Free Budgeting Templates and Spreadsheets: Everything You Need to Know

Whether you strive to tame your small business finances or want to stay on top of your personal expenses, efficient budgeting is the key to financial success. However, for newbies, it often feels like a daunting task. Is there a secret tool that can simplify this process, making it manageable and easy? A budget spreadsheet template is the answer.

These simple yet functional tools for managing your money will guide you toward your monetary goals with precision, like a financial GPS. Standardized financial worksheets offer something to novices and seasoned pros alike, taking the strain out of budgeting math and keeping finances organized. With the help of a free budgeting template, you will be able to achieve your financial goals with more ease.

This guide covers everything from understanding these templates and how they work to finding the perfect fit for your unique financial needs.

Exploring Budgeting Template Types

A budget sheet template is a pre-designed framework that helps individuals, households, businesses, or organizations effectively manage their finances. These tools come in the form of spreadsheets (like an Excel budget template or Google Sheets), feature-rich online calculators, or specialized software. They contain predefined categories, columns, and formulas, enabling users to input their financial data and generate automated calculations.

Budget spreadsheets and templates vary in complexity and purpose. Some are simple and cater to personal needs, while others are more intricate and designed for business budgets and bigger projects. By offering a clear overview of income sources, expenses, and savings goals, they make financial planning more comprehensible and smooth. Besides, they often include features for forecasting, tracking spending patterns, and analyzing financial well-being to keep up with your vital financial indicators.

Budgeting templates come in different types, each tailored to serve specific purposes and each offering a well-structured approach to managing your finances.

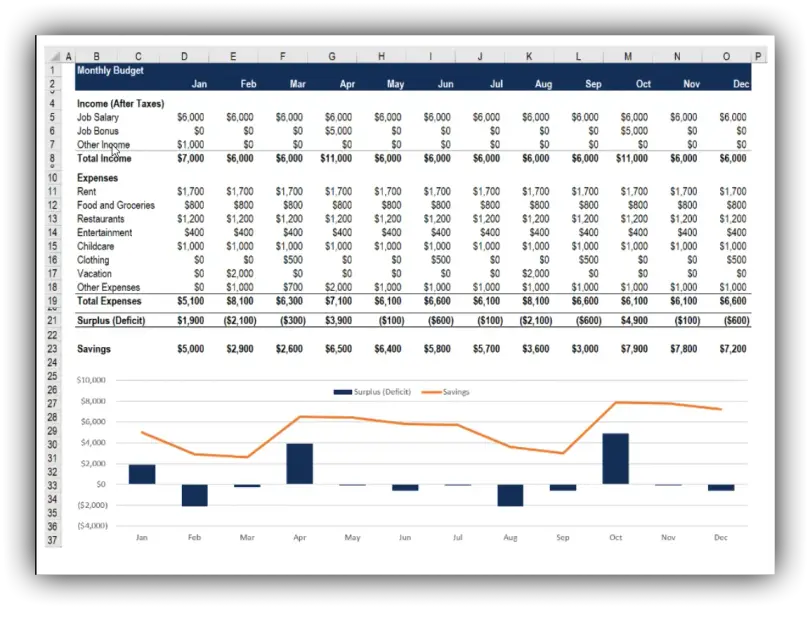

Personal Budget Template

Do you still overlook your finances? Want to get the most out of your earnings? A free personal finance spreadsheet will make the monthly income and expense math easier and help you get full control over your funds.

- Providing a detailed breakdown of your cash inflows and spending, it allows you to understand where your money goes and how much you're saving;

- It will help you set realistic financial goals and track progress, motivating you to stay on track with your savings targets;

- With a structured budget in place, you’ll feel less stressed with financial uncertainty, gaining a sense of control and confidence;

- It encourages disciplined financial habits, promoting responsible spending.

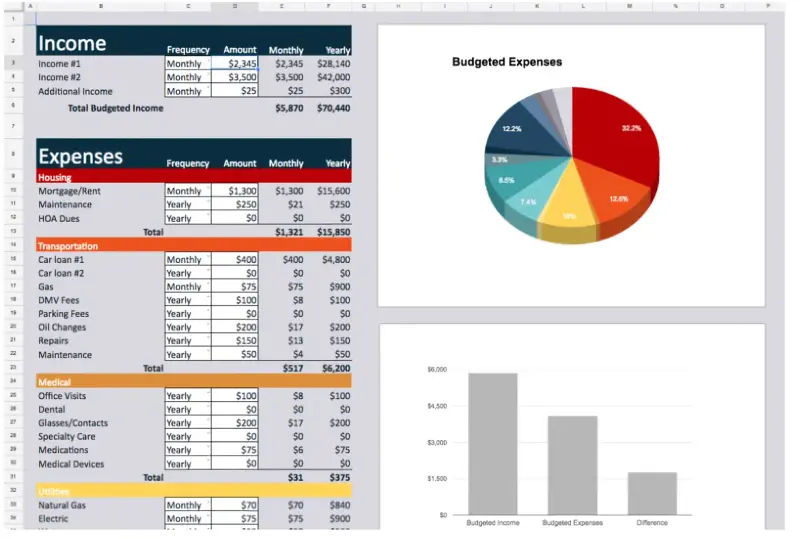

Household Budget Template

A monthly expenses spreadsheet for households is the financial glue that holds a family or shared living arrangement together. Allowing for combined income tracking and shared expense management, the use of this template:

- Promotes open communication among household members about finances;

- Ensures that expenses are distributed fairly among members, allowing everyone to contribute according to their capacity;

- Facilitates planning for future expenses, enabling the household to allocate resources efficiently and save for collective goals;

- Reduces conflicts or disagreements over money matters.

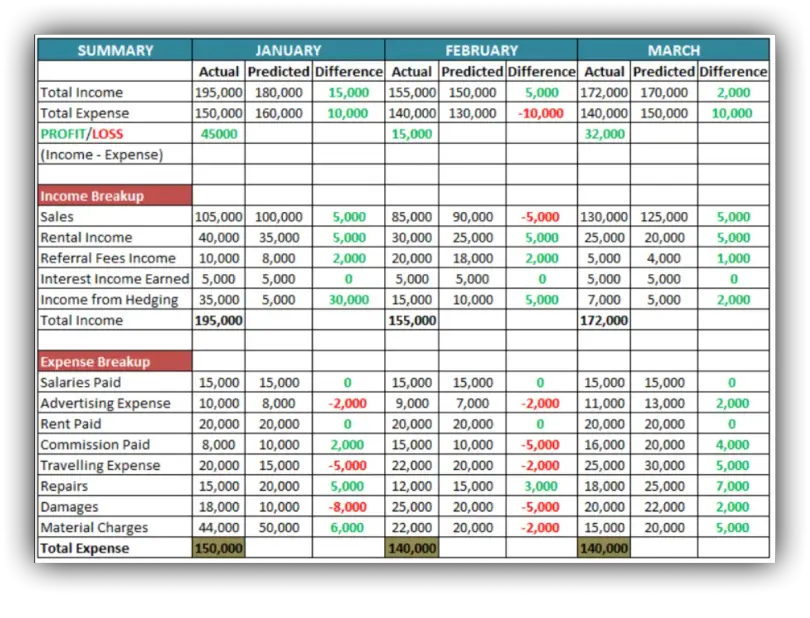

Business Budget Template

Keeping an eye on business finances is easier said than done. Yet, for business owners, it’s vital to accurately manage and control a company's financial activities. With a thought-out and well-structured financial spreadsheet at hand, they will be able to navigate the complex landscape of business revenues and expenses, steering their enterprise toward its financial objectives.

A business spreadsheet template for budget:

- Provides a roadmap for financial planning;

- Equips management with valuable insights into the financial health of the business;

- Helps in allocating resources to different areas, optimizing operations and enhancing profitability;

- Enables the evaluation of actual financial performance against budgeted figures;

- Identifies potential financial risks or areas of concern to address issues before they escalate.

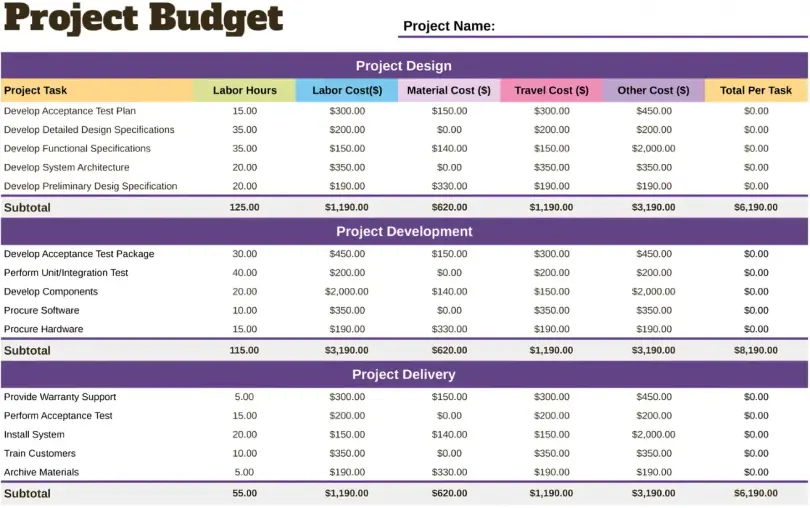

Project Budget Template

A project budget spreadsheet template allows for the input of estimated and actual expenses, automatically calculating totals, remaining budgets, and variances between planned and actual figures. Graphical representations, such as Gantt charts or pie charts, offer visual insights into expenditure distribution and project progress.

As such, it guides project managers and stakeholders toward successful project completion by ensuring:

- Financial clarity and control;

- Effective cost management;

- Resource optimization;

- Risk mitigation;

- Improved decision-making.

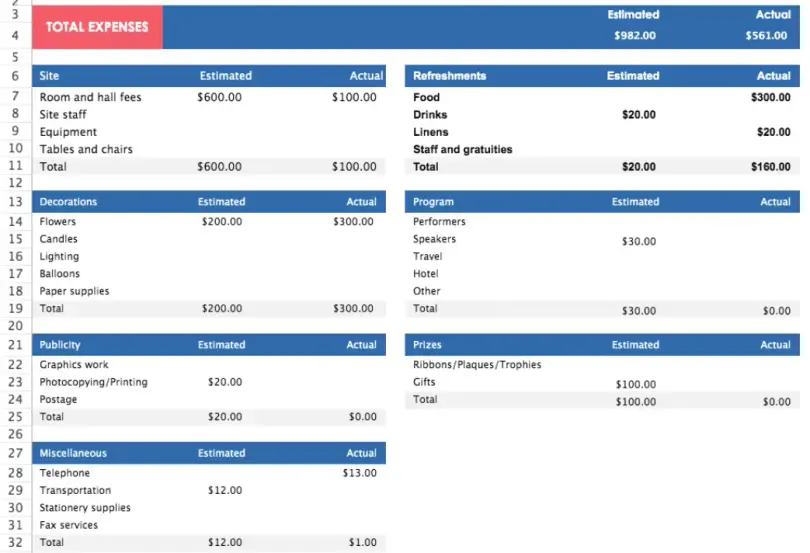

Event Budget Template

This type of worksheet is the financial architect behind any successful gathering, be it a wedding, conference, fundraiser, or any other occasion. It’s an efficient planner for the event’s financial resources and a smart tracker for expenses to:

- Allocate funds to various aspects according to priority;

- Adjust expenses in real time;

- Stay within the budget limits;

- Ensure that the event runs as planned.

Tips on Choosing the Budgeting Template to Match Your Needs

The best budget spreadsheet template is the one that caters to your specific needs and comfort level. To save you the trouble of searching high and low, here are a few criteria to help you make the right choice:

- Your goals: The template type and format should line up with your financial objectives. Give preference to customizable worksheets to accommodate different goals or scenarios, giving you an opportunity to adjust as your financial priorities evolve;

- Your income and expenses: Ensure the template can handle multiple income sources, especially if you have various revenue streams or irregular income. Opt for the one that splits expenses in a way that reflects your spending habits;

- Your preferences and habits: Pick a financial spreadsheet with an interface that suits your preferences, whether it's a simple design or a more comprehensive layout. Consider between fully automated calculations and manual input;

- Your level of knowledge: A template should match your proficiency. Select whether you are comfortable with a straightforward layout or a more advanced, feature-rich design. If you are a first-time user, prioritize options with guides, tutorials, or online support.

Don’t hesitate to try out a few different templates to find the one that will suit you to a tee. Check our list of budgeting templates you can download for free.

- Free Google Spreadsheets;

- Free Excel Budget Templates;

- Top Excel Budget Templates;

- Budget Google Sheets.

HOW TO USE FREE BUDGETING SPREADSHEETS EFFECTIVELY

It is one thing to have a spreadsheet with how much you spend and save, but it’s another thing to use it to the fullest. Once you have a basic understanding of how your spreadsheet works, you need to approach it strategically to get the best results. Here are some recommendations to take into account:

- Make sure your goals are realistic. When you are just starting budgeting, it is essential not to be delusional about your saving and spending goals. This will ensure that you remain motivated, as you will see gradual progress. It is always better to start small and increase your savings over time as you get more comfortable;

- Always add all expenses. It can be easy to forget the minor expenses when creating a budget, but they can add up. You should ensure you enter your cash expenses in your budget and carefully check all your credit and debit card transactions;

- Try different time frames. Depending on your goals and what you use a template for, you can use a monthly, weekly, yearly, or another time frame. It is a good idea to try different structures, as the best one will depend on when you get income and your spending;

- Review your budget every six months. You need to do this even more often if you have some changes in your life — a new job, moving to a different house, buying a car, etc. You may need to adjust your budget accordingly, so you should constantly set aside time to review it carefully;

- Use additional tools to your advantage. You can supplement your free personal finance spreadsheet with additional financial tools, which there are plenty of at the moment. Some of the most popular budgeting apps of 2024 include YNAB, PocketGuard, Goodbudget, and Stash. Having a budgeting app brings you additional features, and they are easy to use on the go.

With money tracking and setting financial goals, it’s essential to be flexible and patient. You need to regularly make adjustments according to changes in your life, inflation, and the overall situation in the country.

Final Thought

Budget templates are a genuine helping hand in their power to guide you toward financial stability and success. By embracing these tools, you’ll unlock a new level of financial awareness and control. So, pick one of the templates from our list or explore others available online and embark on your path to financial freedom.

FAQ

What are some alternatives to free budget templates?

For comprehensive money management, you may consider specialized budgeting software, such as Quicken or QuickBooks. If you need little beyond tracking your spending, Mint is an option.

What are the benefits of using a budgeting template and spreadsheet?

Using a free budgeting template goes beyond just organizing numbers. It ensures financial clarity, realistic financial goal setting and tracking, efficient resource allocation, smart planning, and informed decision-making.

Can I customize a budgeting template or spreadsheet?

Usually, templates are designed to be adaptable to suit your specific needs, preferences, and financial goals. They allow you to adjust categories, format, modify or add formulas, incorporate charts, graphs, or summary sections for better visualization, etc.

How do I choose the best budgeting template for my needs?

The budget spreadsheet should align with your financial goals and plans. Once you pick the appropriate template type, consider its usability, accessibility, flexibility, dashboard customization capabilities, and adaptability to match varying financial scenarios.