How to Pay by Mobile Phone: Everything You Need to Know

Contents

Mobile payments undoubtedly make life a lot easier. So, many people wonder how to pay by mobile the right way. You can experience the convenience of paying with your phone in the store without much effort and use a wallet app for quick online transactions. Some benefits of modern mobile payments include:

- High level of security. Authentication on a mobile device (password, fingerprint, etc.) adds to the safety of transactions. Also, smartphones encrypt any transmissions, and thus there is a minimum risk of any data theft.

- Speed of payments. A significant advantage of mobile transactions is that they are performed instantly, just like those using credit cards.

- Convenience. A lot of people choose in-store payments using mobile devices because they simply don’t want to carry their credit cards with them.

Accessibility. As long as you have a smartphone with an internet connection, you can perform digital operations, regardless of your location.

Do you wonder how to pay with your cell phone and how to ensure the security of such payments? Here’s the information you should know.

Getting Started with Mobile Payments

If you want to pay with a credit card on the phone, there is nothing special you should do beyond installing an app. The reliable options that you can download for free include Apple Pay, Google Pay, and Samsung Pay. You can connect your existing debit or credit cards to one of these apps. In addition to the phone, you can use an app on a respective tablet or smartwatch.

Another part of the configuration, when you want to pay by a mobile phone in offline stores, is that your phone needs to have an NFC chip in it. And, of course, there should be an NFC-equipped terminal when you come to the store. If it is available, you should put your device with a wallet app to the terminal to perform a transaction.

If your smartphone has an NFC chip and you have a wallet account, you can connect your credit or debit card to the wallet. The process is similar to every app and consists of entering your bank details and then verifying your identity through contact (SMS, email, phone call, etc.).

How to pay with a mobile phone in a store? The answer is simple. After you install a wallet app, you should unlock your device and bring it to a contactless terminal for a transaction to be complete.

Pay with a Phone: What You Need

When we talk about mobile payments, they involve the three main categories. You can pay for goods in offline stores or online and also send money peer to peer. How to pay by a mobile phone in each of these categories? Let’s find out.

In-Store Payments

By having a wallet on your device, you won’t have to take a credit card with you to the store. The vast majority of terminals in brick-and-mortar stores accept payments made by phone. To pay with a card on the phone, you should unlock your device (use facial recognition or fingerprint sensor) and hold it over the contactless reader to make a payment.

Online Payments

Once your mobile wallet is ready for payments, you can also use it to buy goods online. When you decide to pay for some product online, you will see a wallet symbol on the checkout page. By tapping this symbol, you will open your wallet app to finish the transaction without having to enter your credit card details on the page.

Peer-to-Peer Payments

For peer-to-peer transactions, you have to use a digital wallet, such as Venmo, Zelle, PayPal, or another. With the help of such payment services, users can send money to others without the need to employ their banking account. These days, a lot of small businesses accept payments using this option, so digital wallets are often used instead of credit cards.

How do you reliably and securely pay with your phone? You need a trustworthy wallet, so here are the popular options in more detail.

Apple Pay

Apple Pay is a payment system for iOS users, and it can be installed on iPhone, Apple Watch, and other devices that support it. You can add several credit cards to the wallet and thus choose the one you want to pay with at any moment. You can pay using Apple Watch the same way you pay for your phone—by bringing your device to the terminal. There will be a slight tap when a transaction is complete.

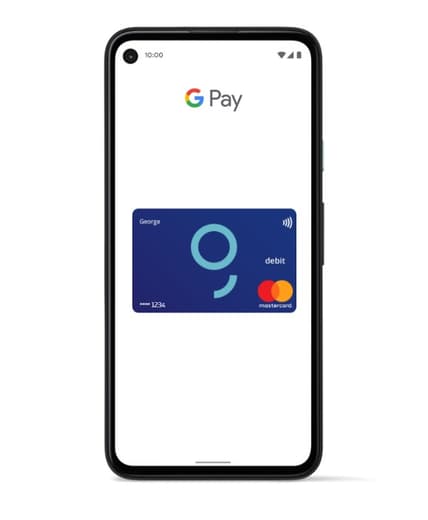

Google Pay

Google Pay is created for Android users who have compatible smartphones. The registration process takes no time, as you should just enter your credit card details manually or take a photo of your card. Just like with Apple Pay, you can add more than one card for payments to the app. To pay, you have to unlock your device and bring it to a terminal at the store. If payment is successful, a blue checkmark should appear on your phone.

Samsung Pay

Samsung Pay users can use Samsung Pay instead of Google Pay, as it is likely pre-installed on their devices. Once you find it on your phone, you should open it and create a unique PIN. Then, you will see instructions on how to add credit card information. When you are done adding details, you can use your phone to pay the same way as Google Pay. The app offers the Favorite Cards feature, so you can add several credit cards and easily switch between them.

It’s important to note that all the mentioned wallets are international and support different currency options.

Enhancing Security and Privacy

How do you increase mobile payment security when paying with a mobile phone credit card? You can maximize the security of mobile payments by keeping your wallet app updated, using two-factor authentication, and enabling auto-lock on your phone. Let’s talk about these steps in more detail.

Make sure you use two-factor authentication

It doesn’t matter which wallet you prefer, enabling two-factor authentication is always a good idea. Usually, it is a password and an additional verification step, such as a code sent to your phone. This minimizes the risk that someone will steal your data or money.

Update your phone and wallet app

Security problems are always fixed in updates, so it’s vital that your phone’s OS and the wallet app you use are up-to-date.

Use auto-lock and a strong password

It’s common for users to create weak passwords on phones so they don’t forget them. If you use your phone to pay, you should have a strong password, which includes at least 12 characters with special characters, numbers, and letters. It should also be unique and without common patterns (qwerty). Additionally, enable auto-lock to maximize your protection.

While these steps are simple, they truly add to the security of your mobile payments.

Conclusion

At this point, it’s clear how to pay with your cell phone, and the convenience of this payment option is truly unmatched. This payment method is ideal for those who always have cell phones with them and don’t want to carry their credit cards. Thanks to wallet app security features, including transaction encryption and phone authentication, it is safe to pay with your device. All payments are performed instantly, so it’s a quick and secure option for everyone. As technology continues to evolve, mobile payments will become even more integral to our daily lives, transforming how we transact and interact with money.