Routing Number: What is it, and Where Can I Find it?

Regardless of the bank you stick to, you get a unique account identifier and also have to use a specific routing number for your transactions. But what is a routing number? And how many numbers are in a routing number? Well, it is a nine-digit sequence used by US financial institutions to mark their operations. The approach was first developed in 1910 to increase transaction efficiency and has remained in use ever since.

Even if there are online banks with similar names, a routing number ensures that they are not mistaken for one another. Moreover, large banks often use more than one routing number in their operation. If a bank is assigned several numbers, they can be used for different locations, so it’s something to keep in mind.

If you’re asking yourself, “Where do I find my routing number?”, “How can I use it?, or “Can I change it?” it’s your lucky day, as we will answer all of those in the article.

Where Can You See Your Routing Number?

It’s a rare person who can recite their bank’s routing number off the top of their head, so it’s better to know where to look it up.

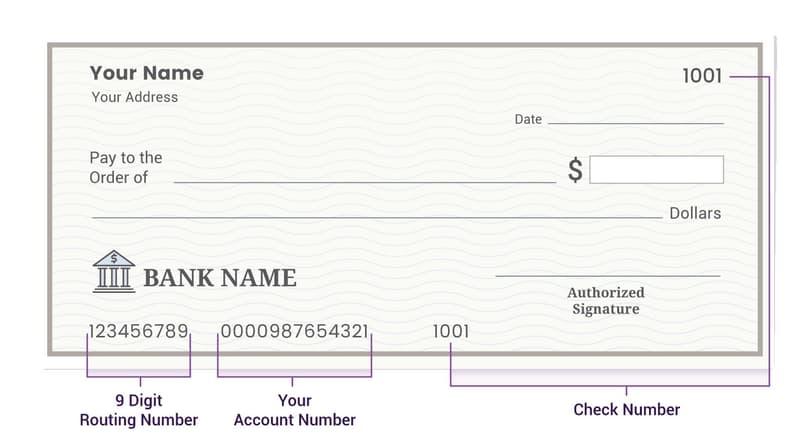

Where is the routing number on a check? When you look in the bottom left corner of a check, you will see a long line of digits. The first nine numbers are your routing number, and it's as simple as that.

Where can you find your banking routing number if you don’t have a check on hand? This also won’t require anything special. There are several ways to find out this information:

- A routing number is always provided either on your bank’s official website or in its app, regardless of which bank you use.

- If you have a bank statement nearby, you can find your routing number there.

- Another option is to refer to the ABA routing number lookup.

- You can always contact the bank’s customer support, and they will provide you with the routing number without any additional effort on your part.

It is important to note that banks may occasionally change their routing numbers due to branch closings or restructuring. In theory, the bank’s clients must be notified about the change, but it’s easy to miss this information. If you need to make essential transactions, you should first check whether the routing number you’re using is still relevant.

Where Do You Use a Routing Number?

There are many situations when knowing the routing number is beneficial or even crucial for you:

- You need to provide this nine-digit number when you file taxes to receive a tax refund in the form of a direct deposit.

- If you decide to send money from your account to another person’s account in a different bank. The same goes for money transfer requests.

- Setting up a direct deposit or recurring bill payments.

- Another important use of a routing number is for connecting your bank account to third-party software or apps.

- Business owners also have to use routing numbers to open online stores and set up business websites so they can accept payments from clients.

These are the main situations where you need to enter your routing number or request it from someone. This number is not used for credit card or debit card purchases, so you only need it when money is sent directly to or from your bank account.

Is It Possible to Change a Routing Number?

Unlike account numbers, the routing number stays the same even if you close an account and open a new one with the same bank. So, the choice of a number is entirely up to the bank and cannot be changed.

If you enter the wrong routing number during a transaction and want to change it, it depends on how quickly the bank catches the problem and rejects the transaction. If your transaction has been denied, you can simply create a new one with the correct routing number.

If your money was deposited into the wrong account, you need to contact the bank directly and explain your problem.

Final Thought

Plenty of people wonder, “What is a bank routing number, and where can I find it?” A routing number is used to identify banks and credit unions, so it is used for various transactions, setting up direct deposits, connecting your bank account to specialized software, and so on. It’s easy to look it up either on a check, on your bank’s website or app, or by contacting customer support.

However, it is vital to find the correct routing number; otherwise, your transactions will either be invalid or your money can be sent to a different financial institution. If this happens, you have to act quickly to withdraw the transaction by contacting your bank’s customer support.