Debt-to-Income Ratio: Everything You Need to Know

When applying for a loan, you should be aware that a large number of different factors are taken into account when deciding whether to approve your application. While your debt-to-income ratio doesn’t directly affect your credit score, it’s one of the key metrics lenders use when making decisions about your potential loan.

DTI shows lenders your creditworthiness, helps assess your riskiness, and determines how effectively you are managing your monthly debt payments. Obviously, lenders are looking for a low debt-to-income ratio, and these are the potential borrowers they consider attractive and reliable.

And to meet their expectations, you must know how to determine your DTI and what to do if it is not good. Keep reading to learn what the debt-to-income ratio is, how to calculate DTI, what types of this metric there are, and how to improve it.

What Is DTI?

So, what is the debt-to-income ratio? DTI stands for the ratio of your monthly loan payments to your monthly income, expressed as a percentage. In simple terms, it is a comparison of the amount of money you spend to pay off debts and the amount of money you earn. For example, a DTI ratio of 35% means that 35% of your income goes toward paying off debt on loans, mortgages, credit cards, and so on.

Your DTI ratio gives lenders and banks an idea of how you manage your finances and can help them predict how you’ll pay back a loan you apply for. The better the balance between your debts and income is, the more desirable a borrower you are. And the lower your debt-to-income ratio is, the better your chances of getting approved for a loan and getting good terms are.

Thus, the debt-to-income ratio is one of the key factors that lenders consider when deciding whether to approve a loan to a potential borrower. DTI demonstrates your creditworthiness and assesses the likelihood of you meeting your debt obligations in full and on time. You may have a decent credit score, a solid credit history, and a good salary, but if you have hefty monthly debt payments that take up a large portion of your income, you may be considered a risky borrower.

In practice, the DTI ratio of 43% is the maximum limit at which a borrower can qualify for loan approval. However, it is better to keep your debt-to-income ratio to no more than 35%. And to determine this, you must know how to calculate the DTI ratio. Also, keep in mind that different lenders have different DTI ratio requirements.

So, how is the debt-to-income ratio calculated? To determine your DTI, you must calculate the total amount of all your monthly loan payments and divide it by your gross monthly income, that is, your salary before taxes and other deductions. To calculate the debt-to-income ratio as accurately as possible, you must take into account all debts (for example, mortgage, car loan, credit card payments, consumer loans, etc.) and all sources of income (for example, salary, part-time jobs, alimony, bonuses, as well as additional income, such as profit from renting out real estate, and so on).

Also, keep in mind that lenders consider not only your current debts, but also the payments on the potential loan you are applying for when determining your DTI.

The Role of DTI for Mortgages

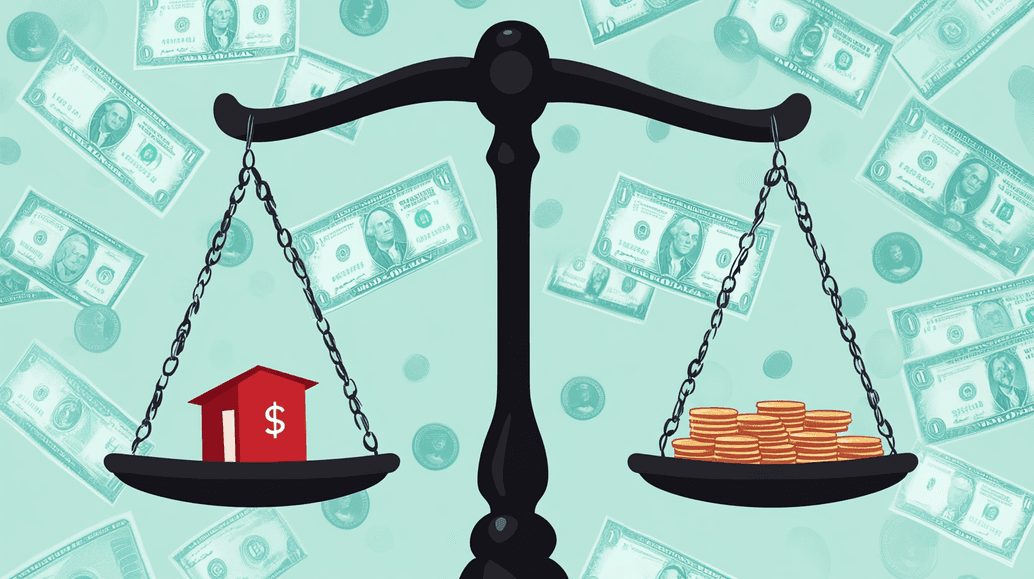

As we have already mentioned, lenders and banks use DTI to assess a borrower’s ability to repay a potential loan. Your mortgage debt-to-income ratio is one of the most important factors when deciding whether to approve you for a housing loan. Therefore, when applying for a mortgage, calculating your DTI is as essential as knowing your credit score. So, to increase your chances of getting the loan you want, you should be aware of what percentage of the DTI ratio is acceptable to lenders.

In general, you can get a mortgage even without a good DTI, but then you will be limited in your choice of loan types and lenders. Fortunately, there are steps you can take to lower your DTI and eliminate the chance of your mortgage application being denied.

So, how can you improve your debt-to-income ratio for a mortgage?

- Improve your credit rating. Your credit score is still the most important factor when it comes to getting a loan, and a high rating can make you a more desirable and credit-worthy borrower. Try to pay off your credit card debts and refrain from opening new credit accounts.

- Make a high down payment. The more money you can afford to pay at once, the more willing lenders will be to approve your mortgage application. Therefore, if you have the opportunity, for example, to ask a relative to borrow money, do it.

- Save up some money. If you realize you don’t have any savings and your salary won’t allow you to pay your monthly mortgage payments, save up some money before applying for a loan. If you can prove to the lender that you have money saved up that you can use to make your mortgage payments, you can hope to get approved even with a not-so-good DTI.

- Find a guarantor. Find someone who will be willing to repay your loan if you find yourself having financial difficulty.

If you’re wondering how to calculate the debt-to-income ratio for a mortgage, keep in mind that lenders consider two types of DTI.

What Types of DTI are there?

- Front-end ratio. This measure shows what percentage of a borrower’s income is spent on housing, such as how much rent or mortgage payments are per month. This type of DTI also includes property taxes, insurance premiums, and other home-related expenses.

- Back-end ratio. This measure shows what percentage of a borrower’s income is spent on paying off all monthly debts and loans, including housing payments. In addition to mortgages or rent, this type of DTI also includes auto loans, student loans, consumer loans, credit card payments, alimony, and so on.

Typically, when we talk about the debt-to-income ratio, we mean the back-end ratio, but both of these types of DTI come into play when it comes to a mortgage.

Final Thoughts

DTI is the portion of your income that you spend on paying off your debts, such as consumer, car, or student loans, as well as mortgage, child support, or your other monthly payments. Therefore, this metric gives lenders an idea of whether you can afford one more loan and whether you will be able to meet your debt obligations.

As a rule, a debt-to-income ratio of 43% is borderline high, at which you can hope for loan approval, but the lower this percentage is, the more attractive a borrower you are. A low DTI indicates that your income greatly exceeds your monthly payments, while a high DTI, on the other hand, indicates that your debt is significant compared to your earnings.

So, to assess your chances of getting a loan, you should know how to calculate the debt-to-income ratio, as well as how to improve it to become more creditworthy and less risky for lenders. To become a more attractive borrower and get the loan you want, you should improve your credit score, increase your income, save some money, reduce existing debts, try to pay off credit cards, refinance or consolidate loans, and refrain from taking out new ones.