Is PayPal a Viable Alternative to a Bank Account?

Contents

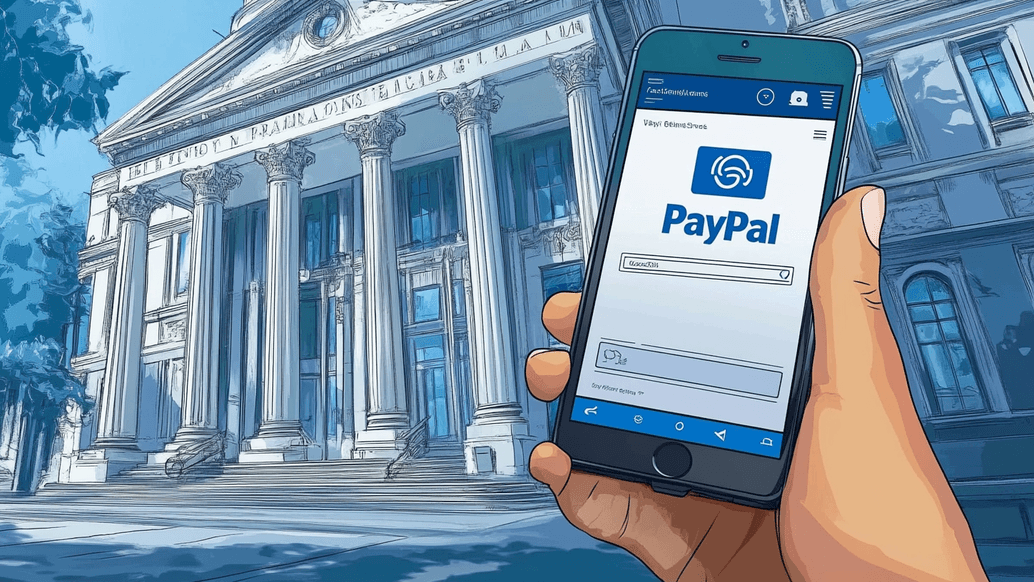

It’s hard to imagine what a modern lifestyle would look like if we didn’t have digital payments. Services like PayPal have changed the way we shop, send money to friends, and receive compensation for work. And while PayPal is surely an extremely convenient and helpful financial tool, does it mean it can replace your banking account? And do you have to have a bank account for PayPal to fully unlock its features and functionality? As more and more people use digital-first solutions in their everyday lives, the question is becoming ever more relevant. Let’s review what PayPal can and can’t do as compared to a traditional banking account.

PayPal Explained: Understanding the Basics

Nowadays, managing money online is no less important than handling cash or using a bank card. With lots of digital payment services around, PayPal remains one of the most popular and reliable platforms, trusted by over 434 million active users from around the world.

What Is PayPal?

Launched in 1998, PayPal was one of the first digital wallet services. Over time, it has transformed into a multi-functional tool that can handle online shopping, money transfers, freelance payments, subscriptions, and even international transactions. With PayPal, you can send, receive, and manage funds without using cash or entering your card or bank details every time. PayPal handles transactions on your behalf, keeping your personal information protected while still being good at its job.

How Does PayPal Work?

PayPal acts as a digital wallet linked to your preferred funding source, such as a bank account, credit card, or debit card. By and large, PayPal functionality comes down to:

- Online purchases: This is where PayPal truly shines, offering its services to e-commerce stores, gaming platforms, and subscription-based apps. It also allows you to deal with both domestic and international retailers.

- Instant payments: You can send money to friends or family, receive payments from clients, or place payment requests.

- Holding funds on your PayPal balance: When someone pays you via PayPal, you can leave the money on your balance to use it for further transactions within the system. Needless to say, you can withdraw the funds whenever you like.

Do You Need a Bank Account for PayPal?

You don’t need a bank account to sign up with PayPal. However, the capabilities of your PayPal account will be limited to prevent fraud.

Without a bank account | With a linked bank account |

|---|---|

|

|

So, while you don’t have to provide your bank account for PayPal to properly function, doing so will give you greater flexibility in what you can do with the service.

PayPal Solutions and Offerings

PayPal has grown far beyond its initial concept as a simple payment platform and has become a full-scale financial ecosystem with a unique product range.

PayPal Balance Account

Does PayPal have a checking account? Combining the features of the former PayPal Cash and Cash Plus accounts, a PayPal balance account is very much like a traditional checking account. Available to personal PayPal account holders, it allows you to store money directly on the platform and use it whenever you need.

With a Balance account, you can not only receive, keep, and send money, but also convert your funds to a different currency, add cash domestically through US retailers, set Direct Deposits, transfer money from PayPal Savings, and even withdraw cash using a PayPal debit card.

PayPal Debit Card

Linked to your PayPal balance, a PayPal debit card works pretty much like a traditional debit card, with the exception that it draws funds from your PayPal account instead of your bank account. This card is supported by Mastercard, so you can use it anywhere Mastercard is accepted. It also offers 5% cashback on chosen categories, comes with Mastercard zero liability protection, and has no monthly fee or minimum balance requirements.

PayPal Credit Line

Similar to banks, PayPal offers a reusable digital credit line, with a quick, simple online application and no interest if fully repaid within 6 months. You can use it as a virtual line for online checkout with PayPal or get a physical Mastercard PayPal credit card for offline payments. The credit card offers 3% cashback on PayPal purchases, has no annual fee, and gives you access to some branded Mastercard benefits.

PayPal Buy Now Pay Later Options

PayPal also offers short-term installment plans for shoppers who want to break their purchases into smaller, more manageable payments without opening a full credit line. You can split purchases up to $1,500 into 4 payments, or enjoy 3- to 24-month plans for big buys up to $10,000. Notably, “Pay in 4” plans are interest-free, while monthly payments are subject to variable interest rates.

Can PayPal Replace a Bank Account?

Does PayPal have a bank? The platform is a fintech company that doesn’t operate its own financial institution. However, partnering with FDIC-insured banks, PayPal protects your funds up to $250,000 per account and has a lot of features similar to those offered by traditional banks.

What PayPal Can Do Like a Bank

- Payments and money transfers domestically and internationally.

- Debit and credit cards.

- Credit products.

- PayPal Savings allows you to earn money via interest.

- Top-level data security and protection.

What PayPal Lacks as Compared to a Bank Account

- No physical locations, so no cash or cash deposit services and no in-person assistance.

- No interest-bearing balances or investment tools.

- Traditional loans or mortgages are not available.

- No overdraft protection, certified checks, or bank drafts.

- Depositing or withdrawing physical cash is less convenient.

Other Ways to Manage Your Money Beyond PayPal

If PayPal doesn’t fully meet your needs, and you want a more bank-like experience, here are some alternatives you may consider.

Credit Unions

If you want easier access to credit products and a more personalized approach with lower account fees and improved loan rates, credit unions are a great choice. Today, many of them have dedicated mobile apps, instant transfers, and digital card management.

Mobile Banking Solutions

Mobile-only banks or neobanks operate entirely online, offering an experience similar to PayPal but with more traditional banking features. You can expect direct deposits, card management, and powerful budgeting tools.

Banks Offering Digital-First Experiences

Many traditional banks provide smart tools and user-friendly apps that make managing your money feel a lot like using PayPal. Virtual cards, integrated digital wallets, and 24/7 account access make managing your funds significantly easier. However, you’ll also get the flexibility and convenience that comes with partnering with a full-scale bank.

Conclusion

Can you have a PayPal account without a bank account? While PayPal profile registration doesn’t require you to link a checking account, the service can’t be considered an alternative to having a proper bank account. Since it lacks many core services of traditional banking and still needs your account information for identity verification, PayPal is more of a helpful addition to your bank account than a complete substitute.