Best Credit Cards For a Small Business [2025]

A business credit card is a useful tool for covering short-term expenses and getting quick access to funds in emergencies. Additionally, this card type often comes packed with rewards like bonus cash back, purchase perks in specific categories, and travel miles.

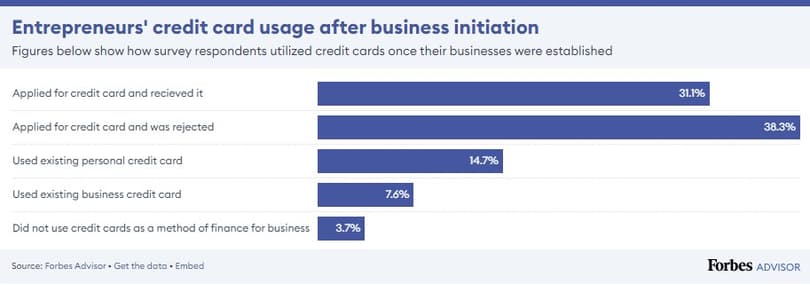

For small enterprises and startups, opening a business card is an excellent way to maintain financial stability and even support reinvestment by leveraging the interest-free grace period on purchases (allowing the business to earn interest on its cash until the bill is due). According to a Forbes Advisor survey, 69.3% of entrepreneurs apply for a card after starting a business, and 31.1% of them get approved.

Choosing a business credit card provider often comes down to comparing approval rates. However, there are other factors to compare before deciding on the best credit cards for a small business:

- The bank's rating, score, and reputation.

- The terms set by the bank.

- The availability of a zero-interest rate or the specific interest accrued for credit.

- Bonus programs, loyalty programs, and other perks.

So, what is the best credit card for a small business? Let’s break down our top picks, their terms, application process, and special promotional offers available to new customers.

Hilton Honors Business Card — The Best Choice for Business Trips

The Hilton Honors Business Card is notable for its lucrative welcome offer. If you spend $8,000 on purchases within the first 6 months, you'll get 175,000 bonus points, which can be redeemed for free stays at Hilton hotels. This card is considered the best small business credit card for entrepreneurs who have to send their employees on business trips on a regular basis.

Let's go over some other advantages of the Hilton Honors Business Card:

- 5 points for every dollar spent on purchases across all categories for the first $100,000 during a calendar year, with the bonus rate dropping to 3 points after reaching this sum.

- 12 points per dollar spent on purchases at Hilton hotels.

- Up to $240 cash back annually on purchases made at Hilton properties, capped at $60 in statement credits quarterly.

- Free additional credit cards for your employees.

- No foreign transaction fees.

However, the card does have a few downsides:

- An annual card maintenance fee of $195.

- Balance transfers are currently unavailable.

- To enjoy some of the premium perks, you’ll need to spend a significant amount annually, which can be tough for smaller companies.

As one of the top business cards for small businesses, Hilton Honors provides a relatively straightforward way to rack up points and enjoy free nights at high-end hotels. Plus, the bonus points accumulate regardless of what you or your employees use the card for.

How to Apply for a Hilton Honors Business Card?

To apply, you’ll need to gather and submit the following documents to the bank:

- A completed credit card application.

- Business owner identification.

- Federal Tax Identification Number (EIN).

- Business formation documents.

- A company income statement.

- Contact information for your business, along with your personal details.

You can also apply online by visiting the official American Express website.

Blue Business® Plus Credit Card from American Express

If you get approved for a Blue Business Plus card from American Express, you’re eligible for a welcome bonus of 15,000 Membership Rewards points. Still, you’ll have to spend at least $3,000 on qualifying purchases within the first three months of membership to get the bonus. This American Express offer also stands out among other good small business credit cards because it doesn't charge an annual fee.

Other advantages of Blue Business Plus include:

- No balance transfer fees.

- Double points for everyday business purchases up to $50,000 per year, with the rate dropping to 1 point per dollar after reaching this cap.

- Free employee cards with customizable spending limits.

- Advanced customer services to help you stay on top of financial management.

- High credit limits for businesses that demonstrate strong purchasing power.

Some downsides to keep in mind:

- A 2.7% fee on international transactions.

- The 2X bonus on various purchases is capped at $50,000 per year, which might not work for rapidly growing businesses.

How to Apply for Blue Business Plus from American Express?

As a small business owner, you can add your application online on the American Express website. To apply, you’ll need to provide:

- Company information.

- Business type and structure.

- Business contact details.

- Federal Tax Identification Number (EIN).

- Estimated monthly business expenses.

- Personal details such as your name, address, phone number, SSN, and date of birth.

Final Thoughts

No matter the direction your business takes, you’ll likely face major corporate expenses and unexpected complications along the way. To address these challenges, banks offer special credit cards that help small businesses secure manageable loans to grow and maintain financial stability.

While the list of top-rated small business credit cards is extensive, we’ve performed a detailed small business credit cards comparison and come up with two standout options:

- The Blue Business® Plus from American Express is at its best when used for everyday corporate purchases.

- The Hilton Honors Business Card can make business travel cheaper and more comfortable.

Both cards are a great pick for a small business, so your pick should depend on your company’s needs and financial goals.