Wise Pricing: Everything You Need To Know about Transfer Fees

Interactions with finances require precision and a clear understanding of your actions to achieve the desired outcome. With the help of this article, you can learn more about Wise transfer fees and find out how exchange rates impact the amount of money you receive.

How Wise Calculates Fees

What are Wise transfer fees? They are the charges you pay to move money from one account or currency to another.

The price structure for the Wise wire transfer fee consists of a percentage-based fee that depends on the converted amount and a fixed fee per transaction. For example, you need to transfer 200 GBP into EUR. In this case, Wise will charge a 0.5% fee plus an additional 1 GBP for sending funds.

Wise also applies a fixed fee for same-currency transactions. The cost depends on the currency, and is always shown in the calculator. This same-currency fee can be as high as 8.27 GBP. Variable conversion fees typically start around 0.33% for major currency routes.

Your payment method can also affect the total cost. For instance, transfers via SWIFT may include a fixed fee of up to 25.99 GBP, depending on the transaction size.

Wise Transfer Fees

As you can see, Wise Transfer combines flat fees and percentage-based charges. As a service advantage, it does not apply markups or pursue hidden profits.

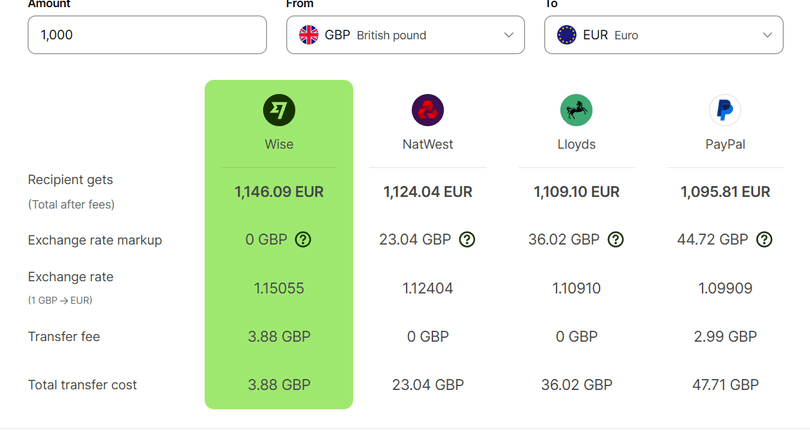

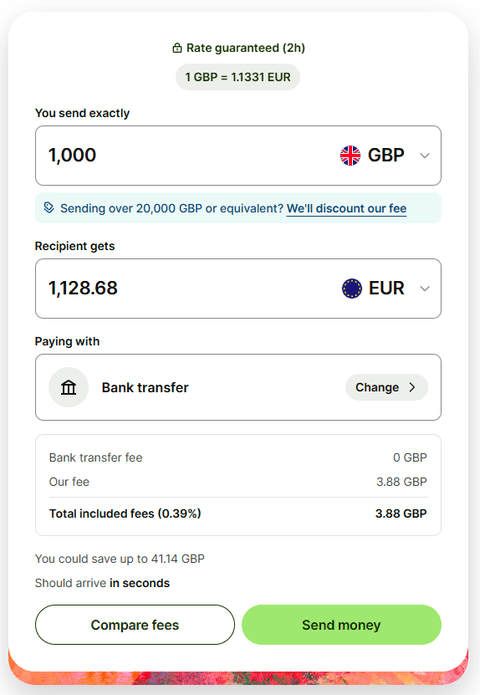

Here’s an overview of the Wise fees for sending money (1,000 GBP) to a EUR account. Wise uses the current mid-market rate (1.150055 EUR per 1 GBP) and adds a transfer fee of 3.88 GBP. This small fixed fee covers administrative and processing costs. Before sending, Wise displays both fixed and variable costs, so you can confirm the total amount before completing the transaction. As a result, the recipient will receive 1,146.09 EUR.

Keep in mind that Wise fees for receiving money may differ. For example, non-wire and non-SWIFT transfers are free for many currencies, but when you receive USD wire and SWIFT transfers, you need to pay a fixed charge per payment. USD SWIFT fee is 6.11 USD. For SWIFT transfers in GBP, Wise charges a 2.16 GBP fee, and in EUR, it's 2.39 EUR.

Wise Exchange Rates

Wise uses a mid-market rate when users transfer money internationally. It is also known as the real exchange rate or internal bank rate. It makes the TransferWise exchange rate the middle price between buying and selling a certain currency on the global exchange market. While some financial services, including banks, add markups to this rate to cover their administrative costs, Wise keeps it transparent. By knowing the real mid-market rate, you can ensure you’re getting the most favorable deal available.

Additional Costs to Consider

To be fully prepared for potential expenses, it’s important to know not only the Wise exchange rates but also the additional fees. For instance, besides extra fees for SWIFT transfer, you may face fees if you choose a debit or credit card as your payment method. For both options, the additional cost in some cases is up to 7.8%.

Why Transparency Matters in Money Transfers

Real-time money transfers are extremely convenient, but transparency is what builds trust. A lack of understanding the process and facing extra fees and hidden expenses causes more frustration than higher upfront costs. For instance, a lot of traditional banks claim that they apply “zero transfer fees” or “free transfers,” but in reality, they just mark up the exchange rate to cover the difference. As a result, the recipients may end up receiving much less money than expected.

WiseTransfer, on the other hand, makes transparency one of its greatest advantages and core principles, starting with the exchange rate. As mentioned earlier, it uses the mid-market rate, the same one you may easily find on Google, with no hidden markups.

Before confirming a transfer, the customer gets a complete upfront fee breakdown, clearly showing which fees apply and how much the recipient will receive in the end.

Another proof of Wise's transparency is its publicly available pricing list on the official website, where any potential or existing customer can check the rates and fees before sending money.

Bottom Line

Wise is a reliable international money transfer system that supports real-time global transfers while ensuring full clarity and transparency in every operation. It openly displays all potential fees you may encounter during transactions, depending on the currencies and payment methods used. For example, non-wire transfers in the same currency are typically free of charge, while SWIFT, debit, and credit payments may incur additional costs.