Western Union Money Order: Pricing and Instructions

According to a report from the Federal Reserve, 6% of American adults don’t have a bank account. How can they send money if they are unbanked? Is it possible to transfer funds to another country without a bank account? The answer is “Yes.” In such cases, a money order is a reliable option.

One of the financial institutions offering money orders is Western Union. In this article, we’ll guide you through Western Union money order instructions and provide useful tips to ensure a smooth transaction.

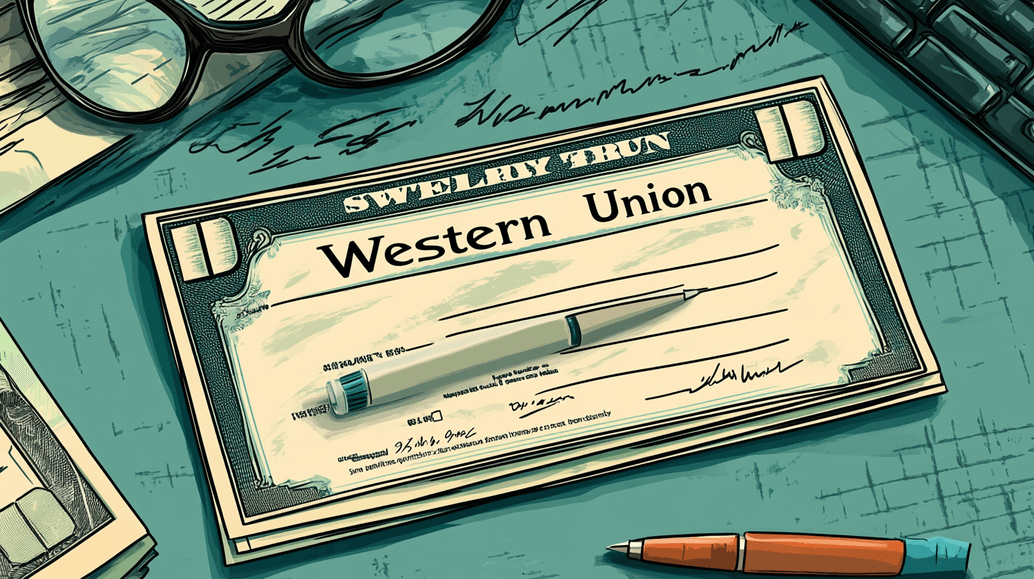

What Is a Western Union Money Order?

A money order guarantees a secure way to send funds. This method is typically used as an alternative for checks or cash when a guaranteed payment is needed. You can use it to send gifts, pay for purchases, or even bills with it.

Essentially, a money order is a paper document that can be cashed out or deposited. Similar to a check, a Western Union money order is prepaid, meaning it won’t bounce due to insufficient funds, unlike personal checks.

It can be sent internationally and received in person or by mail, making it a convenient option for those without bank accounts. Usually, a bank money order limit is $1,000, but Western Union does not specify this information on its website.

Western Union Money Order Cost

The cost of a Western Union money order varies based on several factors.

Payment Method

To begin with, the total cost of a money order depends on how you pay for it. Paying with a credit card usually incurs higher fees because the payment is treated as a cash advance. Also, the card issuer can impose an extra fee. On the other hand, fees are typically lower when paying with cash at a Western Union location or via a bank account transfer.

Delivery Speed

The Western Union money order price may be higher if you need a faster delivery. This way, the recipient will receive funds within minutes, but you’ll pay extra transaction fees for expedited service. Standard delivery, which takes several business days, is usually more affordable.

Exchange Rates

Western Union profits from the currency exchanges. So, if you want to send the Western Union international money order, a market exchange rate plus a markup will apply. As a result, the recipient can get less than expected. That’s why you should always check the offered rate beforehand to determine the actual amount the recipient will receive.

Amount Transferred

As a rule, larger transfers often come with higher fees in this bank. Compare costs for different transfer amounts to find the most suitable option. Also, look for available discounts or promotions to save on high-value transfers.

How to Send a Western Union Money Order

You should know there is no way to send these money orders online — only at physical locations. Additionally, not all agent locations offer this service, so confirm availability in advance. Aside from that, sending a money order is very easy. A bank account is not required, but you must bring a valid ID.

Follow these steps to send a money order:

- Find a Western Union location that provides money order services.

- Determine the amount you wish to send and verify the total cost, including fees.

- Use cash, a bank card, or a bank account transfer to pay for the money order.

- Complete the money order form with your and the recipient's personal details.

- Keep the receipt, so you and the receiver can track the money order.

- Send the money order via mail or deliver it in person.

Once the transaction is complete, when you have the receipt, you can track the order’s status via Western Union’s website or customer service.

How to Fill Out a Western Union Money Order

It’s important to fill in all the details correctly because otherwise, the money order can be lost or delayed, and the recipient will not access the funds. Before sending, verify all the information to prevent potential issues.

- Provide the recipient’s name: Enter the recipient’s name in the “Pay to the order of” field. Ensure correct spelling as once the order is processed, you can’t make any changes to it. If everything is fine, the recipient will be able to use funds quickly after receiving the document.

- Submit your personal information: Correctly fill in your full legal name and actual postal address in the “From” or “Purchaser” section.

- Sign the money order: Your signature should appear on the front, while the recipient will sign the back of the paper upon receipt.

- Fill in the memo field: This section is optional but helpful. Usually, it contains an invoice number, account number, or any relevant payment information.

Conclusion

To sum up, if you need to send a money order, Western Union is a reliable option. However, it’s essential to understand the factors that influence the cost, such as fees, payment methods, and exchange rates, to ensure you use this service in the most cost-effective way. Additionally, consider the delivery speed and your sending amount so you determine when the recipient will receive the funds. Western Union’s global reach makes it a convenient choice for sending money internationally, but you should always compare current currency exchange rates to avoid unexpected costs. Additionally, always double-check the recipient’s details and keep your receipt for tracking purposes. If you frequently send money orders, consider checking for available promotions or discounts to save on fees. Lastly, while Western Union is a trusted service, it’s always smart to compare its fees and exchange rates with other providers to ensure you’re getting the best deal possible.