Amazon Pay Review: Everything You Need to Know

Contents

The disruptive advancements in the IT sphere and the aftermath of the global pandemic account for the global spike in online sales, where revenues are likely to top $5.4 billion within two years. As people expand their shopping activities across numerous e-commerce platforms and retail websites, tackling orders and managing payments becomes increasingly difficult and confusing. And this is when Amazon Pay comes in handy.

In this article, we will address the two most popular queries about this service: “What is Amazon Pay, and how does it work?” We will also dwell on two equally important questions: “Why use Amazon Pay?” and “Is Amazon Pay free?” So, let's not wait any longer and dig in.

Meet Amazon Pay

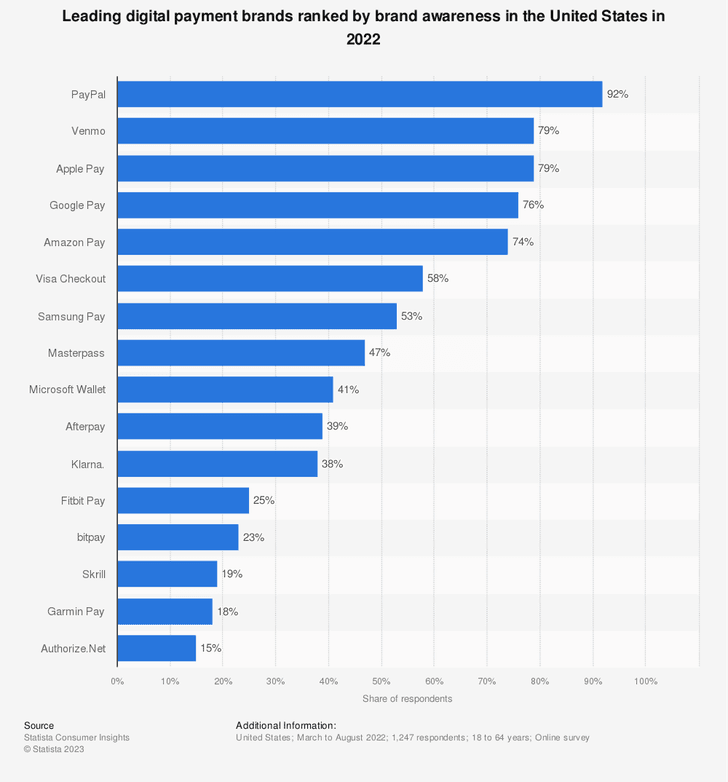

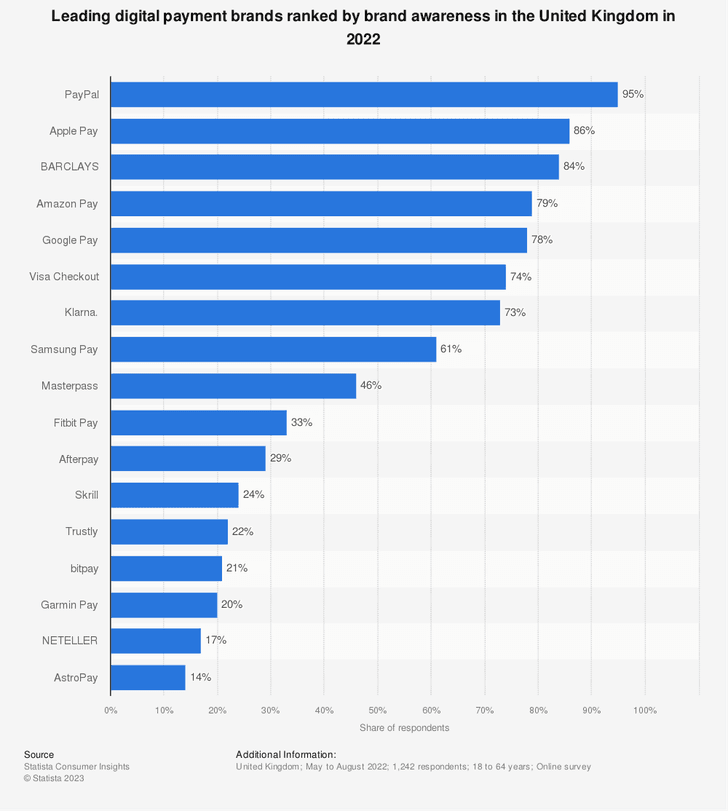

So, what is Amazon Pay? Or, more precisely, what is the Amazon payment processing service? It is a capability available to owners of Amazon accounts, where they can pay for products and services purchased from various third-party websites. Launched in 2007, this online payment processing service has been growing alongside the company and can now be used in the nineteen most developed countries of the world. In the USA, it ranks 5th among digital payment brands, while in the UK, it ranks one position higher.

One reason for its popularity is its seamless integration with various e-commerce platforms (BigCommerce, WooCommerce, and Shopify, to name a few). In 2019, Amazon Pay partnered with Worldpay, allowing its clients to enjoy its services.

How Does Amazon Pay Work?

If you wonder how you can begin using Amazon Pay, the process is quite straightforward. Here’s how Amazon Pay works.

Account Setup

The good news about Amazon Pay setup is that if you already have an Amazon account, you don’t need to do anything else. You can use the Amazon Pay feature on websites where you see it. What is also great is that you don’t have to come up with separate passwords.

If you don’t have an Amazon account, you can create it on the website by providing your name, email, and password and following the steps.

Using Amazon Pay on Third-Party Websites

Amazon Pay is integrated into numerous websites. You can go to your favorite online store and immediately check whether you can use Amazon Pay on it. According to the official Amazon website, there are tens of thousands of shops online (both nationally and internationally) where you can use Amazon Pay.

Payment Process

Once you are on a website where you want to shop, the process is easy. You just press the Amazon pay button in a third-party e-store or the logo on the brand’s site, enter your email address at Amazon.com, and then the password. After this, you can choose the payment method that is most convenient for you.

Order Tracking

To see information about your orders, you need to:

- Go to Amazon Pay and sign in;

- Next, you need to click on “Choose your Amazon Pay orders;”

- To view information about a specific order and its status, you have to click on “Details.”

Amazon Pay Fees and Charges

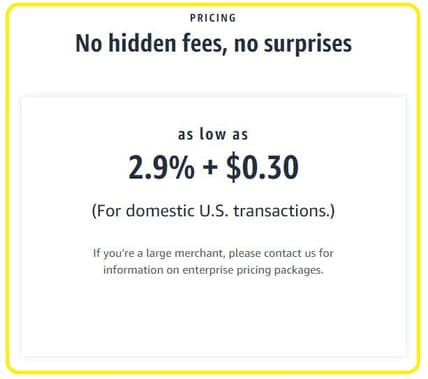

For vendors, a partnership with Amazon Pay comes at a price. Contract length (monthly, quarterly, annual) fees are absent, but they pay 2.9% + 30 cents for mobile and web transactions. If it is a cross-border transaction, 1% is charged in addition to the abovementioned interest. The money the customer paid will appear in the seller’s bank account within five (but usually three) business days. Once a refund is involved, the percentage-based fee is returned, but the authorization fee (30 cents) is not.

For customers, it is a totally different story because using the service will cost them nothing. Amazon Pay doesn’t add any transaction, membership, currency conversion, or any other fee if a purchase is made on sites accepting Amazon Pay. Yet, you must be aware that your card issuer may levy fees in accordance with the contract terms and/or add a foreign transaction fee in case of international shopping.

What are other customer boons associated with Amazon Pay?

Zooming in on the Benefits of Amazon Pay

In all Amazon Pay reviews, service users point out the following major Amazon Pay benefits, including:

- Easy and fast to handle. It doesn’t require typing in your credit card information like it usually happens in keyed transactions. So you don’t have to remember it or find the card to copy it from.

- Elementary checkout. It takes fewer steps to take this since you needn't create accounts on the websites where you shop.

- Order protection. After you make a payment, A-to-Z Guarantee by Amazon Pay sets in. It safeguards the timely delivery and the condition of the item you bought, rules out extra charges by the merchant, and ensures a refund. However, this guarantee doesn't cover digital merchandise, services, and bill payments.

- Flexible payment options. The service accepts all major debit and credit cards, including Visa, Mastercard, American Express, Discover, Diners Club, and JCB.

- Hassle-free donations. Political contributions and charity donations are also available via Amazon Pay.

- Integration with Alexa-enabled gizmos. With the help of this virtual assistant, you can make voice orders or donations, turning your shopping experience into a fun one.

- Trust and security. People are often apprehensive about giving credit card details or billing addresses on multiple sites. But when you see Amazon Pay as a payment option on the webpage, you can be absolutely sure it is a trustworthy brand, and your money transfer will be totally secure.

HOW DOES AMAZON PAY PROVIDE SECURITY?

In an age of rampant cybercrime, compromising enterprise, personal, and financial data may lead to monetary losses and reputational damages for businesses and individuals. Realizing the vital importance of reliable cyber protection, Amazon Pay has the following security measures in place:

Two-factor authentication

To minimize the possibility of unauthorized access to a client's account, the service sends a security code to their mobile phone each time they log in. Only after entering it can customers start using their accounts. First-time service users who want to create an Amazon account have to select two security questions and go through an email verification procedure.

Strong passwords and server protection

The system employs TLS/SSL with 128-bit encryption as a routine standard for secure server protection. The service also recommends leveraging their company’s password manager, NordPass, to generate and store reliable passwords (six characters containing numbers and letters in lower and upper case).

Rigorous data protection rules

Amazon is very strict in handling customer data. Credit cards and the client’s location information are kept secret from outsiders. In transactions with third-party vendors, the latter obtain only the data that is mission-critical for order fulfillment.

Feedback system

Customers can follow ratings and comments about various sellers and even file complaints against unreliable vendors. In this case, Amazon will penalize them according to its practices.

CONCLUSION

Amazon Pay is a convenient and reliable payment processing service that enables Amazon account owners to make online purchases from third-party vendors free of charge. It is foolproof, accepts all mainstream credit and debit cards, and can be employed for international e-commerce activities.

If you are engaged in cross-border shopping, it is important to be aware of the currency exchange rates and realize how much an item will cost in the monetary units familiar to you. Rates will help you convert major currencies and keep abreast of exchange rate dynamics.