Largest Stock Exchanges in the World: Key Players and Market Trends

Contents

As of 2024, approximately 100 key stock exchanges operate worldwide, acting as essential platforms for listing thousands of international companies. These exchanges facilitate the trading of company shares, allowing investors to put their money to work and helping companies raise capital for various purposes.

What is the largest stock exchange platform? Keep reading to discover the major players in the global stock market, as well as the key trends that are shaping today’s financial landscape.

Major Stock Exchanges Worldwide

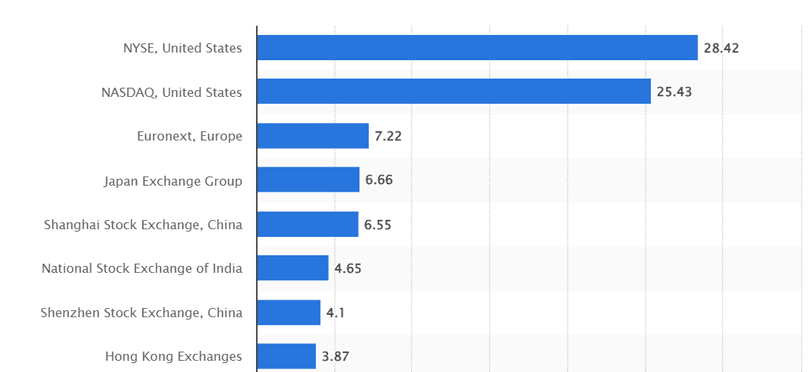

So, what are the world’s biggest stock markets and best bourses? Here’s a roundup of the top 7 financial trading platforms, including the largest stock exchange in the world.

New York Stock Exchange (NYSE)

Founded in 1792, the NYSE handles the trading of stocks and other securities with a total market capitalization exceeding $28 trillion. Based on market capitalization, it is the largest stock exchange in the United States and ranks second in the world when it comes to the number of listed companies.

The NYSE’s members fall into several categories, including specialists, commission brokers, floor brokers, and registered traders. As one of the most renowned and iconic exchanges, it competes fiercely in the market for listings of stocks, exchange-traded funds (ETFs), structured products, futures, options, and other derivatives.

Nasdaq

Nasdaq, one of the three major bourses in the United States, specializes in high-tech company shares. Established in 1971, Nasdaq has grown into a leading electronic trading platform.

It primarily serves companies from the United States, Canada, and Israel. The participants are top spanning industries in the areas of high technology, retail, telecommunications, finance, and transportation.

Tokyo Stock Exchange (TSE)

The Tokyo Stock Exchange (TSE) is the fourth-largest stock exchange globally and the leading exchange in Asia by market capitalization. Established in 1878, the TSE lists over 4,000 companies with a combined market capitalization of more than $6 trillion.

The TSE deals with three categories of shares: large enterprises, medium-sized firms, and start-ups.

Shanghai Stock Exchange (SSE)

The Shanghai Stock Exchange (SSE) stands as a premier trading platform in Asia and the biggest stock exchange in China. Having been in operation since 1990, it’s one of the youngest yet most promising bourses in the world.

The SSE lists over 3,000 companies. The exchange has restrictions—not all shares of national Chinese companies are open to international investors.

Hong Kong Stock Exchange (HKEX)

One of the top ten world’s largest stock exchanges., HKEX started operations in 1891. Today, it lists more than 2,500 companies with a total market capitalization of over $4 trillion.

HKEX plays a vital role globally, serving as a key gateway for international investors looking to tap into the Chinese market.

Euronext

Euronext is a European bourse that is one of the largest trading platforms in the world. It has been present on the market since 2000 and lists approximately 1,900 companies. It is headquartered in the Netherlands, with branches in Belgium, France, Portugal, and Italy.

Euronext offers a broad array of services, including stocks and derivatives trading, clearing services, and financial data. More than just an exchange, it acts as an entire market ecosystem, connecting the European economy to global markets.

London Stock Exchange (LSE)

The LSE is a prominent financial hub in Europe and holds the distinction of being the world’s oldest securities market. It first commenced operations in 1801.

Today, fewer companies list shares on the London Stock Exchange than a few years ago. This decline is attributed to several factors, including a lack of liquidity, an unfavorable regulatory environment, increased private equity financing, and more.

Market Trends

Technological Innovations

The rapid adoption of artificial intelligence (AI) and machine learning (ML) is revolutionizing how investors analyze markets and make decisions in the stock market. AI- and ML-based driven tools allow investors to forecast market trends more accurately, effectively identify lucrative opportunities, and assess potential risks.

Sustainability Focus

Today, sustainability is a top priority, and the stock market is reflecting society’s shift towards stability. Investors are increasingly focusing on long-term efficiency, reliability, and responsibility by backing companies that are part of sustainable solutions rather than being part of the problem.

Globalization

Globalization is a defining characteristic of the modern economy, and stock markets are becoming more interconnected. This means that all geopolitical events have a significant impact on markets worldwide.

Regulatory Changes

Shifts in legal or economic regulations can have a profound effect on the entire financial system. Regulatory changes, whether they occur globally or within individual countries, often lead to market fluctuations and can leave a lasting mark on investment portfolios.

Market Volatility

The rise of blockchain and cryptocurrencies has brought a new layer of volatility to financial markets, a factor that is becoming an integral part of the investment landscape. The volatility of assets has a major impact on the biggest stock exchange in the world, influencing market dynamics and opening up new investment opportunities.