New Cash Advance Apps: A Guide to Choosing the Right One for You

Contents

Did you ever find yourself in a situation where you have to deal with an unexpected car repair or medical bill? Remember desperately looking for some extra cash to get by until payday? Allowing users to borrow small amounts of money quickly and without the hurdles of traditional loans, money advance apps are a good way to cover such emergency expenses.

However, the market will bombard you with a dizzying array of choices. How do you figure out which of those are actually worth your while? This article will walk you through the essential features of apps to borrow money and outline the best cash advance apps to help you make an informed decision.

How to Assess Cash Advance Apps

Choosing the right cash advance app can make a significant difference in your financial health. Remember, not all apps are created equal. Some might offer better terms or features, while others could come with hidden fees or unfavorable repayment terms. Here are key factors you should assess when evaluating a cash advance app.

Reputation Is King

First, consider how long the service has been on the market. It’s not to say that all newcomers should be written off, but a longer presence often correlates with a higher likelihood of receiving quality service. Who would you trust more—a person whom you have known for years, and who proved to be reliable or your new neighbor who just seems to be okay at first glance?

Fees & Rates

Before committing to an instant cash app, take a close look at its fees and rate structure. Calculate how much you would actually pay for the convenience of borrowing. Some apps charge a flat fee per advance, while others operate on a tipping system or require a subscription or membership fee to access features like fast funding or higher advance limits. If you need the cash immediately, an app can also charge extra for express processing.

Advance Limits

Not all cash advance apps offer the same borrowing limits. Some apps allow you to borrow only small amounts like $50, while others may provide advances of up to $500 or more, depending on your financial situation and income. Many apps start low and increase your limit over time as you build trust through regular use and on-time repayments.

Repayment Terms

Most apps automatically withdraw the advance amount from your account on your payday. Make sure this aligns with your cash flow to avoid overdraft fees or penalties. Consider apps that offer flexibility, enabling early penalty-free payments, partial payments, and due date extensions.

Speed of Funding

If immediate access to cash is critical, you may prioritize apps that offer faster funding, even if there are extra fees attached. However, if you can wait a day or two, choosing an app with a standard transfer time may save you money.

Varo

- Reputation and longevity: Operating since 2015, Varo has built a solid reputation.

- Fees and Rates: No interest, no fees, no subscription fees (a flat commission fee of 8% from the borrowed amount).

- Advance limit: $20–500 (could be increased for Varo clients with online bank accounts or savings accounts).

- Repayment terms: up to 30 days.

- Speed of funding: Instant funding.

- Most suitable for: Those willing to pay extra for speed and convenience.

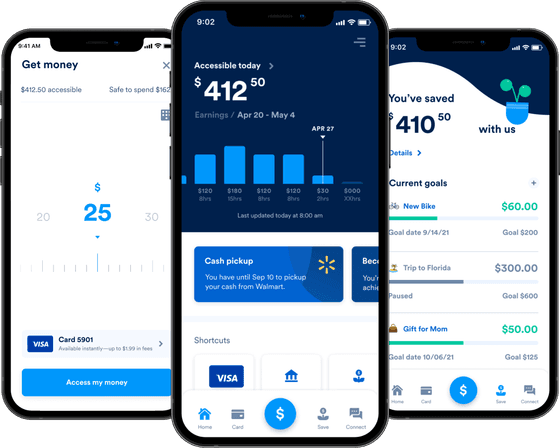

Payactive

- Reputation and longevity: Since 2012, Payactiv has maintained a strong reputation.

- Fees and Rates: No tips or subscription fees, $0 to $3.49 commission.

- Advance limit: up to $1,000 with direct deposit setup or up to $500 without a deposit.

- Repayment terms: Your next paycheck.

- Speed of funding: Immediate.

- Most suitable for: Hourly workers and employees in Payactive partnered companies who want to access earned wages before payday and use budgeting tools.

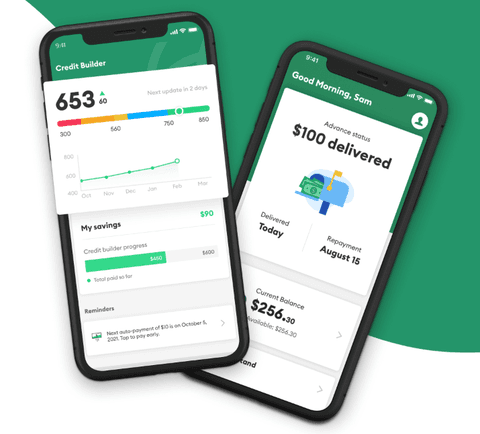

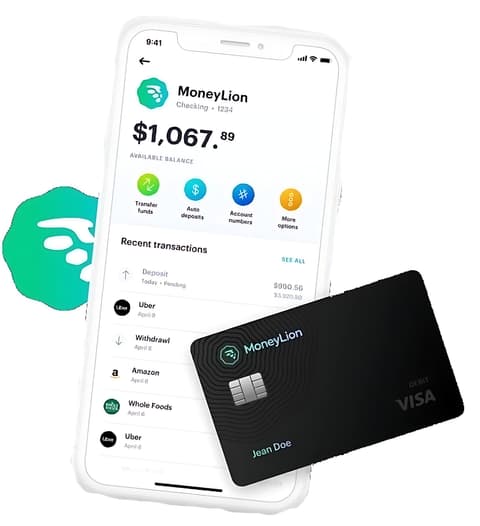

MoneyLion

- Reputation and longevity: Established in 2013, MoneyLion is known for its reliable service.

- Fees and Rates: No interest and mandatory fees, optional tips, $0.49 to $8.99 fee for instant transfers.

- Advance limit: up to $500 (with an option of increasing it up to $1,000).

- Repayment terms: Next paycheck.

- Speed of funding: up to 5 business days or immediate for a fee.

- Most suitable for: Users looking for hefty cash advances and credit-building tools to enhance their overall financial health.

Earnin

- Reputation and longevity: Launched in 2014, Earnin is one of the most popular instant cash advance apps that ranks high among competitors.

- Fees and Rates: No interest, no service fees, $2.99 commission for express funding.

- Advance limit: up to $750 (with a $100 limit for daily transfers).

- Repayment terms: Next paycheck.

- Speed of funding: up to 2 business days, instant funding available for a fee.

- Most suitable for: Individuals with consistent income and direct deposit who want instant access to wages without fees and need help avoiding overdrafts.

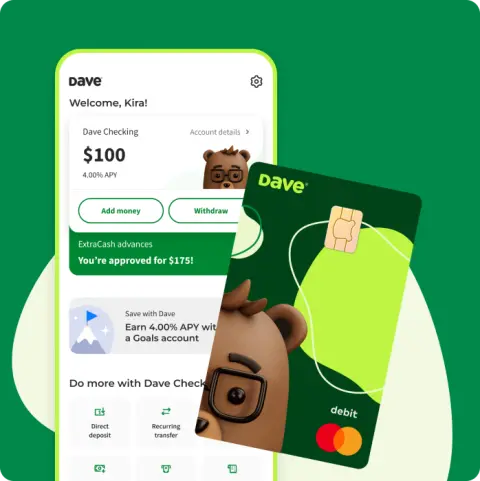

Dave

- Reputation and longevity: Founded in 2016, Dave is one of the new cash advance apps that stands firm on its fit and keeps gaining pace.

- Fees and Rates: No interest, optional tips, 3% fee for express transfer to the Dave account, 5% fee for express transfer to an external account.

- Advance limit: up to $500.

- Repayment terms: Next payday.

- Speed of funding: Instant transfers at a fee, free regular transfers take up to 3 business day.

- Most suitable for: Those who need a simple, no-interest cash advance, especially those looking to find side gigs for extra income.

Brigit

- Reputation and longevity: Brigit has been operating since 2017 as a financial health management and cash advance app.

- Fees and Rates: $8.99–14.99 subscription fee.

- Advance limit: $50–250.

- Repayment terms: Next payday.

- Speed of funding: up to 2–3 business days, instant cash for a fee of up to $3.99.

- Most suitable for: Individuals who need budgeting assistance and are also interested in building or improving their credit score.

Chime

- Reputation and longevity: A solid online bank with an excellent track record.

- Fees and Rates: No interest or service charges, $2 express funding fee.

- Advance limit: $20–500.

- Repayment terms: Next direct deposit.

- Speed of funding: up to 2 business days, immediate funding for a small fee.

- Most suitable for: With no minimum balance requirements and no overdraft fees in place, Chime is an excellent choice for those who want access to cash advances along with solid overdraft protection.

Smart Strategies for Using Cash Advance Apps

To make sure that the borrow money app brings you only a positive experience, consider these simple tips.

Understand the Specifics of Instant Loans and Your Goals

Instant loans, or microloans, differ from traditional bank loans. They typically have shorter terms, are smaller in size, and are accessible even to those with no or poor credit history. Remember, they’re designed to be an emergency solution first and foremost.

Compare Your Desires with Your Capabilities

This principle applies to all financial apps that let you borrow money. A sound rule of thumb is to ensure that your total monthly loan payments don’t exceed 30–35% of your income. Only borrow if you’re confident you can meet the terms.

Read the Terms and Conditions Carefully

Always read the service agreement carefully. The contract should include a QR code with comprehensive details about the lender and the total cost of the loan. Ensure it specifies the maximum overpayment amount.

Final Thought

Considering how many options are currently available on the market, selecting the ideal instant cash advance app requires more than a cursory glance. Focus on the provider’s reputation, terms, and app special features, and you’ll make the right choice most of the time.

The key takeaway? Choose an app that not only helps fulfill your immediate financial needs but also offers broader strategic solutions.