How to Accept Payments Online: 6 Ways, What You Need to Know

Contents

In 2023, e-commerce in the United States comprised 22% of overall retail sales, and there’s no doubt this number will only increase over time. Therefore, any company that wishes to stay relevant needs a way to accept digital payments. But how to accept payments online without compromising on safety? And why is it so important? In this article, we’ll explain the perks of online payments and their types.

Why Accepting Online Payments Is Beneficial for Businesses

Enhance Customer Experience and Satisfaction

Did you know that 13% of shopping carts are abandoned due to the lack of appropriate payment methods? These losses could be easily prevented if a merchant just added a payment option or two.

Imagine yourself as a customer who finally found the perfect furniture for their home. However, you couldn’t order it because the shop doesn’t accept mobile wallets. You would probably just go to another store, right? As you can see, the lack of online payment options is frustrating both for customers and business owners.

Sales and Revenue Growth

Having multiple means of payment helps to attract more customers, resulting in more revenue. As a rule, companies that accept payments online enjoy higher sales and enter new markets faster while also growing their client base by lowering barriers to purchase.

Optimized Reporting and Accounting

Integrating online tools into accounting makes tracking and managing finances easier. It automatically records every transaction, reducing the need for manual data entry and reducing costly errors. By automating accounting, you can easily create financial statements and view cash flow or balance sheets. This will save you time and make the accounting process smoother so you can focus more on strategy and decision-making.

Less Chance of Fraudulent Activities and Chargebacks

If you accept business payments online, your chances of running into fraud and chargebacks are decreased. Online transactions can be verified in real time, so suspicious activity is far easier to detect. Built-in security features help confirm the customer’s identity and prevent unauthorized access, protecting both your business and your customer base. This means fewer disputes and chargebacks, saving money and hassle, while also building trust.

Rapid Transactions

Traditional payments like mailing checks from customers can take weeks to process. Online payments can be done in a matter of seconds or, at most, a couple of days.

6 Ways to Accept Payments Online

So, how to accept online payments for your business? There’s more than one option here, and you should employ as many as you can afford.

1. Credit and Debit Cards

Usually, this is a primary payment method in online stores, as nowadays, most people have at least one bank card. Even though it’s costly for a business to take credit cards due to a high processing fee, the practice remains widespread.

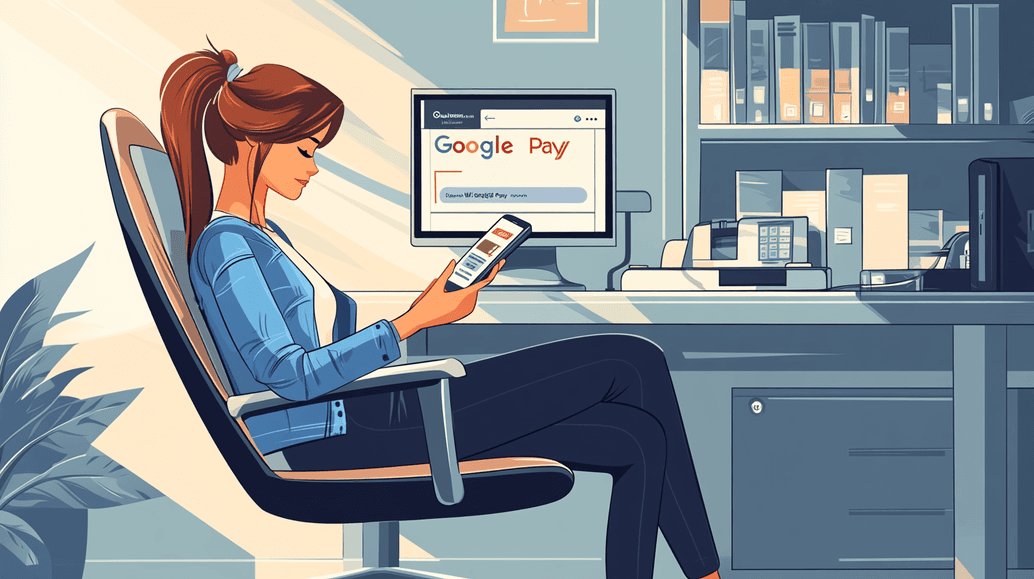

2. E-wallets

Accepting digital wallets, like Apple Pay or Google Pay, allows businesses to process fast, contactless payments that most customers find extremely convenient. Digital wallets use advanced cryptography to protect payment details, reducing the risk of fraud and making transactions feel smoother.

Today, this payment method is even more popular than traditional credit cards, accounting for a whopping 50% of global transactions. As you can guess, this is the best way to accept payments online, or at least one of them. Yes, you’ll have to deal with a processing fee, but it’ll surely add a lot of convenience and security for your customers, which always boosts sales in the long run.

3. Mobile Payments

Today, everybody has a smartphone and carries it everywhere, so enabling mobile payments is as relevant as ever. This tool is not limited to just digital wallets but also encompasses direct bank transfers, QR code payments, and in-app purchases. The method is fast, secure, and highly convenient, making it popular for all sorts of transactions. For businesses, mobile payments can simplify point-of-sale management, reduce cash handling, and even engage tech-savvy consumers. Even with small processing fees, mobile payments often increase sales and improve customer satisfaction enough to be profitable for you in the end.

4. Online Invoicing

If you wonder how to take payments online with no credit cards, here’s a solution for you. Invoicing is sending a document (an invoice) to a customer that shows how much they owe for a product or a service. Customers can pay these bills later via bank transfer, check, or online payment venues like PayPal. Popular invoicing platforms like Xero, Zoho Invoice, FreshBooks, and Invoice Ninja integrate with leading payment providers. With these platforms, your clients will receive emails already containing a payment button, making the whole process far simpler than it seems.

5. Cryptocurrencies

Even though this solution doesn’t seem very popular at the moment, this is starting to change. Now, more and more people are using crypto, and so are global companies like Microsoft, Twitch, and Tesla. Even Shopify now allows its sellers to take crypto payments.

To decide if you need to add this additional payment method or not, think about the specifics of your business and your customers. If your company provides technical services and your customers are tech-savvy, they'll likely appreciate this innovation. If you run a local coffee shop or a small business offering organic self-care products, accepting cryptocurrency is far from essential.

6. ACH Transfers

This payment method allows businesses to receive funds directly from a customer's bank account, often with lower processing fees compared to using a credit card. ACH transfers are ideal for recurring payments or if you have to deal with a high volume of transactions. This method is a fast and fully automated way to receive payments, although businesses wishing to adopt it still need to set up systems to monitor and confirm transfers. ACH transfers are especially popular for B2B transactions and subscription-based services.

Conclusion

Today, online presence is more vital than it ever was, and so are online payments. In addition to satisfying customer needs, moving your finances online gives you an opportunity to scale your business up, make it more secure, and even improve cost-effectiveness. As a final piece of advice, always remember to consider the nature of your business and the preferences of your customers when choosing which payment methods to implement.