What is the SWIFT Code?: Everything You Need to Know

As the world is more connected than ever, millions of international transactions take place every day. Whether you are a business owner or just an individual sending money to relatives, you have likely come across SWIFT. The code is widely used by banks worldwide, as it is both convenient and ensures the highest level of security.

But what is the SWIFT code exactly? In this article, you will learn the SWIFT code meaning, what information it includes, and how to find it to perform transactions.

UNDERSTANDING SWIFT CODE FOR ALL BANKS

So, what is a SWIFT code for a bank? It is wise to start with the meaning of the SWIFT. SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication, and it provides a secure network that allows different financial institutions in 212 different countries to share transaction information. SWIFT is an easy-to-use and secure service that allows people to send funds to each other, even if their accounts are in different banks or different countries and currencies.

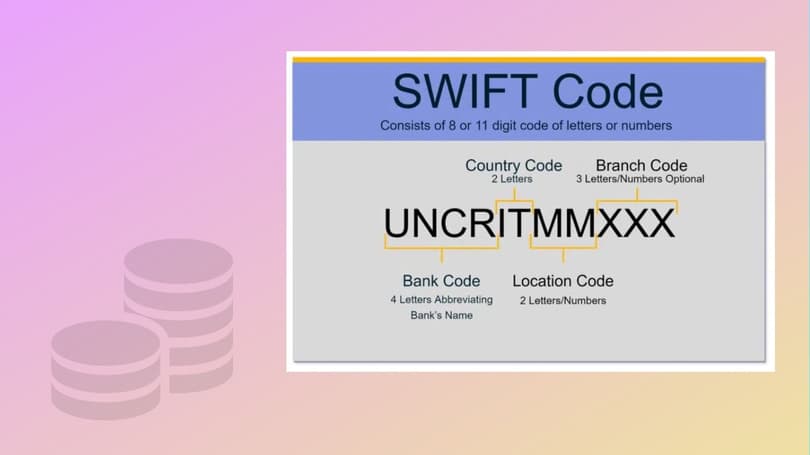

Swift code, also known as SWIFT ID contains 11 characters. This character set is divided into the following groups to identify the bank:

- Bank code: The first four letters are the bank identifier.

- Country code: The next two letters are the country code.

- Location code: The following two letters identify the location of the financial institution.

- Branch code: The last three digits indicate the receiving branch.

SWIFT codes’ key purpose is to facilitate international transfers, which are faster and safer thanks to such identifiers. SWIFT codes are also used to monitor financial transactions and facilitate communication between banks.

Sometimes, you may also face a question like, “What is the SWIFT number for a bank account?” Please note that a SWIFT code is not the same as an IBAN code, which also includes a bank account number, branch, name, country, and city. This code consists of numbers and letters that identify an account of a certain bank user.

As for payment processing, if we talk about SWIFT payments, they are not always sent immediately. SWIFT performs anti-fraud and anti-money laundering checks on every transaction. Such procedures can take time, but they make your payments more secure.

SWIFT makes money by charging its bank members to use its services. This means that each financial institution in the SWIFT network pays SWIFT a one-off fee plus an annual fee that depends on the types of payments they use. Clients are charged a small fee for each transaction, which is usually 3–5%.

Ways How to Find SWIFT Codes

Now, you may wonder, “How do I find the SWIFT code for my bank or the one I want to send my money to?” There is no problem in finding the SWIFT code. In most cases, customers can find such information in their accounts. You can use your bank’s mobile app and see such a code as well as your IBAN code in the info section.

Also, such information can be found on the bank’s official website. If there is no way to use the website or mobile app, you can also get such data at the financial institution’s nearest branch. If nothing from it fits, various database sites allow you to find what is a bank account SWIFT code online. All you need to do is enter the bank’s name, country, and city.

But what is the bank’s SWIFT number if you can’t find anything using the method mentioned above? It is worth paying attention to the fact that not all financial organizations provide transfer services with the SWIFT system. This is true for small or medium financial institutions. So, you need to check whether the bank uses such a system, and then you will be able to discover the SWIFT number of this precise institution.

Conclusion

To conclude, the bank SWIFT code is explicitly created to facilitate international payments. The bank users get the opportunity to make global transactions in various currencies quickly and securely at low fees. The only thing to keep in mind is that such payments are usually not immediate because of all the safety measures in place. If you decide to send a payment to another country, in most cases you can easily find this code on the financial institution’s site or its app.

FAQ

What is a BIC or SWIFT code?

A SWIFT or BIC (Business Identifier Code) can be used interchangeably. It is a unique bank code consisting of 8 or 11 characters used when making payments abroad. Each bank that uses the SWIFT system has its identifier (a number of specific and unique characters).

What is the SWIFT and IBAN code?

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a secure network that allows different banks and financial institutions in 212 different countries to exchange transaction information.

IBAN (International Bank Account Number) is a unique identification number for a bank account of a particular client that contains 34 characters. The IBAN includes all the information to verify the identity needed to transfer funds: account number, bank name, bank branch, and country code.

How do I find my bank’s SWIFT code?

There are several ways you can do this. You can receive this information in your bank’s app. You can also find the Swift code on the official website of the bank or with the help of specialized database sites after you enter the needed info. Also, you can always get such data at your nearest bank branch.