The Rule of 72: How Does the Rule of 72 Works and When to Use It

It is no secret to anyone that investing your money is the key to a secure and prosperous future. However, this field may seem intimidating and challenging for beginners, especially when it comes to calculating the possible income. That's when hacks like the rule of 72, come to the rescue.

The rule of 72 is a formula that can assist you in calculating when your investment will double. That is when every dollar invested will make another dollar in the current market conditions. But there is more to it than just simple calculation. In this article, we will talk about the rule of 72 in simple terms to help you evaluate the effectiveness of investments and answer the questions, “What is the rule of 72?” and “How long does it take to double your money?”

How the Rule of 72 Works

To fully understand the rule of 72, we first need to understand compound interest. This concept describes the profitability of investments and is, therefore, of paramount importance. However, it complicates the calculation of potential profits, and we cannot simply add up all the interest for the required period and add it to the original amount.

Understanding Compound Interest

To better understand the concept, it is important to take a look at the rule of 72 examples. Let’s say you have deposited $100,000 in a bank, and the bank rate is 10%. In the first year, you will receive $10,000 in interest. Let’s say, you will not withdraw any funds and instead add this money to your investment. Next year, 10% will no longer be charged for $100,000 but $110,000. You will already receive $11,000 in income at the end of the year. In another year, interest will accrue at $120,000, and at the end of the year, you will receive $12,000, and so on.

This basic example shows how compound interest works and why you can't just add up percentages until you get 100% to see when you double your money. You need a 72 rule for that.

What is the Rule of 72 in Finance

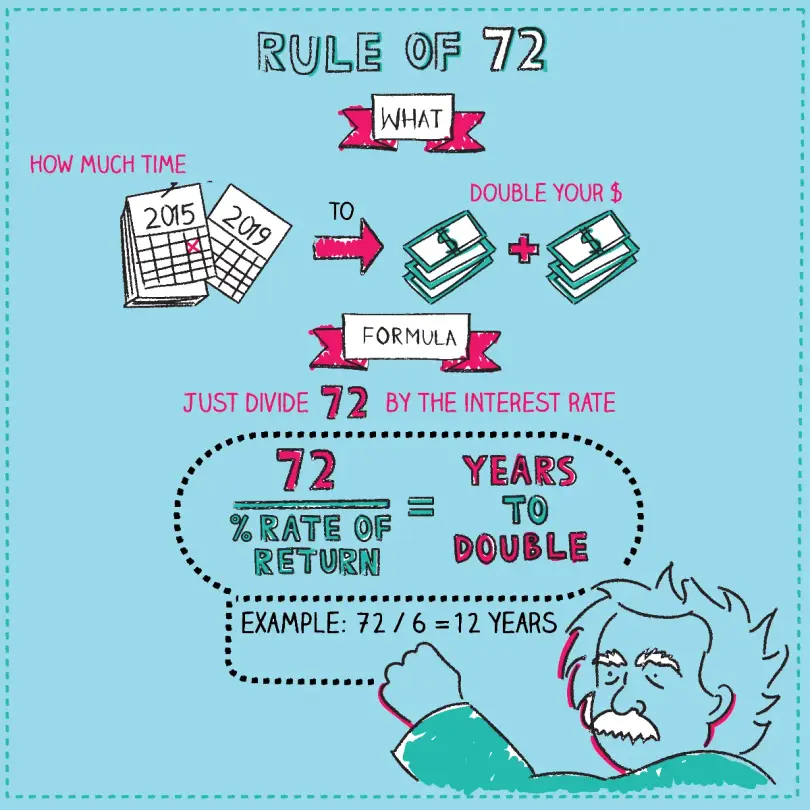

The mathematical rule of 72 is the ratio of the number 72 to the bank's interest rate or to a stock's dividend yield. This value will show how long it will take to double your capital under current conditions. The formula looks like the following:

72 / interest rate = Number of years to double the deposit

Here are a few 72 rule investing examples to grasp the principle better:

- The dividend yield of ABC company shares is 9% per year. Using the formula, you will get 72:9 = 8, meaning that in 8 years, the funds you invested in ABC shares will double.

- The dividend yield on shares of company CBA is 18% per year. Utilizing our method, we get 72:18 = 4. In this case, you double the invested money in 4 years.

This useful formula will help you understand how your investment portfolio will grow.

When to Use the Rule of 72

The rule of 72 is one of the most important principles in personal finance, and it applies to much more than just calculating profit from deposits. For instance, it can be used to estimate the effects of inflation. If prices rise by 6% per year, then after 72:6 = 12 years, you can buy half as much with the same money.

It is also helpful to calculate the rule of 72 when taking out consumer loans to figure out whether you need it at all. For example, you are offered a consumer loan at 9% per annum. Then, you just need to calculate 72:9 = 8. That is, in 8 years, you will pay twice the amount you take out.

It seems like a simple calculation, but utilizing this formula allows you to avoid falling for marketing tricks banks might employ. Plus, you can easily figure out how much money and at what percentage you need to invest so as to guarantee a comfortable retirement for yourself. Finally, you can also use the rule to compare different investment plans.

Benefits of Using the Rule of 72 for Investors

You may wonder, “How does the rule of 72 assist savers and investors?” When applying this calculation tool, you can benefit in the following ways:

- Maximum simplicity of calculations. Many people don’t need comprehensive financial software and calculators. The rule of 72 offers a straightforward way to visualize potential growth without spending money on additional tools or consultations with financial advisors.

- Quick comparison of growth rates. Using the rule, you can see how quickly different types of investments will double your potential. The process is not complicated, so you can repeat it easily with different investments whenever you need to.

- Inflation management. Inflation can be difficult to calculate, as there are many factors affecting it. However, you can still use the rule of 72 to get an idea of how inflation will impact your buying power and when the cost of living will double. You can do this by dividing 72 by the average inflation rate.

- Tracking investment costs. The rule of 72 can help you account for all fees and other expenses, even minor ones. For example, even something as seemingly low as a 1.5% fee can change how many years it will take to see your investment double.

Rule 72 Limitations

One simple solution cannot be ideal for all financial situations, and this one is no exception. Here are some main disadvantages to calculating your income using this formula:

- The formula uses a fixed percentage. As you understand, a fixed percentage can only be obtained on a deposit; in investments, the percentage varies depending on the market situation.

- It works only with annual payments. The formula works with annual payments, but if they occur more often or less frequently, the final amount may differ.

- It does not take into account third-party factors, such as the rate of inflation or taxes you pay on your income. However, investing does not exist in a vacuum, and the final amount you will receive in a few years may be less than expected.

- The rule might not be correct at high interest-rates. The optimal range in which the calculation will give accurate results is from 6 to 10%. At a higher interest rate, the results can be misleading.

- The rule does not take into account investment risks. Since investing always involves some risk, remember that there are chances of losing your money.

How to Use the Rule of 72 More Accurately

To apply this principle for maximum benefit, consider a few tips:

- The optimal number for returns in the 6% to 10% range is 72. If you are looking at a potential return of less than 8%, a good rule of thumb is to subtract one from 72 for every 3 points below 8%. Thus, at a rate of return of 5%, the investing rule of 72 becomes the rule of 71. Similarly, at rates above 8%, add 1 for every three percentage points. Thus, with a projected rate of return of 11%, you change the number to 73.

- Consider general market trends as well as historical data. This will help you better assess your investment prospects and make more accurate forecasts. Also, try to maintain realistic expectations to avoid falling for the first tempting offer you’ll see.

- Combine the rule of 72 with other financial tools and indicators. This will allow you to fully evaluate and compare investments and get a more realistic financial picture.

Final Thought

The rule of 72 provides a significant benefit to investors: it shows the effect of compounding in the long run. However, it is best used for quick estimates on the fly. For long-term plans, more complex indicators and financial tools will serve you better. Assess the associated risks and prospects of the assets in which you want to invest, and also include fees, taxes, and other third-party factors in your calculations. With this approach, you can make better forecasts and eventually succeed in investing.

FAQ

What is compound interest?

Compound interest is a method of calculating investment returns that uses the income from interest paid over the past investment period. For example, an investor does not leave the amount of bond coupons lying idly on their account but reinvests in securities. Thus, the investment size regularly grows, and interest is accrued on the increased amount in the next period. The process is called interest capitalization.

How does the rule of 72 work with inflation?

The 72 rule will work just the same with inflation, as it works with calculating your income. However, you can quickly check how fast the money under your pillow depreciates if you divide 72 by the inflation percentage. If the expected inflation rate is 5%, then it will take 72/5%=14.4 years to depreciate your money in half, as long as it stays at 5% each year.

What are the best practices for using Rule 72 effectively?

Use this rule to evaluate investment performance, deposit terms, inflation calculations, and bank loan offers. It is also beneficial to combine the method with other financial indicators and consider other factors like taxes, fees, and inflation.

Can the 72 rule of investment be applied to calculating short-term investments?

It is not a good idea to apply this rule for investments that are characterized by high volatility or are short-term. The reason is that you get the highest level of precision when you apply this role to long-term investments, particularly those with compound interest. It is best to consult a financial specialist to get accurate calculations with short-term investments.

Does the rule of 72 work for stocks?

No. The reason is that the rule of 72 is used when there is a fixed return rate. When it comes to stocks, you cannot see when your money will double, as the percentage varies according to market changes.