Monzo vs. Revolut: Comparing Features and Benefits

Contents

The contemporary fintech landscape is defined by the rapid rise of challenger banks. Operating exclusively through dedicated apps and without traditional high-street branches, these banks deliver high-quality financial services at competitive prices, which are often far below the fees and rates offered by any conventional bank.

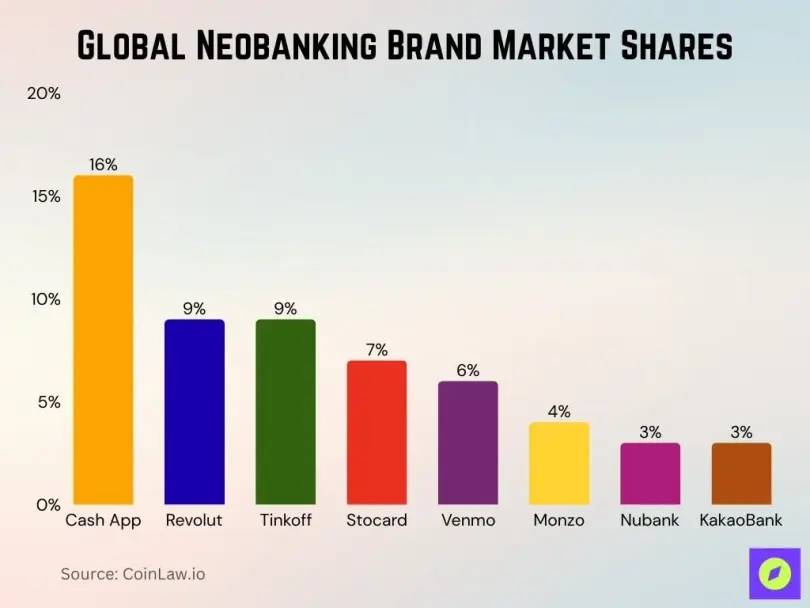

The popularity of such digital-only companies has surged in recent years, growing from 188 million users three years ago to a projected 377 million by 2027. Notably, 38% of these digital-only institutions are based in Europe. With such rapid expansion, how can customers avoid getting lost in the sea of financial service providers and their offerings?

This article presents a comprehensive Monzo versus Revolut comparison as two juggernauts in the niche, covering their services, fees, perks, security, customer support, and more to help you decide which is better — Monzo or Revolut.

Monzo and Revolut Services Overview

Both innovation-driven fintech companies launched in 2015 and quickly captured a significant share of the UK banking market (with Revolut’s share now more than twice that of Monzo).

If you sign in with Revolut, you can set up a personal or business account (linked to Google Pay and Apple Pay) with a debit card for spending. Revolut supports transfers to 160+ countries in 70+ currencies, and you can hold or exchange 25–30+ currencies in-app. Revolut was granted a UK banking license in mobilization, but most customer accounts are still under its e-money entity. These funds are safeguarded under e-money regulations but are not protected by the FSCS until accounts are migrated.

By contrast, Monzo already provides government-guaranteed fund protection that covers deposits up to £85,000 per person. It also offers regular banking services, including overdraft. The range of bank accounts is almost identical, with the same option to link them to Apple Pay and Google Pay. Unlike Revolut, each Monzo account includes a savings pot option, allowing money to be ring-fenced for specific purposes but moved between pots when needed. Monzo’s savings rates vary depending on the product and over time.

Let’s compare Monzo and Revolut in terms of the services they provide.

Revolut and Monzo Account Services Showcased

Out of the five accounts tiers available at Revolut, the free one includes a debit card with fee-free spending in the UK and abroad. Monthly payments for fee-charging accounts equal £3.99 for Plus, £7.99 for Premium, £14.99 for Metal, and £45 for Ultra. Higher tiers unlock extra benefits such as fee-free ATM withdrawal limits, shopping discounts, airport lounge access, baggage insurance, and more. On the free and Plus plans, you can withdraw up to £200 per month without fees; anything above incurs a 2% charge.

Monzo also offers a free account, but with fewer paid accounts: Extra (£3 per month), Perks (£7 per month), and Max (£17 per month). The Monzo app helps customers track daily spending and provides a budgeting tool to manage finances.

The main difference between Revolut and Monzo is that the latter allows for up to £3,000 overdraft, with an interest rate tailored to the customer’s credit score and history (19%, 29%, or 39%). Monzo debit card spending overseas is also fee-free, and ATM withdrawals are unlimited in the UK and the European Economic Area. Outside these regions, free and Extra Monzo customers can cash out up to £200 per month, while Perks and Max accounts allow up to £600. Beyond those limits, a 3% transaction fee applies on any account holder.

Monzo also offers pension consolidation through BlackRock, with a standard annual fee of 0.63%. Customers on paid plans benefit from a reduced platform fee, lowering the total cost to about 0.53%.

What about using Revolut vs. Monzo abroad for money transfers?

Money Transfers: Revolut vs. Monzo

Both banks enable international money transfers, but Monzo partners with Wise for this service. To send money abroad, Monzo customers must first connect their account to Wise. Is Revolut better than Monzo in this regard? Let’s compare their money transfer policies.

Exchange rate

Monzo uses Wise rates, which add a small fee on top of the mid-market rate. Similarly, Revolut’s exchange rates are formed by adding fees to the mid-market rate.

Transfer fees

At Monzo, fees vary depending on the currency and destination. Typically, the charge is a sum of a flat rate (between £0.31 and £0.61) and a variable amount up to 1.3%.

Revolut charges no fees within the Single Euro Payment Area, but fees apply outside it and are calculated based on transaction size. Currency exchange under £1,000 per month for Revolut customers is free only on weekdays, but weekends and public holidays carry a 1% fee.

Transfer speed

Monzo does not guarantee a standard transfer timeline, making it conditional upon the place you send money to. Transfer times depend on the destination, currency, and method, with details shown in the app. However, if you are a Premium or Ultra account holder, you are entitled to a shorter transfer time.

To make the comparison between the two banks clearer, here’s a direct comparison.

Revolut vs. Monzo: A Comparison Table

Characteristics | Revolut Standard Account | Monzo Current Account (including Wise for money transfers) |

|---|---|---|

Monthly account fee | Free | Free |

In-credit interest | up to 4% | 3.35% |

Debit card | Free (delivery charges may apply), replacement card costs £5 | Free, and a free replacement card (if the original is lost or stolen in the UK) |

ATM usage | Free worldwide up to £200 or 5 withdrawals a month, 2% fee beyond this limit | Free worldwide up to £200/month (if not main account); 3% beyond. No restrictions if used as the main account |

Overseas card usage | Fee-free debit card | Fee-free debit card |

Currencies supported for money transfers | 70+ | 40 (via Wise) |

Money transfer fee | No fees on weekdays up to £1,000/month, 1% charge beyond this limit in the eurozone, variable fees for transfers outside eurozone | Depends on the currency, transaction value, and transfer method; a sum of a Wise fixed fee, a percentage, and 0.3% of the Monzo partner fee |

Exchange rates | Interbank rate | Mid-market Wise rate |

FSCS fund protection | No | Yes |

Yet, there are some comparison criteria that aren’t included in the table.

Revolut vs. Monzo: App Security

Revolut authentication includes biometric checks and multi-factor verification through its app, rather than relying solely on passwords, Face ID, or fingerprints. You can always turn off/on such functionalities as online, contactless, or ATM payments, and freeze the card if it is stolen or lost.

Monzo login is handled through a secure email “magic link,” combined with strong customer authentication for online payments and in-app approvals. Additionally, any in-app financial operation requires entering a PIN. Another layer of security technique is applied by Monzo for online payments. All online purchases should be verified either in-app or by text.

On balance, Monzo wins security-wise. What about using Monzo or Revolut for travelling?

Monzo vs. Revolut: Travelling Benefits

Revolut allows spending worldwide and transfers to more than 160 countries in 70+ currencies, but exchange fees apply above monthly allowances or on weekends. Rules for ATM withdrawals overseas are the same as those within the UK: up to £200 fee-free per month (2% fee beyond the limit) and up to £1,000 fee-free money transfers or spending per month (0.5% fee beyond the limit).

The main drawback of using Revolut abroad is its weekend currency exchange markup. Depending on the currency, it ranges from 0.5% to 2.5%.

Monzo goes out of its way to support customers by sending travel reports as soon as they arrive in a country. The memo includes the current exchange rate and tips on using the card at the destination. Spending with Monzo overseas is fee-free in any country and in all currencies. To exchange money, the bank applies Mastercard’s exchange rate with no additional charges. ATM withdrawals are fee-free within the eurozone and unlimited in amount. Outside this area, you can withdraw up to £200 per month fee-free, after which a 3% charge applies.

All in all, using Monzo or Revolut for travel is equally beneficial.

Revolut vs. Monzo: Customer Support

In Revolut’s in-app live chat, customers can speak directly with a human representative (not a bot), which essentially speeds up problem-solving. And if you are a Premium or Metal tier client, your call will receive priority support. In case you want to freeze your card in an emergency, an automated phone line is at your service.

Monzo offers two dedicated phone numbers for customer support (one for calls inside the UK and another for calls from abroad), both connecting you to a human representative. In-app live chat is also available.

Drawing a Bottom Line

In Great Britain, Monzo and Revolut are two leaders in the sphere of digital-only banking. Both companies provide a wide range of fintech services, including free and paid accounts, domestic and international money transfers, currency exchange, ATM withdrawals, and more. They also offer useful travel perks, responsive customer support, and secure financial operations. Your choice between them should depend on which provider’s benefits, Monzo’s or Revolut’s, best match your specific needs.