Best Ways to Send Money Internationally: Top Methods Reviewed

Cross-border money transfers are often necessary for a variety of reasons, but what is the best way to send money internationally? Banks used to be the go-to option, but now specialized services offer better value, convenience, and speed.

This article reviews the top international money transfer platforms, comparing their services and fees to help you identify the best way to transfer money overseas.

Best Ways to Send Money Internationally

What is the best way to send money abroad? Here’s a closer look at some of the most popular international money transfer services.

PayPal

Coverage: With availability in 200+ countries and the support of over 25 currencies, PayPal is currently one of the most convenient options for global money transfers. You can send funds to a bank, PayPal account, or even a mobile wallet.

Cost: On average, PayPal charges 5% of the transaction amount, plus a fixed fee that depends on the recipient’s country. Currency conversion fees apply, ranging between 2.5% and 4% above the base exchange rate. Find out more about PayPal fees here.

Speed: Transfers between PayPal accounts are instant, whereas sending funds to a bank takes up to 5 business days.

Transfer Limits: If you don’t have a PayPal account, you can send a one-time payment of up to $4,000. However, with a verified PayPal account, there are no overall limits on the total amount you can send, though individual transactions can be capped at $60,000.

Customer Experience: PayPal is known for its ease of use, strong security, and responsive customer service. Is it the best way to send money internationally? Not always. When dealing with large sums, high transaction costs and exchange rate markups can be a drawback.

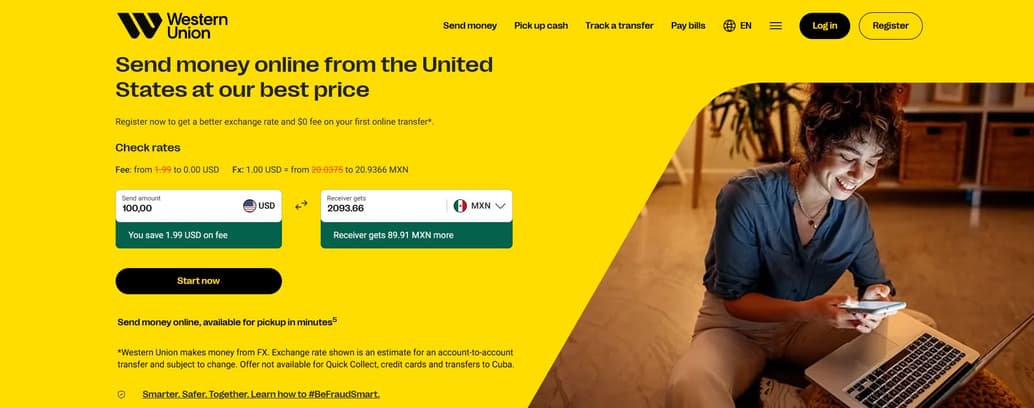

Western Union

Coverage: Western Union offers a global presence in over 200 countries and territories. It supports transfers in more than 130 currencies.

Cost: Cross-border transfers typically incur fees ranging from $35 to $50.

Speed: WU provides flexible transfer speeds to suit your needs—instantly, by the next day, or within 2–5 days.

Transfer Limits: Transfer limits vary by destination. For example, you can send up to $5,000 to Mexico and $50,000 to India. Be sure to check the Western Union website for the latest updates.

Customer Experience: Western Union stands out for its vast coverage and ease of use, especially for cash pickups. However, its fees and less favorable exchange rates may not make it the best international money transfer option for all transfers.

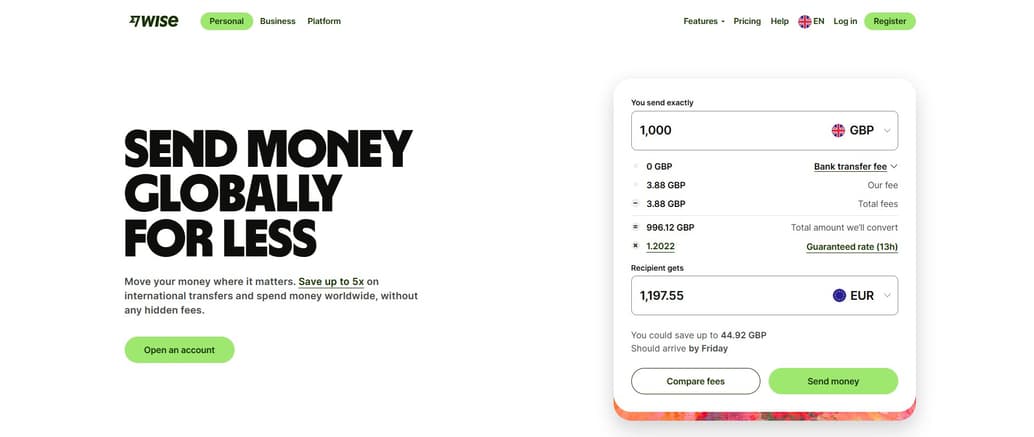

Wise

Coverage: Operating in over 80 countries, Wise works with 40+ currencies for international transfers.

Cost: Wise is known for its low, transparent fees, which include a flat fee plus a percentage of the transferred amount, usually between 0.4% and 1%. Wise uses the real exchange rate without a markup, making it one of the most affordable ways to send money internationally.

Speed: Transfers typically take up to 2 business days.

Transfer Limits: Transaction limits depend on the currency and the sender’s location. If your routing number starts with 084, there’s no limit to how much you can receive into your Wise account. Find out more about Wise international transfer fees in 2024 here.

Customer Experience: Wise attracts users with its transparent pricing, low fees, and competitive rates. However, it’s important to note that it may not be the best option for urgent transfers.

Xoom

Coverage: Xoom is a PayPal service available in 160+ countries. It primarily deals with four major currencies: US Dollar (USD), Canadian Dollar (CAD), Euro (EUR), and British Pound (GBP). However, when sending money, you can choose from over 98 currencies.

Cost: Fees vary depending on the transfer destination, payment method, and speed. Generally, bank transfers incur lower fees, while card payments come with higher fees. Additionally, Xoom typically marks up currency exchange rates by approximately 2–4%.

Speed: In most cases, most recipients can access the transferred funds within minutes. However, the speed of the transfer may also depend on the availability of funds from your payment source—whether it’s a checking account, credit card, or debit card.

Transfer Limits: The sending limits depend on several factors, including your location, the delivery method, and the limits set by Xoom’s payment partners.

Customer Experience: Xoom offers a quick and user-friendly experience. But is it the best way for international money transfer? For larger transfers, the higher fees and exchange rates markups might make it less attractive for international money transfers.

How To Send Money Internationally?

No matter which platform you choose, the process for sending money internationally tends to follow a standard flow:

Register or Sign In

First, create an account or log into your existing one on your chosen platform. Most services make this step simple and user-friendly.

Provide the Recipient’s Details

Next, enter the recipient's information, including their full name, address, and banking details.

Choose How Much Money To Send

Input the amount you wish to transfer. Many platforms will display the fees and the projected exchange rate at this point.

Select Payment Method

Select an appropriate funding option, such as a bank account, credit card, or debit card. Additionally, some services allow payments using a PayPal balance or other digital wallets.

Review and Confirm

Double-check the details, including fees, the total debited amount, along with the estimated delivery time. Once the transaction is confirmed, you’ll receive a notification or email confirmation.

Track the Transfer

Many services offer robust tracking features, enabling you to easily monitor the status of your transfer online in real-time. For instance, this is how Western Union allows you to track your transfers.

In short, when deciding on the best way to transfer money internationally, it’s important to compare costs, transaction speed, and ease of use. The benefits vary from service to service, depending on your specific needs. Wise typically offers lower costs and more favorable exchange rates for regular transfers. However, if you’re in a rush or need cash quickly, Western Union might be the better option.

![Does Chase Bank Have a Notary? [Complete Guide]](https://rates.fm/static/content/thumbs/385x210/8/8e/bi6ezw---c11x6x50px50p--f48cb9f72af321dbb5c42412d17da8e8.png)