AmEx Platinum Rental Car Benefits

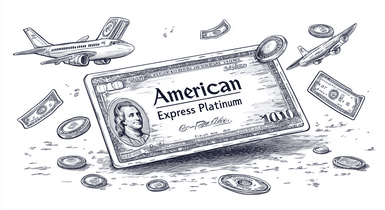

The American Express Platinum card offers a robust rewards program in return for its hefty $695 annual fee. These include a host of additional benefits tailored for those who frequently travel by rental car or have to use one on business trips. The notably long list of AmEx Platinum rental car benefits includes lots of complementary services, like protection that covers damage that the vehicle may receive during use. In addition, AmEx Platinum credit card holders are granted privileges such as status upgrades when using several rental providers, access to elite vehicles, high bonus rates, and more.

In this article, we’ll explore the benefits of renting a car with the AmEx Platinum card and the insurance coverage it provides. Read on to discover how to get the most out of this package.

AmEx Platinum Car Rental Benefits

Considering that the card is custom-made for frequent travel, it’s no surprise that AmEx Platinum car rental benefits cover a variety of user needs. For example, you can get a discount on renting cars for local or even interstate travel, access to a preferred queue for transport, or even free driver services.

The Platinum package also includes premium perks, like coverage in case of car theft, damage, etc.

In addition, cardholders accumulate points for each dollar spent on car rental and use those to cover a part of later spendings. Finally, Platinum users can often access the premium services of rental providers without a long reputation building period.

To do this, you must register with the relevant service and make a payment with your Platinum card.

AmEx Platinum Car Rental Status

With such a high maintenance cost, the card has to offer pretty substantial benefits to be viable, and Mastercard did a good job optimizing this offer for the target audience. AmEx Platinum car rental allows you to use different types of transport to travel within the state or even the whole country, all the while enjoying additional membership perks.

Without further ado, let’s take a closer look at what benefits an AmEx Platinum cardholder can expect to receive from each of the leading car rental companies. We’ll also take a closer look at the third-party benefits for drivers and car owners.

Avis Preferred Plus

Quick Preferred Plus package access at Avis is definitely among the more notable AmEx rental car benefits. Under normal circumstances, you would need 12 basic rentals, or $5,000 in spending per year, to qualify for the premium status.

As an AmEx Platinum member, you get an instant upgrade to your Avis account after the first payment with the card, which entails a number of nice bonuses. For example, car reservations can be made at any time, and there are discounts on vehicles and additional bonus points per dollar spent.

Hertz President’s Circle

With Hertz, the AmEx car rental benefits include quick access to the company’s premium membership tiers, as well as a flat 20% discount on rental and booking. The cardholders will also receive a number of secondary bonuses, including:

- A grace period for returning the vehicle;

- Access to higher-end cars;

- A free driver option;

- Premium access to the company’s support service.

To receive all these benefits, you need to register in Hertz’s President’s Circle in advance and use your Platinum card when renting a car.

National Emerald Club

American Express Platinum rental car benefits also include premium access to Emerald Club services. If you are registered as a member of the club and have an AmEx Platinum membership, you automatically receive a number of benefits:

- You can rent a car of SUV class and above at usual rates;

- A day of free rental after six days of paid rental;

- Expedited car delivery;

- An additional driver;

- Bonus programs.

You will receive coverage for any damage to the car.

Additional Benefits

Additional benefits of the Platinum program include bonuses for hotel stays, airline services, and 5x points for travel-related expenses. You will also earn 80,000 points per $8,000 spent during the first six months of membership, which you can use later to pay for a range of services, including car rental.

Banks insure AmEx customers and their hand luggage. The insurance covers both owned and rented cars, and you can combine it with other policies (although there are considerable limitations).

What Does AmEx Car Rental Insurance Cover?

The insurance that cardholders receive as one of the American Express Platinum car rental benefits has several limitations. The insurance applies to a limited list of vehicles and only to certain insured events, such as theft and accidents involving other cars and people.

Please note that this is a limited coverage package and it comes with lots of additional paperwork. To use this insurance, you must cancel your rental provider’s primary policy and meet additional conditions, such as age and insurance rating.

The policy covers the entire rental period (up to 42 days) and covers the following expenses:

- Up to $75,000 for car restoration;

- Up to $300,000 in cases of fatalities, dismemberment of pedestrians and other road traffic accident participants;

- Up to $2,000 for damaged property.

However, keep in mind that this is a secondary policy, and its processing can be problematic, so you better use it only as a safety net.

What Does Rental Insurance Not Cover?

American Express car rental perks in the insurance plan are sadly not comprehensive. For instance, they do not cover the following types of cars:

- Full-size or cargo vans;

- Commercial minivans;

- Customized vehicles;

- Antique cars;

- Limousines;

- Off-road vehicles.

The policy also can’t be applied in the following cases:

- Vehicles rented in Australia, Italy, or New Zealand;

- Illegal activity of the lessee;

- Driving a vehicle under the influence of alcohol or drugs;

- Operation of the vehicle off-road;

- Intentional damage caused by the lessee;

- Predictable degradation of the car or its individual components;

- Theft or damage to an unlocked vehicle;

- Use of the vehicle for commercial purposes or for “rental” purposes.

You can see that some of these restrictions apply to the cases where a primary policy will still provide coverage.

Conclusion

American Express car rental benefits are worth the hefty $695 annual fee for the AmEx Platinum only if you use all the privileges of membership in this program. An intended user of the card is someone like a company executive who has to travel across the country multiple times per year. Otherwise, it’s better to use reasonable alternatives such as AmEx Green/Gold, or even opt for other banks’ offers.

However, given the benefits of Platinum, this card is virtually unrivaled in its class, especially in terms of insurance for rented cars and airline baggage. It also provides access to excellent rewards programs and has a stable spend conversion rate of $1:5 points. The Platinum loyalty program also has a fairly large partner network, so you’re unlikely to struggle to utilize its benefits.