How to Invest Money: A Beginner’s Guide

Starting an investment journey may seem overwhelming because there is so much information and options available. The good news is that you can always start small and grow your investment portfolio over time. With the right investment plan, you can stay ahead of inflation and grow your wealth.

In this article, you will learn about how to invest money, define your goals, choose an investment account, and pick the right investment strategy.

Set Your Investment Goals and Determine Time Horizon

Understanding investments for beginners should start with the idea of setting the right goals. To determine whether you have a good investment goal, you can use the SMART principle:

- Specific

Your investment goal should be specific, such as funding your child’s education. If your child will enter a university in 2034, you have 10 years to save up money for this goal. You can determine how much you need to save based on this information.

- Measurable

Next, your financial goals should be measurable. You have to see at which point you are at every step of the way and how close you are to success.

- Achievable

The best way to stay motivated and not get carried away is to make sure your goals are achievable. Investment can be a long journey, and there is no shame in starting small.

- Relevant

Your financial goals should be relevant to your life and align with your other goals and personal values.

- Time-bound

Having time-bound goals allows you to be more disciplined with your finances, and you can see how much you need to save every month or week.

Furthermore, when you are learning how to start investing, you have to be familiar with the concept of time horizon. The time horizon is a period during which you plan to hold an investment before you decide that you need your money back.

To determine your time horizon, you need to take a look at your investment goals and plans. When an investor decides on a shorter horizon (up to 5 years), it is best to choose a less risky portfolio while those who have extended time horizons can allow themselves to make riskier decisions.

What Investment Account Is Right For You?

The next step in understanding how to invest money for beginners is to choose the right account — a tax-advantage or a taxable one.

Your account selection should depend on its purpose. For example, if you want to save for retirement, you should go with IRA or 401(k) accounts, which belong to the tax-advantage category.

The benefit of taxable accounts is that you get more flexibility and you can withdraw money at any moment. Referred to as brokerage accounts, they don’t require you to pay specific amounts and you can withdraw your money whenever you want.

Choose the Right Investment Strategy

An article on how to invest for beginners wouldn’t be complete without talking about investment strategies. The two main options available to you are active and passive investing.

Active investing

When you choose this strategy, you maintain and manage your portfolio on your own, researching your stocks and performing investment analysis. Active investing doesn’t have to involve frequent selling of stock, but it requires experience.

Pros

- Higher chance of getting significant returns

- High level of flexibility

Cons

- Requires specific knowledge

- Higher risks

Passive investing

Passive investing usually refers to delegating part of your investment management to another person in mutual funds or other forms of agreement. You may even adopt a fully passive stance and hire a financial advisor. This investment plan involves less selling and buying, as it is a strategy for the long run.

Pros

- Tax efficiency

- More predictability and stability

- Low fees

Cons

- Smaller returns

- Reliance on other people to make decisions

- Less flexibility

Passive investing is a better option for beginners, as it is less risky and allows you to get first-hand experience.

What Are the Main Types of Investments?

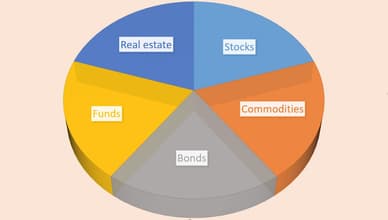

From individual stocks to real estate, there are plenty of types of investments for a wide range of goals and budgets:

- Stocks

Buying stocks is a great option for beginners, and they offer a good way to diversify a portfolio. When you become a shareholder in a certain company, you get a portion of the company’s ownership. Depending on the share type, you may have voting rights and dividend payments.

- Commodities

Commodities are any type of tangible resource that you can purchase. This can be anything from agricultural goods to gold. Commodities are considered more volatile classes of assets and they are associated with a higher risk compared to some other investments.

- Bonds

Bonds fall into a category of debt instruments and are issued by corporations or the government to raise money. When you purchase a bond, you give a loan to an issuer and receive interest payments over the established period. Bonds are generally considered a secure option.

- Funds

This category includes index funds, mutual funds, and exchange-traded funds. When you decide to invest in funds, you have an opportunity to simultaneously purchase an entire basket of bonds, stocks, and other assets to get a diversified portfolio.

- Real estate

With this investment type, you can purchase real estate directly or buy shares in real estate trusts. The latter option is similar to mutual funds, with investors purchasing properties collectively.

Final Thoughts

Learning how to invest your money is an excellent way to get the most out of your finances. At the same time, you have to be honest about your risk tolerance and have a specific time horizon when investing. By choosing a suitable investment account and strategy, you can make your investment journey profitable.

FAQ

What is investing, and why is it important?

The goal of investing is to acquire assets to get income later. The value of an asset can increase over time, and investors will earn money by selling it in the future. Currently, there are plenty of good investments for beginners on the market.

How much money do I need to start investing?

It is possible to start investing at any financial level. Even if you have just $10, you can still invest in the stock market thanks to fractional shares. However, if you are serious about getting into the world of investing, $200 to $1,000 is a good start.

What are the different types of investment accounts, and how do I choose?

Investing money for beginners starts with choosing an investment account. The main types of these are standard brokerage accounts, self-employed retirement accounts, individual retirement accounts, employer-sponsored accounts, and more. Your choice should depend on your personal finances, age, types of assets, and preferred tax breaks.