How to Open a Chase Bank Account?

For better or worse, having a bank account is near-mandatory to participate in modern society. Thankfully, there are plenty of options to choose from, all packed with reward programs, welcome bonuses, and other perks. Among those, Chase was always one of the better options you can go for. It is known for reliability, having lots of account types, excellent mobile banking, and more.

Chase Bank is a subsidiary specializing in consumer and commercial banking services under the transnational holding company JPMorgan Chase.

In 2024, JPMorgan Chase ranked first among the world’s largest banks, with its market capitalization reaching $610.57 billion.

Bank | Market Cap (August 2024) |

|---|---|

JP Morgan Chase | $610.57 B |

Bank of America | $300.68 B |

Industrial & Commercial Bank of China | $291.46 B |

Agricultural Bank of China | $233.78 B |

Wells Fargo | $188.77 B |

Bank of China | $188.76 B |

China Construction Bank | $187.86 B |

Royal Bank of Canada | $159.81 B |

HSBC | $159.21 B |

Goldman Sachs | $156.78 B |

HDFC Bank | $153.53 B |

So, what do you need to open a bank account at Chase?

Step-by-Step Guide on How to Open a Chase Bank Account

What do I need to open a Chase bank account? Not much, as the process is relatively straightforward, and can be completed in just a few minutes on the bank’s website or at your local branch. It includes the following steps:

Step 1: Choose an Account

The first thing to do is to choose an account type that meets your current financial needs. With Chase, you can open checking, savings, business accounts, and more. Each has distinct features and its own fee structures, including Chase wire transfer fee. You can find all the information about these on the bank’s official website. And for information on how to avoid wire transfer fees in Chase, see our separate article. Think a bit about your financial goals and compare your options to find the best fit.

Step 2: Gather Documents

The next step is to prepare the documents needed to verify your eligibility. To create a Chase Bank account, you’ll need to provide:

- Passport with a photo;

- Social Security card or ITIN;

- Driver’s license or ID;

- Birth certificate (minors only);

- Proof of address (bank statement, lease agreement, utility bills, etc.).

The list may vary depending on whether you are a US citizen, permanent resident, or non-resident.

Step 3: Apply

You can apply either at a local Chase branch or on the bank’s website. Please note that the online option is available only to customers who are 18 or older and can provide a valid identification.

How can I open a Chase bank account online? Visit the bank’s website, fill out the application, and submit the required documents for verification. You will later receive an email confirmation of your application and a second email with verification results (i.e., whether your request to create an account has been approved). If your request weren’t approved, you would also receive an email detailing the cause of rejection.

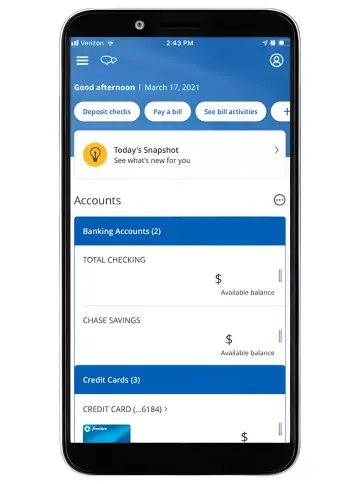

Step 4: Check Bank Account

If your application is approved, log in to your account through the website or mobile app. Upon successful login, you’ll see a dashboard with your account information, current balance, recent transactions, and other details. You can also receive electronic statements and documents related to your account. If you have multiple accounts with Chase Bank, such as checking and savings, you can easily switch between them using built-in navigation tools.

By the way, you can use the Chase credit journey features to learn more about your credit report and your credit score.

Step 5: Manage Your Chase Bank Account

Congratulations! Now you can send money, make deposits, pay bills, withdraw funds, and use other banking features Chase offers. You can set up automatic payments, receive transaction alerts, etc. If you have questions or encounter issues, contact Chase customer support by phone, online chat, or in person at any local branch.

If you suddenly no longer need to use Chase, close the account, and stopping using it is always easy.

Final Thought

Chase Bank is among the most reliable financial institutions available to US citizens and residents, making it a natural choice for your first bank account.

The primary requirements to open a Chase Bank account:

- An applicant must be at least 18 years old (however, accounts for minors with added parental control are also available);

- An applicant must provide a complete set of documents confirming their identity and residential address.

With a Chase Bank account, you can enjoy quick and secure transactions, improved financial management, electronic statements, and much more. Additionally, it grants access to more advanced banking services like business loans, insurance, and investments, but those will be covered in a separate article. And good luck with your new bank account!