What Are the Different Ranges of Credit Scores?

If you are thinking about getting a loan or opening a credit card, the first thing you should do is check your credit score and make sure it is sufficient to qualify for the product you want. And it won’t be enough just to know your score—you’ll also need to reach the credit score ranges your lender considers high enough to qualify.

Fortunately, even if your score is subpar, there are a lot of ways you can improve it. However, the main thing you need to know is what factors affect your rating and what credit range you should aim for. And this is what we will talk about today.

So, what are the different credit score ranges, and how do they affect your chances of getting a loan? Let’s find out!

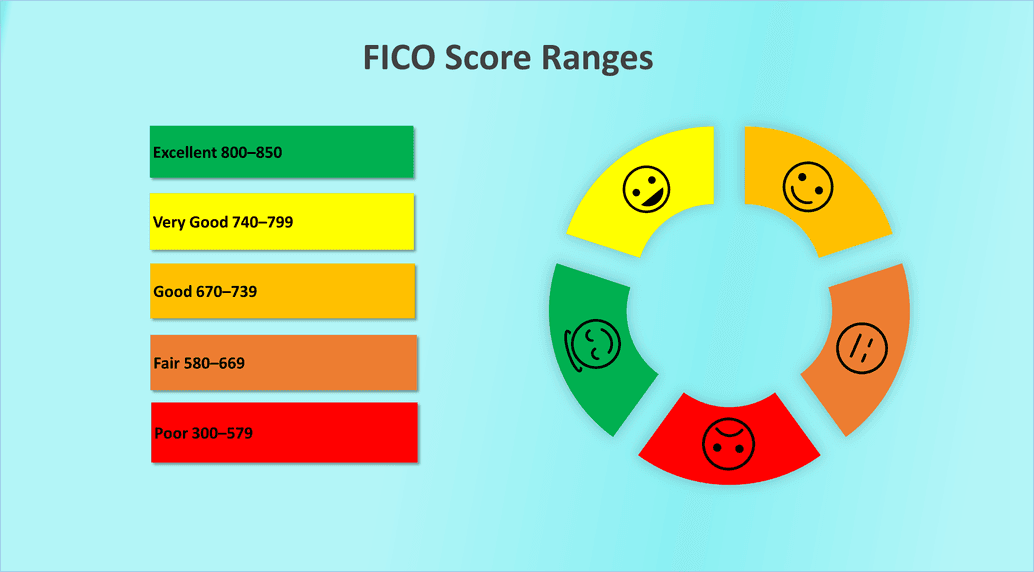

FICO Score Ranges

Although decisions regarding loan approval and loan terms are influenced by many more factors than just your rating, your score range is a good metric of whether you can get the loan you’re applying for. One of the most common credit ratings is the FICO. Most credit companies use this model to determine the creditworthiness of potential borrowers.

FICO scores are calculated by using data from your credit reports to evaluate your reliability as a borrower and predict whether you will repay the loan on time and in full. So, your chances of approval and interest rates depend on this score.

Under FICO, credit scores range from Poor (300+) to Excellent (800+). Here’s a credit score range chart for you to better understand the concept:

- Excellent (800–850). Such a high rating marks a potential borrower as a highly desirable customer with great creditworthiness, as any risks of lending them money are minimal.

- Very Good (740–799). This score is above average and shows lenders that the potential borrower is very reliable and is likely to meet their debt obligations.

- Good (670–739). This level of creditworthiness encompasses average and slightly above-average ratings, and most lenders consider it decent.

- Fair (580–669). This credit rating is below average, but borrowers with these scores can still qualify for various loans. However, they will likely have to cope with high interest rates.

- Poor (300–579). This level of rating is significantly below the average and signals to lenders that the potential borrower may be risky and unreliable.

If we are talking about FICO scores, the factors that affect your placement in this credit score rating chart are as follows: payment history (35%), amounts owed (30%), length of credit history (15%), credit mix (10%), new credit (10%).

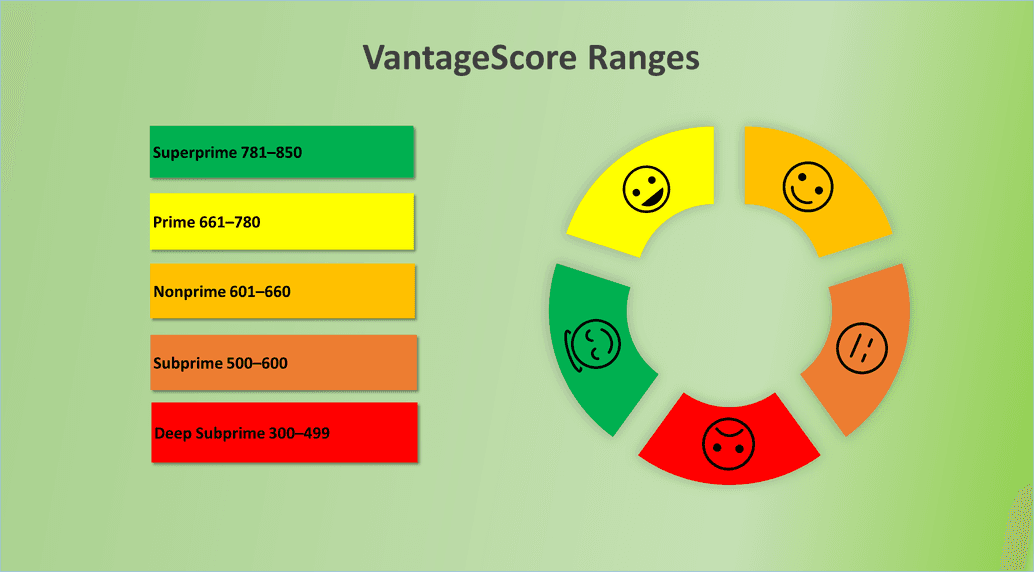

VantageScore Ranges

There is more than one credit scoring model and more than one rating range, and although they work similarly, their scores and metrics vary and are distributed differently. While the VantageScore model is not as widely used as the FICO one, it is also a good indicator of a potential borrower’s overall financial health.

So, what does a VantageScore credit range chart look like?

- Superprime (781–850). This rating demonstrates that the potential borrower is reliable and low-risk; they can usually access virtually any loan on the market and can expect better terms on top of that.

- Prime (661–780). This score suggests that the borrower has good credit discipline, which makes most lenders willing to work with them.

- Nonprime (601–660). This range is generally the bare minimum you’ll need to obtain a decent loan.

- Subprime (500–600). Borrowers at this level are considered risky, and lenders may be reluctant to approve them for a loan.

- Deep Subprime (300–499). This score is considered bad, and borrowers with this rating will find it difficult to get a mortgage or any other loan product.

In VantageScore rating, credit score categories are formed based on the following factors: payment history (extremely important), age and type of credit (highly important), percent of credit limit used (highly important), total balances and debt (moderately important), recent credit behavior (less important), and available credit (less important).

Still, the main principle stays the same: the higher your score is, the higher your chances of getting a good loan. If your rating is not sufficient for the type of loan or card you are applying for, you should look for ways to increase it.

How to Improve Your Score

Here’s what you can do to improve your credit rating before applying for a loan:

- Regularly monitor your credit reports. Check them thoroughly and immediately correct any inaccuracies or errors you find.

- Think about your financial strategy. Set clear deadlines for repaying your loans and do your best to stick to them.

- Avoid late payments. Set up automatic write-offs and make a habit of paying all bills on time and in full.

- Try to pay ahead. If possible, pay more than the minimal required amount and reduce your total debt.

- Set your priorities. Pay off the debt with the highest interest rate first.

- Keep your credit utilization ratio low. Your debt-to-total credit limit ratio should not exceed 30%, and if you manage to stay below 10%, it will do wonders for your credit score.

- Keep your old and unused credit accounts open. Having open and active lines of credit has a positive effect on your score.

- Don’t apply for multiple credit accounts at the same time. The fewer credit applications you have, the higher your chances of getting approved.

Remember that there is no way to get a good credit score quickly. The best thing you can do is remain patient and practice good credit habits.

Final Thoughts

A credit rating is a metric that lenders use to determine the creditworthiness and reliability of a potential borrower. But what are the credit score ranges? These are simply the different methods of calculating your score.

It is important to understand that there is no single score that would guarantee you’ll get a loan and the best conditions—different lenders have different requirements for borrowers and use different scoring models. The most common scoring models are FICO and VantageScore, and while they analyze pretty much the same factors, they prioritize them differently. Finally, keep in mind that even if your score is currently insufficient to cover your financial needs, you can increase it by practicing good credit discipline and following the guidelines outlined in this article.