Top 8 Revolut Alternatives

If you are a UK resident and travel abroad, you will almost certainly need to exchange currency, transfer money, pay for goods and services, withdraw cash from ATMs, and perform other financial operations worldwide. For many British people, Revolut is the natural choice of fintech platform to handle all their money-related needs. It is a digital-only bank whose virtual card and online account linked to a specialized app, enabling a wide range of financial operations with no or minimal fees. However, as the saying goes, there are plenty more fish in the sea, which is true: the fintech ocean is no exception.

This article explains the reasons why you may want to consider apps similar to Revolut and provides a list of strong alternatives to Revolut that deliver the same services at competitive rates.

Alternatives to Revolut: A Head-to-Head Comparison

To clearly show what Revolut's competitors can offer, here is a quick side-by-side comparison:

Provider | Transfer fees | Transfer time | Exchange rate | Coverage |

|---|---|---|---|---|

Revolut | 0% between Revolut customers, 2.49% + $0.60 for bank and card transfers | From a few hours up to three business days | Mid-market rate if you keep within the plan limits | 36 currencies |

Wise | 0.43% of value | Between a few hours and two business days | Mid-market rate | 40+ currencies |

Monzo | 0.4% + third-party partner fees | Depends on the linked third-party services | Mid-market rate | 35+ currencies |

Remitly | 3.99% for express and 1.99% for economy transfers | Within 4 hours for express and between 3-5 business days for economy transfers | Mid-market rate + markup | 100+ currencies |

PayPal | 3.49% of the sum + $0.30–$0.50 | Transfers between PayPal accounts are usually instantaneous (or at most within minutes), while withdrawals from PayPal to a bank account typically take 1–3 business days (up to ~5 days in some cases) | Mid-market rate + 3-4% markup | 25+ currencies |

Panda Remit | Between 1.4% and 2.5% of the value | Between a few minutes and two business days | Mid-market rate | 40+ currencies |

Skrill | 0% for bank-to-bank transfers, 1% - 2.99% for other payment methods | A few minutes between Skrill accounts, from 1 to 5 business days for other transfers | Mid-market rate + up to 4.99% markup | 40+ currencies |

Western Union | Vary depending on the amount, destination, payment method, and urgency | From a few minutes (when using the "Money in Minutes" service) up to 5 business days for international transfers | Mid-market rate + markup | 130+ currencies |

MoneyGram | Vary depending on the amount, destination, and payment method | From a few minutes to several business days | Mid-market rate + markup | 200+ countries |

Before diving into details about each alternative to Revolut, let's find out the reasons that make people look for other fintech apps like Revolut.

Why a Revolut Alternative May Be an Option?

There are several considerations that financial services consumers keep in mind when switching to a provider other than Revolut.

- Cost-efficiency. Thanks to the absence of physical branches, Revolut’s exchange rates and service fees are considerably lower than those of traditional banks. But what if competitor platforms beat Revolut in these or other expense-related aspects (such as fees for additional functionalities)?

- Available financial services. People may want something Revolut doesn’t provide to its clientele (investment options, wealth management, tax consultancy, invoice management, etc.), prefer more favorable conditions for their account, or look for a more tailored approach to service delivery.

- Greater global reach. Perhaps someone is planning a trip to a country whose currency isn’t supported by Revolut exchange services, or where Revolut doesn’t operate. In that case, you’ll need a provider that can fill the gap.

- Better customer service. Some people may be dissatisfied with the customer support Revolut offers. Then, they switch to providers that respond faster or handle issues more effectively.

Opting for a more rewarding alternative requires extensive preliminary research. We’ve done it for you.

The List of 8 Best Revolut Alternatives

What is the best alternative to Revolut? Let’s find it out together.

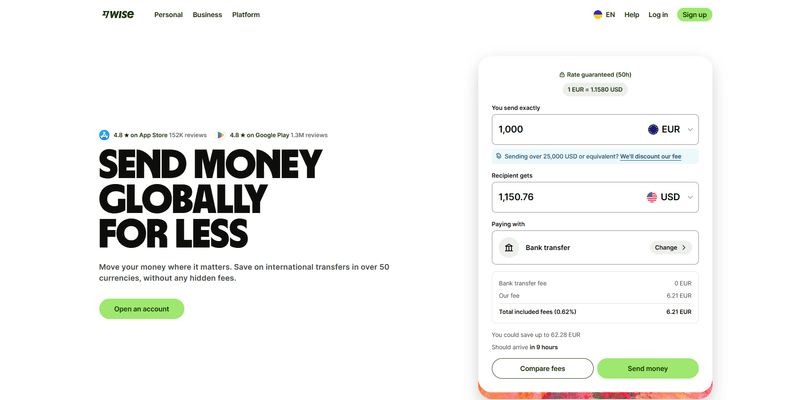

Wise

With over 15 million users worldwide, Wise is a popular platform for international money transfers, serving both individuals and businesses.

Features beyond money transfers and currency exchange: multi-currency accounts, business-specific functionalities, international payments, 24/7 customer support.

Pros:

- Transparent pricing;

- Extensive coverage (over 160 countries and about 40 currencies);

- Versatile services.

Cons:

- Unavailable in some countries;

- Service fees;

- Limited cash services.

Ideal for: individuals and organizations involved in frequent international transactions.

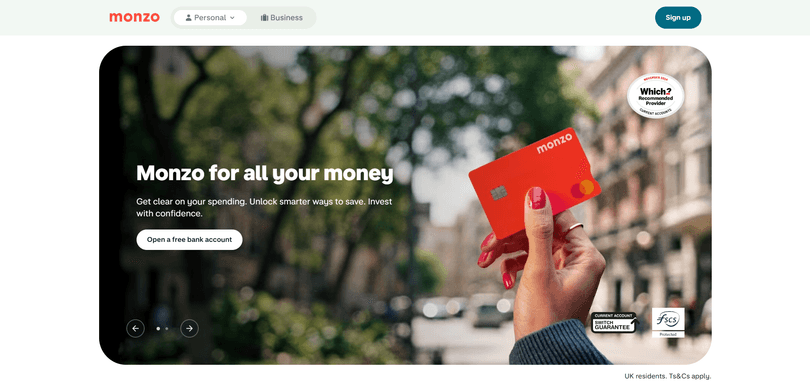

Monzo

This fully licensed UK bank provides FSCS protection for deposits below £85,000 per person and offers both free and paid plans (with extended features in the paid tiers). Similar to Revolut, it supports international transfers in 35 currencies via its Wise integration.

Features beyond money transfers and currency exchange: early salary access, bill splitting, budgeting tools, instant spending notifications.

Pros:

- Free plan available;

- Mid-market exchange rates;

- User-friendly app.

Cons:

- Third-party fees for international transfers;

- No cash pickup options on transfers.

Ideal for: frequent travelers and people who want better money management with friends.

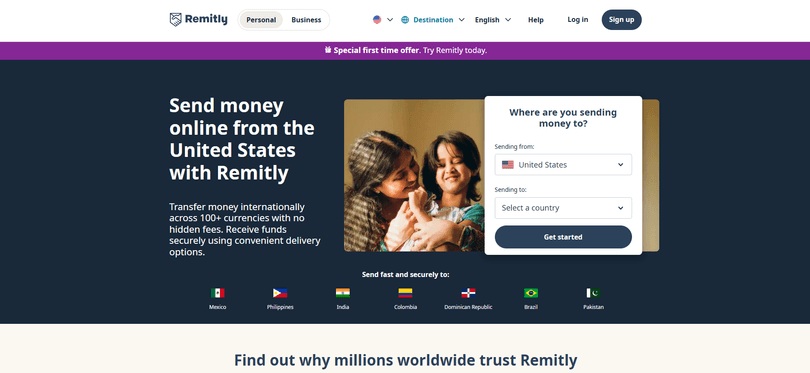

Remitly

Primarily designed for sending small remittances, Remitly supports about 100 different currencies to recipients in over 170 countries (especially in Asia, Africa, and Latin America).

Features beyond money transfers and currency exchange: flexible delivery options, real-time transfer updates, 24/7 customer support.

Pros:

- Multiple payout options (cash pickup, bank deposits, mobile wallets);

- Strong security;

- Promotional offers for new users.

Cons:

- Transfer limits;

- Restricted coverage in some regions.

Ideal for: people sending modest sums who need flexible payout options.

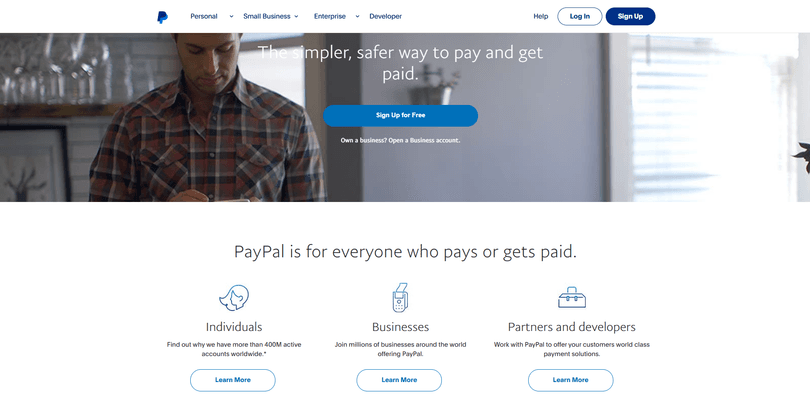

PayPal

It serves a worldwide user base of over 430 million active accounts and offers robust solutions for both personal and business needs.

Features beyond money transfers and currency exchange: digital wallet, transaction management, e-commerce integration, invoicing, bill payments.

Pros:

- Global reach;

- Wide range of payment options;

- Free basic account.

Cons:

- High international transfer fees;

- Expensive currency conversion.

Ideal for: businesses seeking global expansion.

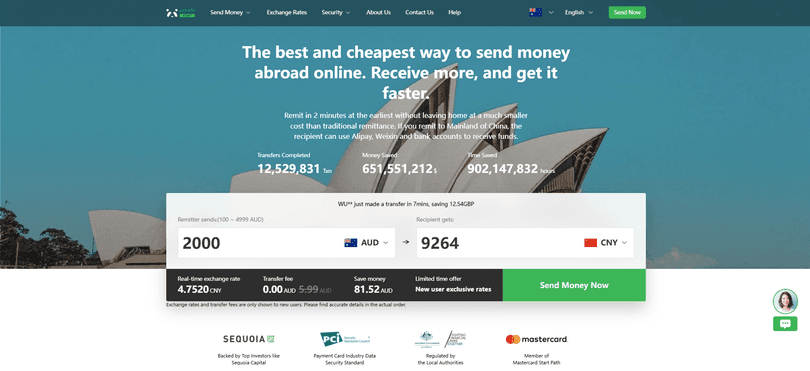

Panda Remit

Its major specialization is fast and secure money transfers from North America to Asia, Africa, and the Middle East.

Features beyond money transfers and currency exchange: multiple payout options, partnership with WeChat and Alipay, instant transfers, 24/7 customer support.

Pros:

- Low transfer fees;

- High security (PCI DSS-certified);

- Real-time transfer tracking.

Cons:

- Limited availability (not in Europe);

- Average app experience;

- Possible delays in identity verification.

Ideal for: migrant workers and international students sending or receiving money across Asia and beyond.

Skrill

One of the oldest digital wallets (founded in 2001), Skrill supports both personal and business accounts while also enabling online payments, including gaming and betting.

Features beyond money transfers and currency exchange: cryptocurrency operations, prepaid card, loyalty program.

Pros:

- No fees for international bank-to-bank transfers;

- Easy-to-use app;

- Fraud protection.

Cons:

- High exchange rate markup (up to 4.99%);

- No cash payment or pickup.

Ideal for: online shoppers and gamers, and freelancers receiving payments.

Western Union

Being in the market for over 160 years, Western Union has established a ramified network of branches in more than 200 countries. Thus, you can not only utilize its mobile app but also send and receive cash transfers personally.

Features beyond money transfers and currency exchange: bank, mobile, and in-person transfers, cash pickup, mobile wallet.

Pros:

- Wide range of delivery methods;

- Fully regulated globally;

- Easy transfer tracking via the app.

Cons:

- Complex fee structures;

- Extra charges for fast transfers.

Ideal for: people who need to transfer money to regions with limited digital banking infrastructure.

MoneyGram

Operating in more than 200 countries through its 350,000 kiosks and agent locations, MoneyGram is known for its speed, including same-day bank transfers (available in some regions).

Features beyond money transfers and currency exchange: multiple delivery options (debit cards, mobile wallets, bank deposits, cash pickups, and even home delivery), automatic setup of recurring transfers.

Pros:

- Global presence;

- Fast delivery;

- Strong security.

Cons:

- High fees;

- Transfer limits;

- No phone support.

Ideal for: users who value broad reach and multiple transfer methods.

Key Takeaways

As a leading neobank, Revolut provides convenient fintech services (mainly currency exchange and money transfers) to Britons traveling abroad. However, there are plenty of other banking service providers that offer broader functionality, lower rates and fees, more extensive global reach, or superior customer support.

To find the best alternative to Revolut, individuals or organizations should carefully assess their specific needs, weigh the pros and cons of different fintech platforms, and compare the range of services each one delivers.