What Is the Average Credit Score by Age in the US?

While credit history can vary significantly from one individual to another, there are noticeable trends based on age. By comparing the credit scores of Millennials and Baby Boomers, for instance, we can identify key patterns. In this way, knowing the average credit score by age can help you gauge your financial habits and see where you stand on your financial journey.

So, what is the average credit score by age in the United States? Let’s break it down by age groups to see the typical numbers in order to understand your financial standing.

Credit Score Basics

In general, a credit score serves as a financial report card, reflecting the likelihood of a borrower repaying their debts. Lenders, landlords, insurance companies, and even employers use these scores to assess an individual’s financial responsibility and reliability. Higher scores often signal lower risk, making it easier to qualify for loans, secure better interest rates, find rental housing, and access various financial benefits.

In the United States, a credit score is a three-digit number, ranging from 300 to 850, indicating your financial credibility. They are generated based on data from your reports, which includes data about your credit accounts, payment history, outstanding debts, and financial behaviors.

While many scoring models exist, the two most commonly used in the US are FICO and VantageScore. Look at the table below (compiled using Experian data) to see how these models compare in terms of figures.

FICO Score Categories | VantageScore Score Categories |

|---|---|

Exceptional: 800–850 | Excellent: 850–781 |

Very Good: 799–740 | Good: 780–661 |

Good: 739–670 | Fair: 660–601 |

Fair: 669–580 | Poor: 600–500 |

Poor: 579–300 | Very Poor: 499–300 |

Statistically, over 60% of Americans have a good to exceptional FICO score and an excellent to good VantageScore rating. Speaking of the average credit score in America, the FICO and VantageScore averages are pretty close, at 717 and 701, respectively.

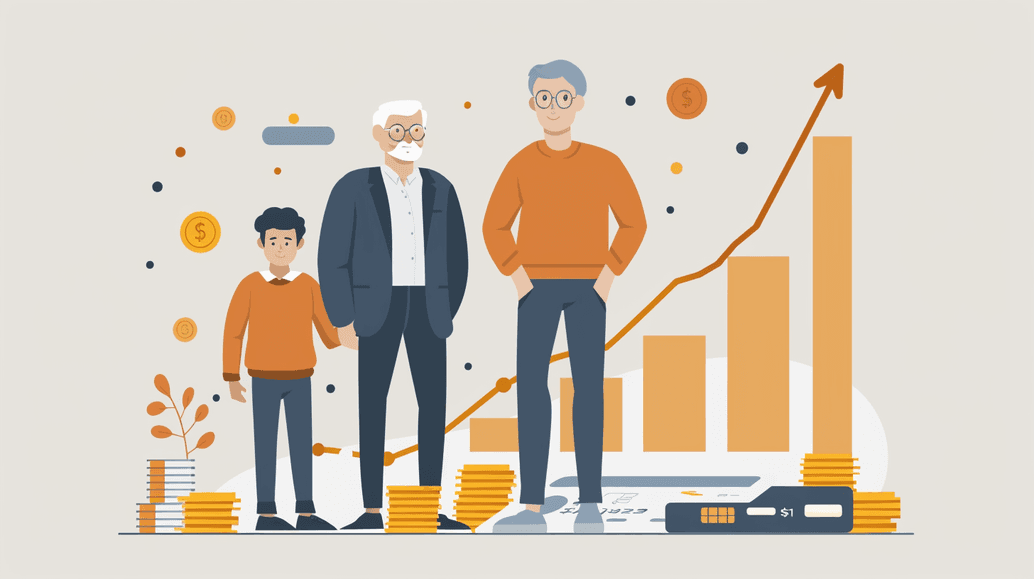

What Is The Average Credit Score in America by Age?

Now that we’ve covered the basics of credit scores and explained how they are determined in the US, let’s explore how the average American credit score breaks down by major age groups.

When calculating the average FICO score by age and that of VantageScore, the two models implement slightly different approaches in age classifications. The final figures, though, are nearly identical, so we’ve combined them in a single table for your convenience.

Age Group | Credit Score |

|---|---|

Gen Z (18–26) | 680 |

Millennials (27–42) | 690 |

Gen X (43–58) | 709 |

Baby Boomers (59–77) | 745 |

Silent Gen (78+) | 760 |

As you can see, the average credit scores tend to increase with age. This metric is primarily calculated on credit history, so older individuals have higher ratings because they have a longer borrowing history due to their age, which positively impacts their scores. The math here is quite simple: the longer your credit account exists, the higher your rating gets over time.

Here’s a breakdown of how different age groups compare in terms of earning scores:

- Gen Z (18–26 years): Many individuals at this age just start their financial journey, often building credit through student loans or their first credit cards. They try to set the foundation for future financial success by responsibly managing a card or student loan.

- Millennials (27–42 years): For this age group, the focus is shifted to building financial stability. This is the time when many are settling into their careers, starting families, or making substantial financial commitments like buying a home. They have to manage multiple financial responsibilities and strive to reduce debt and increase savings for long-term goals.

- Gen X (43–58 years): At this life stage, individuals prioritize financial stability for the future. Paying off mortgages, funding college for their children, and maximizing retirement savings are among the top priorities. People try to maintain a strong rating to secure the availability of borrowed funds to support their financial goals.

- Baby Boomers (59–77 years): Approaching or in retirement, this group tends to focus on debt reduction, downsizing their living arrangements, and securing their retirement savings. Maintaining a high credit score remains essential for accessing credit if needed, allowing them to refinance existing debt, or making significant purchases if necessary.

People’s priorities, needs, and demands change throughout life. As people grow older, most pay off loans and mortgages and reduce or close credit lines. At the same time, they have long credit histories and reduced active borrowing. Their credit habits reflect decades of their financial reliability, hence a higher credit score average by age for oldsters.

Factors Contributing to Credit Scores

Your credit score significantly impacts your eligibility for loans, the interest rates you are offered, and your financial opportunities regarding approval when applying for a mortgage, auto loan, or credit card. Understanding the key factors that influence the average American credit score is crucial to keeping yours in top shape.

- Payment History: This is the most crucial aspect of your score. It reflects how consistently you have made timely payments on your credit accounts. A history of on-time payments without delays and overdue can bolster your score, while late payments or defaults can significantly harm it.

- Credit Utilization: This measures the ratio of your current card balances to your total available credit limits. Keeping it low (preferably under 30%) positively impacts your score.

- Credit History Length: This includes the age of your oldest account, the average age of all your accounts, and your newest account. Longer credit histories generally relate to higher scores.

- Credit Mix: Lenders appreciate diversity in your portfolio. A diverse mix of credit accounts, including cards, mortgages, and installment loans, can demonstrate your ability to manage various types of credit responsibly.

- New Credit: Opening too many new accounts in a short period can be a red flag for lenders, as it may indicate financial stress and a higher risk of default. It’s best to limit the number of new credit inquiries to keep your score healthy.

Notably, payment history and credit utilization are the prime factors to monitor and keep your eye on since they account for 35% and 30% of your overall rating accordingly. So, to maintain your healthy rating, make sure you pay your bills on time, keep your credit card balances low, and pay off your balances in full whenever possible.

Final Thoughts

All in all, a high average credit score by age in the US reflects a solid level of financial literacy and responsibility among Americans. When it comes to personal finance, this metric serves as a benchmark for comparing your creditworthiness against your peers. Understanding where you stand compared to these average numbers can help you identify the areas for improvement and take proactive steps to enhance your credit health. With consistent discipline, diligence, and a bit of smart financial management, you can steer your score toward greater heights, opening doors to better financial opportunities and securing your future.