Discover Travel Card Review: Discover it Miles

Contents

Even though going on vacation typically eats into your budget, there are still smart ways to cut back on expenses. One popular strategy is getting a travel credit card. One of the main reasons Americans sign up for a travel card is mainly because of the rewards programs. But with so many, how do you pick the best option? In this Discover it Miles Credit Card review, we’ll break down the basics, examine its pros and cons, and help you decide if it’s the right fit for you.

Discover Travel Credit Card Overview

Both expert and casual travelers want to find a beneficial and affordable travel card. The Discover it Miles is a great choice for such people since it has no foreign transaction fee or annual fee.

The card offers 1.5 miles for every dollar you spend on all purchases. There are no category limits, making it easy to earn and redeem for everyday spending. Miles can be redeemed for travel, cashback, or gift cards. Plus, Discover doubles all miles earned in the first year, making it especially rewarding for new cardholders. This makes the card flexible and valuable, especially for travelers.

All new cardholders also score a limitless Mile-for-Mile Match, which means the card doubles all the miles earned at the end of your first year of membership. This attractive feature is a game-changer for anyone eager to rack up rewards early.

On top of that, the Discover it Travel Card doesn’t charge interest on balance transfers and spending for the first 15 months, followed by a variable APR ranging from 17.74% to 27.74%. The precise interest rate is calculated personally, based on the applicant’s credit rating and other aspects.

When comparing travel-focused options, a good starting point is the broader Discover credit card landscape.

Discover it Miles Card Benefits

Flexible Redemption Options

At first glance, this card is no different from others. Earning and redeeming miles couldn’t be simpler. You earn 1.5 miles on every dollar spent on every purchase. Miles can be redeemed for 1 cent per mile on travel purchases from the last 180 days. However, the miles can also be redeemed for cash as a direct deposit at the same rate. Additionally, they can be exchanged into statement credits to pay for hotel bookings, dining out, gas, and ride-sharing. You can also transfer these bonuses to PayPal and Amazon.

Understanding the Discover pros and cons helps you decide if this card truly fits your style.

No Redemption Minimums

Often, cardholders must accumulate a hefty number of points in order to withdraw and redeem them. Usually, there’s a requirement to have at least $25 or even more. With Discover Travel Card, you can cash in even 1 mile from your account and get 1 cent. Of course, 1 cent might not make a difference, but this feature means that you can chip away at small travel expenses, like grabbing a taxi or paying for a coffee at the airport.

Unlimited Bonus Offer

Discover offers a limitless Mile-for-Mile Match for new cardholders, doubling all miles earned at the end of the first year without restrictions on spending or rewards caps. This maximizes reward potential by giving customers 3 miles per 1 dollar spent throughout the first year.

For instance, if you earn 20,000 miles, Discover will match that with an additional 20,000 miles, giving you a total of 40,000 miles. It’s a valuable perk that allows cardholders to earn significantly more on their first purchase without spending a penny on annual fee or sign up.

Affordability Due to No Fees and Low Rates

The Discover Miles Credit Cards are incredibly cost-effective to maintain. They charge no penalty APR, no annual fee, and no foreign transaction fees, making it a wallet-friendly choice for both everyday use and travel.

The card's variable APR ranges from 17.74% to 27.74%, which is relatively competitive compared to other popular travel cards. In addition, you will be able to limit the amount of interest you pay by taking advantage of a 15-month intro APR of 0% on purchases and balance transfers. It can help a great deal staying on top of your budget without piling on interest if you have planned a big purchase or trip that will take longer to pay off.

Easily Monitor Your FICO Score

The card provides free monthly access to your FICO Credit Score. This feature helps you monitor your credit health over time by showing your FICO score updates directly in your account, along with key credit insights. This is a valuable tool for tracking credit improvements or changes, especially if you plan to use the card for substantial travel-related purchases or other expenses.

Downsides of Discover Travel Cards

In addition to basic information about the card and the fact it has a lot going for it, the Discover it Miles Card review will also reveal some downsides to consider.

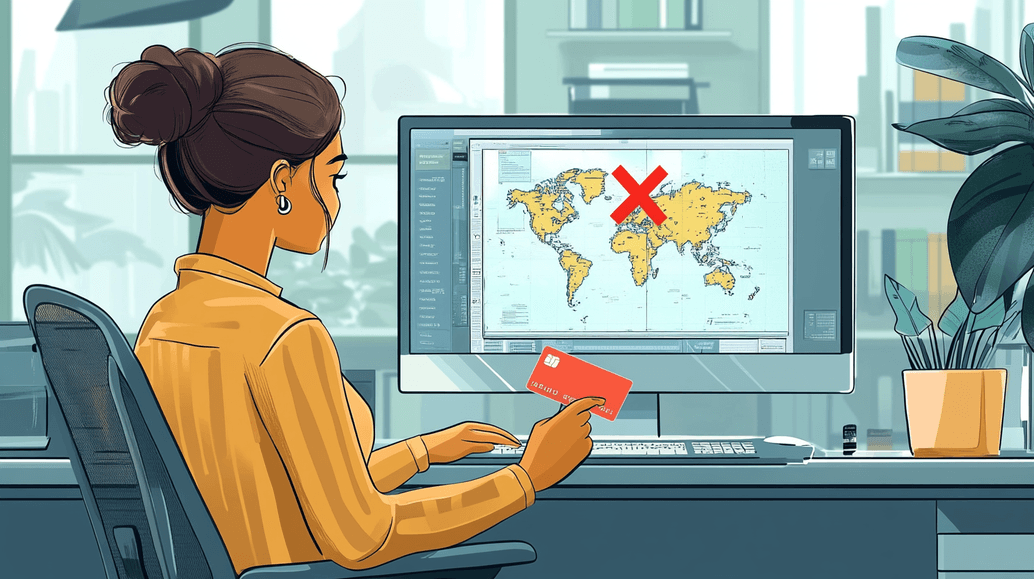

Not Readily Accepted Abroad

Even though the card doesn’t charge foreign transaction fees, its acceptance internationally is limited compared to Visa and Mastercard. If you’re traveling overseas, it’s wise to carry a backup payment option to avoid being caught off guard.

Reliable but Limited Redemption Options

Compensate for travel expenses with statement credits instead of using miles to pay for flights, hotels, holiday packages, or rental cars. This consistent redemption value makes Discover miles worth approximately 1 cent per mile for all options. This is a valuable feature because many travel cards reduce the value of points for non-travel redemptions. However, unlike cards that allow you to transfer points to airline or hotel partners for potentially higher values, the Discover it Miles Card locks the redemption value at 1 cent per mile across all categories. So, there’s no opportunity to maximize rewards beyond their base value.

It’s also wise to review Discover card payment options to make the most of your rewards.

Travel Perks Are Not Very Impressive

While this plastic provides unlimited 1.5 miles per dollar on all purchases and a first-year Mile-for-Mile Match, it falls short in terms of traditional travel perks like airport lounge access, travel insurance, and exclusive airline or hotel partnerships. The inability to transfer points to travel partners for potentially higher-value redemptions also limits its appeal for frequent travelers seeking flexibility. Instead, miles are primarily used as statement credits for travel expenses or cashback, which offers simplicity but fewer options for leveraging your benefits and rewards for premium travel experiences.

For students or newcomers, the Discover it Student Cash Back Card review offers useful insight into entry-level rewards.

Who Will Like the Discover it Miles Card?

So, is applying for this card worth it at all? To wrap up this Discover it Miles review, let’s pinpoint who would benefit the most from having this card. Our separate Discover credit card review is essential reading before choosing the right card.

Travel Novices

If you’re just dipping your toes into the travel rewards world, the Discover it Miles Card is a straightforward and user-friendly option. It’s easy to figure out how to earn and redeem rewards, and you don’t need to keep track of specific travel partners for point transfers. Additionally, traveling abroad becomes less stressful without foreign transaction fees that could chip away at your earned points.

Occasional Travelers

While the card’s benefits may not blow seasoned travelers away, it suits those who don’t travel frequently. The flat-rate incentives mean you can earn rewards consistently in the long run without fussing over categories.

If you’re looking for financial tools beyond cards, a Discover student loans complete review may be worth exploring.

Laid-Back Travelers

Compared to some competitors, the reward rates here might seem modest. On the other hand, the priceless flexibility this card offers when planning your journey can be a game-changer. You can book a voyage and earn rewards on any purchase, whether it’s a flight, hotel, or other travel-related expenses, unlike cards that limit rewards to specific travel portals, categories, or brands.

While there are no transfer partners for redeeming miles with airlines or hotels, this straightforward redemption option is ideal for those who prefer simplicity and freedom over brand-specific perks. For travelers who value spontaneity, the lack of redemption partners may not be a significant drawback.