Bitcoin Price Prediction: What to Expect in the Future?

Contents

As the world’s first and most widely recognized cryptocurrency, Bitcoin has stirred up fascination since its inception. Launched in 2009, Bitcoin has grown from a niche digital currency into a significant player in global financial markets. Its meteoric rise has drawn in the interest of investors, financial analysts, and even regulatory bodies across the globe. Bitcoin price prediction, however, remains one of the most complex challenges in finance.

So, what are the projections for Bitcoin? We’ll go over historical trends, key drivers, and expert forecasts to paint a clearer picture of what you can expect. Let’s dive into the future of Bitcoin together.

Bitcoin Current State

Before looking into Bitcoin predictions, let’s first lay out where this groundbreaking currency stands today.

Today, Bitcoin holds onto its dominant position in the crypto market with the highest market capitalization, far outpacing thousands of other digital currencies. In mid-2024, Bitcoin’s market cap sits around $1.2 trillion, making it the leading digital asset by a significant margin. Its decentralized nature, secure blockchain, and deflationary model (with only 21 million coins ever to be mined) have built up its reputation as a “store of value,” often put alongside gold.

Bitcoin’s journey in recent years has been a rollercoaster characterized by notable highs and sharp corrections.

- In 2022, the failure of the Terra Luna stablecoin ecosystem and the bankruptcy of major cryptocurrency exchange FTX sparked a broader “crypto winter,” causing Bitcoin’s price to fall back below $20,000 by July 2022, with the year closing in uncertainty and low investor confidence.

- 2023 brought signs of recovery. Bitcoin entered the year trading around $17,000 but began picking up momentum. Institutions like BlackRock and Fidelity hinted at a return to Bitcoin investment, and the launch of new Bitcoin-based ETFs opened up access to Bitcoin for retail and institutional investors alike. By the end of 2023, Bitcoin was trading between $35,000 and $43,000—a modest but steady recovery from its 2022 lows.

- 2024 marked a major resurgence, with Bitcoin seeing its first major rally since the 2021 highs (nearly $69,000 in November). Starting at $44,000 in early 2024, Bitcoin soared past its previous all-time high, reaching a new peak of $72,000 by March 11, 2024.

What’s behind that impressive BTC price jump-up in Q1 2024? One of the reasons for that hike was the approval of spot Bitcoin ETFs in the US. Another reason was the anticipated interest rate decrease from major central banks.

From March to April 2024, prices hovered between $70,000 and $65,000 in anticipation of the BTC halving event. Historically, Bitcoin halvings are followed by significant price increases due to reduced supply and heightened demand. However, the one that took place on April 19, 2024, didn’t match the increase projections for Bitcoin. Though prices remained high, they didn’t skyrocket, and the Federal Reserve’s April 30 decision to keep interest rates unchanged further slowed down Bitcoin’s price rise, leading to a drop below $57,000 in May 2024.

The next spike above $67,000 came in July after the withdrawal of US presidential candidate Donald Trump and current president Joe Biden, which shook up the election race.

Bitcoin Forecast for the Remainder of 2024

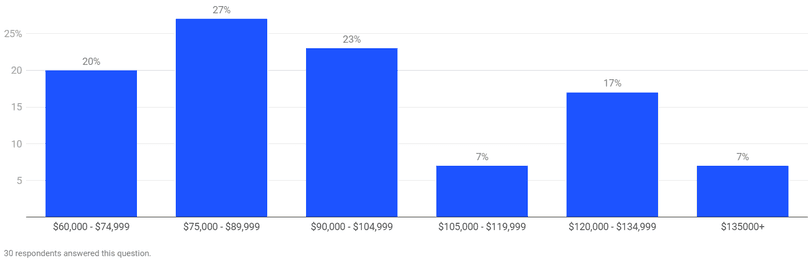

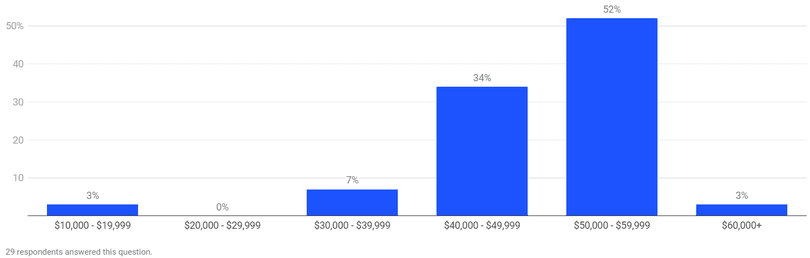

In mid-2024, Bitcoin continues to experience significant price swings, marked by periods of sharp growth followed by deep corrections. Volatility remains its defining feature. So, what are Bitcoin price projections till the end of the year? Here’s a quick breakdown of the range of predictions by year-end of the recent Finder survey conducted in July 2024 with 32 industry experts for Bitcoin price forecast:

Highest Bitcoin Projections for the End of 2024

Lowest Bitcoin Projections 2024

Note: Each figure above shows the percentage of experts forecasting within each price range.

What impacts BTC prediction? There are several key factors that are likely to play a role in shaping the price movements for the rest of 2024.

Institutional Investors

Institutional interest in Bitcoin has been a driving force behind its recent price growth, and this trend is expected to stay strong through 2024. Major financial institutions, asset management firms, and corporations are looking at Bitcoin as a legitimate asset class.

Bitcoin ETFs make it easier for both retail and institutional investors to gain exposure to this crypto without needing to buy and hold it directly. In uncertain economic times, institutions also turn to Bitcoin to diversify their portfolios. Entities that once avoided cryptocurrencies are now seeing BTC as a potential guard against inflation risk, fiat currency devaluation, and geopolitical instability. Large corporations, following the lead of early adopters like Tesla and MicroStrategy, may continue accumulating Bitcoin as part of their long-term strategy.

Increasing institutional participation could help smooth out Bitcoin’s volatility over time by providing more liquidity to the market.

Macroeconomic Trends

The global economic environment will be a crucial factor for BTC price prediction in the second half of 2024. This year, banks are trying to balance out inflation control with economic growth, creating uncertainty in traditional markets, such as Europe and the US. Bitcoin, with its fixed supply and decentralized nature, is often seen as a reliable protective shield against inflation, which could drive demand as fiat currencies lose purchasing power.

Despite the global economy showing signs of slow yet consistent growth in 2023–2024, global recession concerns still hang over the market, particularly in light of the economic turbulence caused by the ongoing geopolitical tensions and supply chain disruptions. Though the recession is not likely to materialize in 2024, these worries may push investors to protect their capital by seeking refuge in assets that are not tied to traditional economies.

Regulatory Trends

The US government has been working on introducing comprehensive crypto regulations, focusing on such areas as taxation, anti-money laundering (AML) compliance, and investor protection. Though the pre-election rush slows down progress in this sphere, any positive regulatory developments could spur more institutional investment.

Beyond the US, other countries are moving toward clearer regulations. For instance, in Europe, the Markets in Crypto-Assets (MiCA) regulation is set to come into effect, providing a clearer framework for crypto businesses. Meanwhile, some countries in Asia, like Japan and South Korea, show progress in this area and are becoming more crypto-friendly.

All in all, any moves in the regulatory landscape can influence BTC prices both positively and negatively.

Political Momentum

The prediction of BTC prices largely hinges on geopolitical events and decisive moves, particularly in key countries like the US. So, the 2024 pre-election rush in the US has already triggered swings in Bitcoin prices, and this tendency is expected to play out through the rest of the year. Growing crypto support from high-profile lawmakers, including the presidential candidate Donald Trump, has boosted investor confidence and spurred BTC prices. However, public sentiment is as volatile as BTC pricing and can flip overnight, which could turn Bitcoin’s gains into sharp drops.

Bitcoin Halving in April 2024

As we’ve noted, Bitcoin halvings have historically spurred rapid price hikes. Although we haven't seen a dramatic jump following the recent halving in April 2024, it’s too soon to gauge its long-term effects. For instance, following the 2020 halving, the BTC price boosted from over $10,000 in October 2020 to above $64,000 in April 2021, requiring over five months to show significant gains. So, we might still see this halving follow suit.

Future Bitcoin Projections: Bull and Bear Scenarios

As Bitcoin moves through 2024, bulls and bears keep debating to outline market sentiment and throw potential both optimistic and pessimistic Bitcoin prediction versions at us grounded in a blend of economic, technological, and regulatory factors, as well as shifts in market psychology.

Bullish Scenario

In the bullish view, several forces converge to push Bitcoin toward new peaks, potentially surpassing previous cycles.

While global economic uncertainty, fueled by factors like inflation, rising debt, and currency debasement, could set Bitcoin as a “safe-haven” asset, many experts perceive accommodative monetary policies as the main driver of the anticipated BTC rally. They look to the green light from the Federal Reserve to drop interest rates as a launchpad for Bitcoin’s price ascent. This shift could end up flooding financial markets with liquidity in financial markets, drawing in investors flush with capital who may be drawn to riskier assets like Bitcoin in pursuit of higher returns, setting off a new bull run.

Institutional adoption of Bitcoin is also picking up steam in the bullish outlook. Pension funds, hedge funds, and even sovereign wealth funds are carving out a slice of their portfolios to Bitcoin, which not only legitimizes the asset but also helps push its price higher. By the second half of 2024, the accumulated participation from institutional players could keep prices on an upward trajectory.

Technological advancements in BTC could also be a game-changer, pushing prices further in 2024. Among the most anticipated updates is the expansion of the Lightning Network, a second-layer protocol that speeds up and lowers the cost of BTC transactions. With improved scalability, this cryptocurrency could come off as more appealing for everyday payments and transactions, potentially ushering in a broader wave of adoption.

Finally, the introduction of spot Bitcoin ETFs will likely lift BTC price trends by channeling in additional investor money.

Bearish Scenario

Even though the bullish argument is persuasive, Bitcoin’s future isn’t without significant risks that could lead to price drops and stymie Bitcoin’s growth in 2024.

While bulls hail 2024 as a positive milestone, bears are more cautious about it. Halvings create scarcity, yet they also chip away at miners’ earnings. In the short term, this scarcity can drive up prices as investors look forward to supply constraints. However, in the long term, as the block rewards drop off, miners may find themselves relying more on transaction fees for revenue. If fees don’t rise enough to make up for the reduced block rewards, this could introduce security risks.

The rise in inscriptions on the Bitcoin blockchain—often dubbed “Bitcoin Ordinals” or “Bitcoin NFTs”—poses another potential threat to BTC’s long-term viability. These inscriptions allow for the permanent storage of arbitrary data, like text, images, or code, directly on the Bitcoin blockchain, but they also raise concerns about network congestion, transaction fees, and Bitcoin’s intended use case as a decentralized currency.

Governmental pressure remains a crucial factor in the bearish scenario. Stringent tax laws and compliance demands might end up pushing away both retail and institutional investors, shrinking demand. Countries like China might continue cracking down on cryptocurrency usage, further shrinking Bitcoin’s market. If more governments decide to impose tough regulatory measures, BTC’s global adoption could slow down, pushing its price downwards.

Finally, Bitcoin has also historically run through cycles of ups and downs, with steep dips following parabolic rises. A bear scenario in 2024 could unfold if Bitcoin hits a new all-time peak (like the one in March), leading to a large sell-off from investors eager to lock in gains.

Bitcoin Future: Is This Crypto a Good Investment?

Whether Bitcoin is a good investment or not largely depends on your investment objectives, risk tolerance, and long-term outlook. To make a call, you need to consider the key aspects that make it attractive, as well as the risks that come with it.

Benefits | Risks |

|---|---|

Potential for high returns | Volatility and market fluctuations |

Hedge against inflation | Regulatory uncertainty |

Growing institutional adoption | Sustainability risks |

Decentralization and security | Hack risks |

Portfolio diversification |

|

One way or another, Bitcoin, often seen as “digital gold” in the financial world, continues to hold strong investment potential. So, as we look at 2024, is it time to buy, sell, or hold BTC? Given the recent trends, selling may not be the best move. With numerous indicators of a bullish outlook on the horizon and many experts forecasting a potential BTC price surge to an impressive $100,000 by 2025, it’s likely the time to buy or hold onto your BTC.