Apple Pay vs. Google Pay: Comparison

Contactless payment apps have seamlessly integrated into our day-to-day lives, so it’s difficult to imagine what it was like before their invention. This is not surprising—bringing your NFC-supported device or card to a terminal to pay is incredibly easy and quick.

According to Juniper Research, total contactless payments are expected to grow by $11 trillion by 2027. And while there are many payment systems, the most famous and popular are Apple Pay and Google Pay.

Since both Apple and Google apps are widely used, the question arises—which is better, Apple Pay or Google Pay? In this article, we will do a detailed Google Pay versus Apple Pay comparison, examine their key features, and updates so you can make the most informed decision about which one to use.

What is Apple Pay?

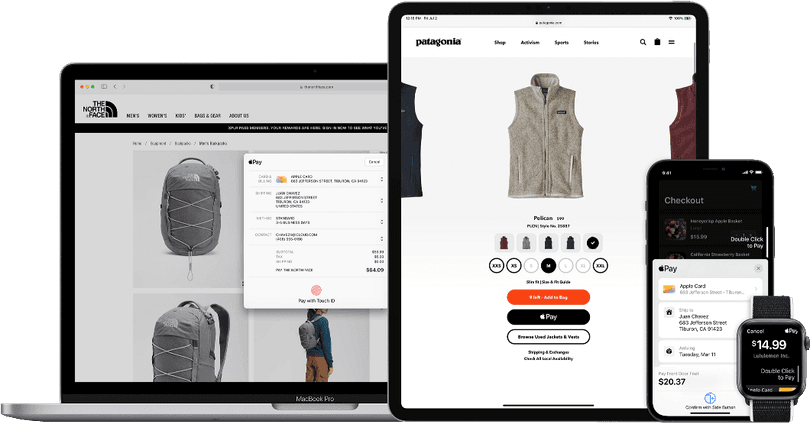

Apple Pay is a contactless payment technology developed by Apple. It allows users to make online and offline purchases. The system is based on the NFC protocol.

The system is based on the NFC protocol, so you can pay at terminals that support contactless payment. They usually have special marks: PayPass or PayWare.

The contactless payment system is available for:

- iPhone 6 and later;

- iPhone SE (all generations);

- iPad;

- Apple Watch.

To link a bank card to your iPhone, download Wallet and enter your card details. If your cards were previously linked to iTunes, the system will make them default. Additionally, you can add up to 7 cards.

Key Features and Updates

Apple Pay constantly introduces new updates to improve the user experience and expand the system's capabilities.

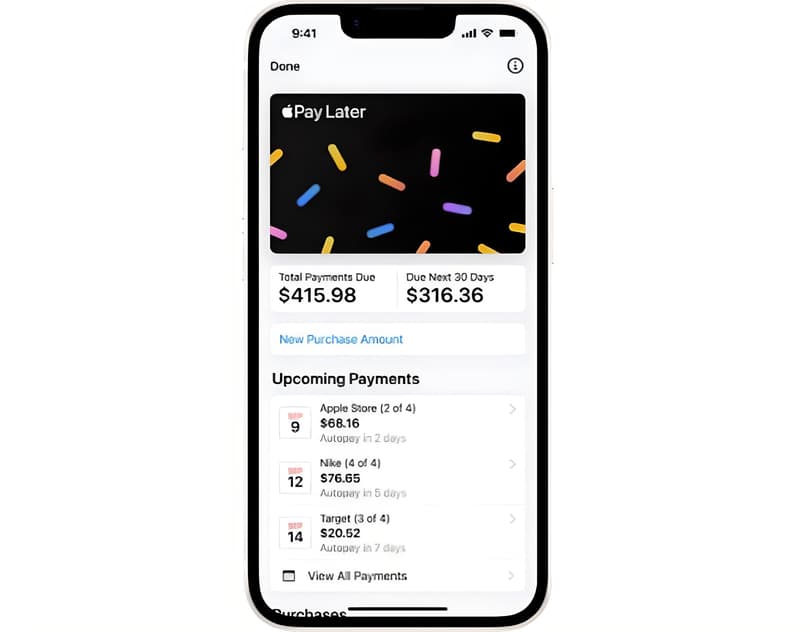

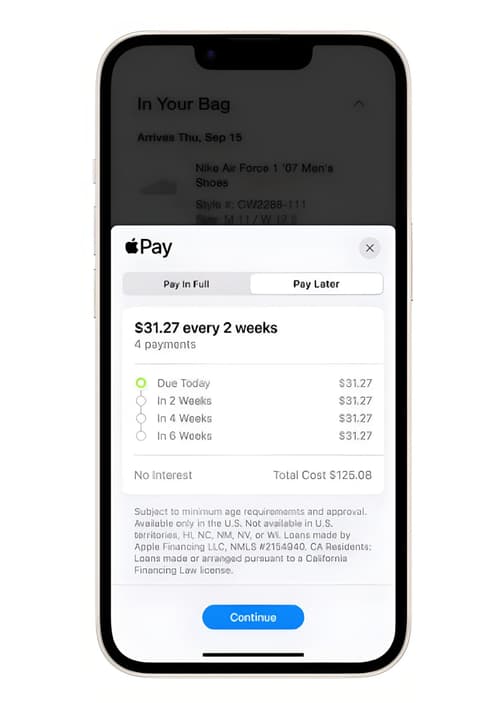

Apple launched Pay Later, which allows you to make online purchases in installments. Users can spend between $50 and $1,000 but cover that later. You can repay this amount in four installments within six weeks without penalty. When it’s time to make a transaction, the service sends a notification.

The service is available in Apple Wallet on iPhone (iOS 16.4) and iPad (iPadOS 16.4). It is currently available only in the US.

To get started with the new service, the user must apply for payment in installments in Apple Wallet "without impact on credits." However, the fine print notes that credit data and transaction history can be shared with the credit bureau. If payment in installments is approved, the user will see the "Pay Later" option at checkout in apps and websites on iPhone and iPad.

In addition to new features and updates, Apple e-wallet has improved security measures:

- Biometric authentication. Apple Pay uses Touch ID and Face ID technologies to authenticate purchases.

- Secure Element. This is a hardware platform (chip) protected from unauthorized access for storing and safeguarding payment data.

- Data tokenization. Apple Pay uses tokenization technology, replacing real transaction information with a randomly generated token that cannot be reused.

What is Google Pay?

Google Pay is a contactless payment technology developed by Google. It allows you to buy goods using smartphones, tablets, and smartwatches. This e-wallet is also based on the NFC protocol. It may be used in stores and other places with terminals for contactless transactions.

The service supports adding several cards, and there are numerous options available: Visa, Mastercard, American Express, Discover Card, etc.

GP may be used on modern smartphones on Android version 4.4 and higher, with an NFC module (the controller must support HCE technology). To work with the service, install the mobile app and add a bank card.

Key Features and Updates

Google Pay is constantly evolving and offering new features to meet user needs.

Google improved the security of financial transactions on Android devices by introducing merchant liability protection for Visa-compliant online transactions.

Besides, checking and adding payment forms has been simplified. For example, Google has implemented support for card authentication before and after completing the transaction. Users can verify their cards with a one-time password (OTP code) or banking app. It creates a device-bound token that enables secure and seamless transactions online and offline.

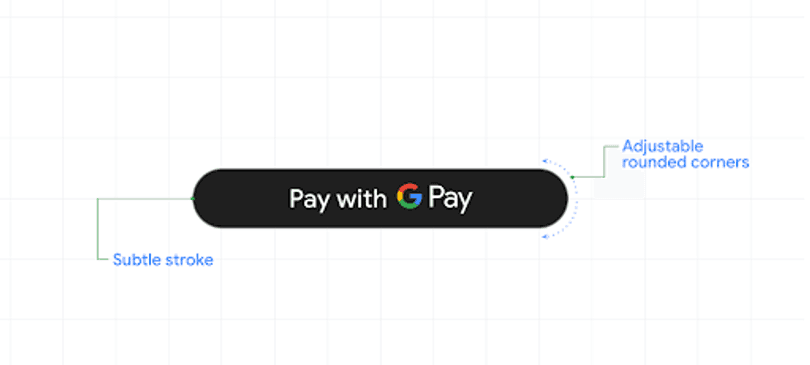

The service also updated the button with the latest Material 3 design principles. The new Google Pay button has two versions, making it look great in dark and light app themes.

Rewards and Incentives

Is Apple Pay or Google Pay better in terms of additional perks? Google and Apple offer cashback and rewards programs that allow you to receive bonuses for making purchases.

With Apple, users can use Apple Wallet Passes to participate in the loyalty program, earn points, and access special offers. Google provides a similar rewards program, which allows you to earn points and use them for shopping.

Both mobile payment systems support various reward categories, and points are usually awarded automatically when you make purchases.

It is important to note that the availability of loyalty programs, the percentage of cashback, and the conditions for receiving rewards may vary depending on the region, category of purchases, and the bank in which your card was issued.

Comparison between Apple Pay and Google Pay

Google Wallet vs. Apple Wallet: which option should you choose? To understand which contactless payment technology is better, check out the characteristics of each in our table.

Apple Pay and Google Pay POS: comparison

Characteristics | Apple Pay | Google Pay |

|---|---|---|

Platforms | iOS, iPadOS, watch OS | Android, Wear OS |

Supported devices | iPhone, iPad, Apple Watch | Android smartphones/tablets and Wear OS devices |

Security | Face ID, Touch ID, Secure Element | Fingerprint, PIN, Secure Element |

Global availability | Available worldwide | Available worldwide |

Available integrations | Apple services and devices | Google services like Google Maps, Google Assistant, Chrome, etc. |

Price | No fees | No fees |

Sending funds to other users | Transfers to the US are available. International transfers require a payment intermediary, for example, Wise | Transfers to the US and India are available. International transfers require a payment intermediary, for example, Wise |

Rewards | Cashbacks, points accrual, loyalty programs | Cashbacks, points accrual, loyalty programs |

So, as you can see when comparing Apple Pay vs. Google Pay, both systems offer convenient and secure payment methods. The choice depends on the device platform and individual user preferences.

Conclusion

So, are Apple Pay and Google Pay the same? While both systems remain market leaders, each one has its strengths and weaknesses. In the battle of Google Pay vs. Apple Pay, it's impossible to pinpoint a winner as each service offers many features, including contactless payments, cashback, and reward programs, integration with loyalty programs, and storing digital copies of bank cards.

FAQ

Is Google Pay the same as Apple Pay?

Google Pay is similar to Apple Pay. The main difference is that the first one is available for Android devices, while the second option is for iOS devices (iPhone, iPad, and Apple Watch).

What's better, Google Pay or Apple Pay?

The services offer similar features and security measures. The choice between them may depend on your personal preferences, your device’s OS, and the service availability in your country.

What are the advantages of Google Pay?

Google Pay provides many benefits for users:

- fast payment;

- no commissions;

- high protection of all transactions;

- support for a wide range of devices and platforms.

What are the advantages of Apple Pay?

The benefits of Apple Pay are:

- shopping security;

- ease of use;

- no commissions;

- availability of loyalty programs.

What is more safe: Google Pay vs. Apple Pay?

Both Google Pay and Apple Pay are equally safe if you take the usual precautions, such as not sharing your PIN with others and checking your account and transactions regularly.