fees

The service cost for individual entrepreneurs is $15 per month. There are several cases when you can reduce the fee to $0, like having a military status.

Minimum balance requirements

None. However, maintaining a minimum daily balance of $2000 will reduce your service fee to $0.

Transaction limit and fee

The daily spending limit for Chase Business debit cards is $10,000. The overdraft fee is $34.

Interest rate and APY

Not provided.

Other features and benefits

For new Chase customers, a $300 bonus is offered. After opening an account at a bank branch or online, you need to make a minimum deposit within the next 30 days. Maintain this balance on the card for 60 days and complete 5 qualifying transactions within 90 days of registration. The reward will be credited to your account within 15 days.

Pros:

- Access to cash on the same day (except Saturdays) when the deposit is approved by 8:00 PM.

- Unlimited electronic deposits and cash deposits up to $5,000 without a replenishment fee.

- Easy virtual payments through the QuickAccept mobile app.

- Send and receive online bank transfers using Chase QuickDeposit and Chase Online Bill Pay.

Cons:

- Only 20 free paper check transfers when visiting the bank in person.

- Monthly service fee if the reduction requirements are not met.

How to open an account?

To obtain a current account at Chase, you need to fill out an application on the bank's official website. Some accounts can only be opened at an offline bank branch, and you may need documents confirming your identity, a company income statement, contact information, and more.

2. Axos Bank Basic Business Checking

Axos is another strong contender for the title of the best bank for small businesses and enterprises operating online.

Monthly fees

None.

Minimum balance requirements

None.

Transaction limit and fee

No limits on processing debit and credit card transactions, as well as deposited assets.

Interest rate and APY

Not provided.

Other features and benefits

You can earn up to $700 in the form of cashback by connecting your Axos personal and business checking accounts. For this, you need to use the AXOS700 code during registration, maintain a $50,000 balance in the account for 5 statement cycles, and make at least 10 POS transactions each month.

Pros:

- A basic business account with no monthly service fee.

- The first set of paper checks is free.

- No restrictions on ATM transactions within the country.

Cons:

- No physical bank branches.

- Outgoing fund transfers, paper statements, and paper checks incur fees.

How to open an account?

To register and obtain a business account, you need to fill out an application on the official website and prepare some documents.

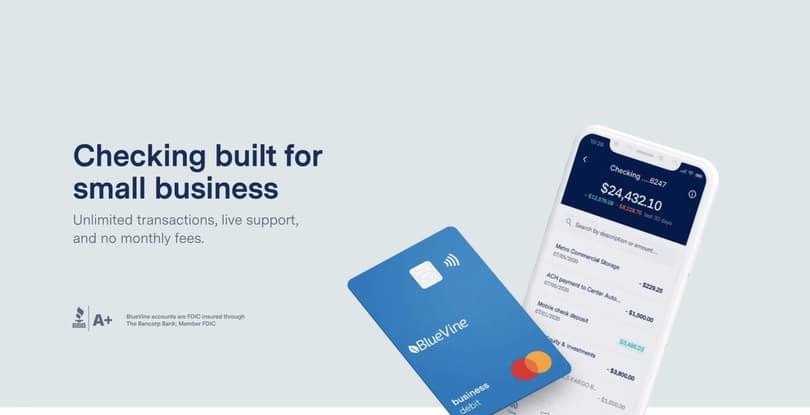

3. Bluevine Business Checking

Bluevine is a banking technology company closely collaborating with the service provider Coastal Community Bank. The company offers a top business checking account with numerous advantages for small businesses.

Monthly fees

None.

Minimum balance requirements

None.

Transaction limit and fee

Unlimited transactions. No fees for insufficient financial assets on the account. Additionally, no fees are charged for cash withdrawals at over 37,000 MoneyPass ATMs.

Interest rate and APY

Provided 2.00% APY for balances up to $250,000, with monthly expenditures of $500 using the Bluevine Business Mastercard debit card. Alternatively, receive payments of $2,500 to the Bluevine Business corporate account by any means.

Other features and benefits

The Bluevine mobile app ensures 24/7 access to your corporate accounts and their management from anywhere in the world. The program also provides customer support and an online resource center to resolve any potential issues. The bank offers two free checkbooks and special credit lines for high-interest businesses.

Pros:

- Easy money transfer between accounts and the ability to plan both one-time and regular payments to suppliers or customers.

- No requirements for an initial minimum deposit and balance.

- Competitive APY rates.

- Option to create sub-accounts for employees.

Cons:

- Fee for cash deposits.

- The bank has no physical branches.

How to open an account?

You can only open an account online on the Bluevine website. To do this, you need to fill out the application form and register.

Final Thought

Each of the three banks we've discussed offer the best business accounts for entrepreneurs, with favorable service conditions, the use of debit and credit cards, and straightforward registration requirements. To determine which one is suitable for your enterprise, consider the following points:

- The goals for which you need a current business account.

- The primary type of transactions using corporate cards.

- The terms, interest rates, and fees the bank offers.

This way, you can select the best bank for a business account that will fully cover your company's needs in conducting various financial transactions.

FAQ

What is a business checking account, and why do I need it?

A business checking account is an active account that allows you to transfer and receive money. You require it to make deposits, complete check payments, and conduct transactions using a bank card.

What are the tips for managing my business checking account?

Even the best small business checking account requires some management. That is, you shouldn’t use your business account for personal transactions, as it can lead to higher taxes and accounting problems. It is also advisable to regularly monitor your account, automate recurring transactions, track business expenses, and stay informed about banking fees and offers.

What documents do I need to open a business checking account?

The document package may vary depending on the specific bank's requirements. However, more often than not, to apply for a top business bank account you need to provide a copy of your passport, contact details, the enterprise's founding documents, and information about its income and expenses.