Indigo Mastercard: How to Apply, Manage, and Get All Benefits

Do you have a low credit score and wonder what credit card for personal finance you qualify for? Choosing a credit card, especially if your credit score is far from perfect, is not always an easy task. Luckily, there are options for which you can qualify without much trouble, and one of the popular choices is the Indigo Mastercard.

Indigo cards are straightforward and won’t overwhelm you with numerous features and additions. One of the main advantages of this card is that you can apply for one even if your credit score is poor, so it’s no wonder that plenty of people are interested in it.

In this article, you will learn about the Indigo credit card, how to apply for it, how to set up an account, and how to build your credit score with it.

Applying for Indigo MasterCard: What You Should Know

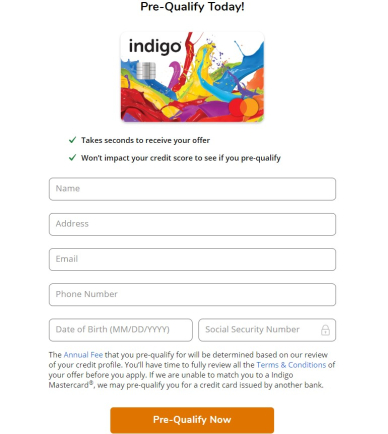

If you wonder whether you will be able to get the Indigo card, you can access a convenient tool and find out this information without impacting your credit score. The pre-qualification tool will calculate whether you’re eligible for this card. All you should do is enter your personal information on the official website of Mastercard Indigo. Even individuals who have gone bankrupt may be approved for this card, so it’s worth checking.

Anyone who applies for the pre-qualification process has to:

- Provide their personal details, such as full name, address, email, phone number, date of birth, and social security number. All the information has to be valid.

- An individual has to be at least 18 years old to apply.

- Applications from people whose Indigo accounts were charged off because of delinquency are not accepted.

Once you submit your information for the Indigo pre-qualify process, the initial offer will be provided within minutes. However, you should remember that the tool gives you only an approximate estimate. You will still need to submit a full application and wait for your credit score to be checked before getting the card. If you are approved, you will receive your card within 14 business days.

How Can I Use My Indigo Credit Card?

If you have been approved for the card and received it, the next step is to manage it conveniently. First, you need to create an account on www.myindigocard.com.

To register an account, you have to enter the following information:

- Your credit card and social security number.

- Date of birth.

Next, you should follow the steps on the site, and your account will be created in minutes. With the online account, you will be able to easily manage all your information, pay bills, send payments, and more. Indigo credit card reviews claim that the online cabinet is fairly easy to use, so it’s certainly great news.

As for the payments, there are several options to choose from. You can make payments online, pay your credit card balance by mail, or you may also do the same over the phone. To avoid late payments and the fees associated with them, it is a good idea to set up automatic payments in your online cabinet.

The credit limit of Indigo Mastercard is usually $300, but it can be up to $2,000 if you have a better credit history. One thing to note is that the limit can be increased by applying for the credit increase program. To make changes, you need to pay six minimum monthly payments without delays.

As the Indigo credit card is designed for those with poor credit scores, it is only natural that its reward program is quite limited. Those who have versions of Indigo cards with more benefits get a 1% cash back on some categories of payments (grocery shopping, restaurants, and such).

Building Credit Score with Indigo Card

Do you ask yourself — how does using my Indigo Mastercard affect my credit history? You’re not alone. One of the main reasons users are interested in the Indigo card is the opportunity to build a credit score and thus get more financial advantages. Indigo reports to three major credit bureaus — Experian, TransUnion, and Equifax, which means that when you make payments on time, your credit score will go up over time.

Those interested in improving their credit scores should consider getting a personal loan as long as they are sure that they can pay it up on time. If you are interested in getting a personal loan with the Indigo credit card, there are a few recommendations:

- It is a good idea to first get a report from all three above-mentioned credit bureaus. It is free, and you will see your credit history over the years. You can notice areas of problems and may be able to fix them before applying for a loan.

- Compare different lenders in terms of requirements (maximum DTI, minimum credit score), loan details (amounts, APR), and additional features.

- Consider getting a co-signer with a higher income than you and a better credit score. This will increase your chances of getting a decent loan.

The most important thing when building a credit score by getting a loan is that all your payments are made without delays. You can ensure this by setting up automatic payments.

Final Thoughts

If you are in search of a card to rebuild your credit score, it is more than likely that you have stumbled upon Indigo Mastercard reviews. This card is actively used by individuals for this purpose and is highly popular among those who have a less-than-ideal credit score.

The advantage of the card is that your information is reported to the three major credit bureaus, so you can be sure that your credit score is improving. Also, the application process is easy, which is always a bonus. Because the Indigo credit card is aimed at rebuilding credit, its inevitable downside is the lack of a rewards program. Luckily, as your credit score improves, you can either progress to a better version of this card or find a different option altogether.

Before you apply for this credit card, it is a good idea to complete pre-qualification on the site. The pre-approval process doesn’t take a long time and won’t have a negative impact on your credit score, but you will see whether you are likely to receive the card.

FAQ

How do I pre-qualify for the Indigo credit card?

If you are interested in getting the Indigo finance card, you can use a pre-qualification tool on the official website. All you need to do to see whether you are likely to qualify is provide your personal information and social security number. It takes only minutes to view the corresponding information.

What are the fees and interest rates of the Indigo Credit Card?

There are several options for annual fees, from $0 to $99, depending on your credit history. As for the interest rate, it is quite high compared to some other credit cards, but it makes sense, considering it’s a card for those with poor credit. The current APR is 24.90%.

How do I manage the Indigo credit card online?

To manage your card online, you need to create an account on www.myindigocard.com by entering your information and following the steps provided there. According to numerous Indigo card reviews, an account is convenient and offers everything you need.

What are Indigo credit card payment options?

The payment options associated with this credit card are versatile, so anyone can find the most convenient method for them. You can quickly pay your credit card bill online by visiting the official website or by using the Indigo credit card app. Another option is to do this over the phone at (866) 946-9545 or via mail.

Can I go over my Indigo credit card limit?

Keep in mind that if you try to spend over the limit, the bank may refuse a transaction completely. At the moment, the credit limit of the Indigo card is $300. Those with a better credit history may have a limit of up to $2,000. You should also remember that if you manage to spend your money over the credit limit, you will have to pay an over-limit fee.

What do you need to do to close the Indigo credit card?

The only way you can currently close your Indigo credit card is over the phone by contacting customer support at 1-800-353-5920. Depending on your situation, you will be given instructions on how to close your account. You should make sure you don’t have money in your account before you proceed with the steps.