Payoneer Review: Features, Benefits and Fees

Contents

In a world where remote work, cross-border eCommerce, and global freelancing are the new normal, managing international payments efficiently is no longer a luxury, it’s a necessity. This is where Payoneer stands out as a go-to platform for receiving payments across countries, quickly and affordably.

In this Payoneer review, we’ll explore more about this payment platform, its capabilities, Payoneer fees, and whether opening a Payoneer account is the right choice for you. So, what is Payoneer, and how does it work?

Payoneer: What Is It?

Founded in 2005, Payoneer is one of the most trusted names in the fintech industry, serving over 5 million users worldwide. It’s a robust financial services platform that allows businesses and professionals to send, receive, and manage international payments with ease.

The Payoneer payment system excels in borderless payment solutions, enabling you to receive payments in multiple currencies, hold and manage funds, withdraw to your local bank account, and even order a prepaid MasterCard (with a $29.95 annual fee) for convenient spending and ATM withdrawals.

Before we dive into a detailed Payoneer online payment processing platform overview, let’s first outline who this digital payment service is best suited for:

- Freelancers and remote professionals;

- eCommerce sellers and online entrepreneurs;

- Affiliate marketers and digital nomads;

- Small and medium businesses and agencies;

- SaaS companies and B2B service providers.

How to Get Started With Payoneer

On a basic level, the Payoneer platform functions similarly to any other online payment system and requires a personal or business account. So, let’s start with a Payoneer account review. You can set up an account in just a few simple steps.

Step 1. Provide Basic Information

If you decide to open a Payoneer account, you should go to Payoneer’s official website and click “Register.” You’ll have to choose between a personal or business account. Then, you’ll enter your full name, email address, date of birth, and preferred language. Make sure the name you enter matches the name on your official documents and bank account. This is important for verification purposes later on. The email address you use will be set as your username in the system.

Step 2. Enter Contact Details

Next, you’ll need to provide your physical address, city, postal code, country of residence, and phone number. Payoneer will send a verification code to your phone, so make sure your number is correct and active. You can use either a mobile phone number or a landline number.

Step 3. Set Up Security Questions and Password

At this step, you’ll be required to create a strong password and store it for future use. You’ll also need to choose a security question that'll appear if you forget your password. These will be used for account protection and for recovering access if you forget your login credentials.

Step 4. Add Bank Account Information

Before you can start using this online payment platform for purchases online, you’ll be asked to enter your banking details. You’ll need to enter:

- Account holder’s name;

- Bank name;

- Account number;

- Bank branch code or routing number (depending on your country);

- Preferred currency for receiving funds.

The bank account must be in your name or registered business entity.

Account Verification and Approval Time

At this point, Payoneer will proceed with the account review and verification process. You may be asked to upload some documents, such as a government-issued photo ID, a bank statement showing your name and account number, or a utility bill to prove your address.

Account verification typically takes up to 3 business days. You’ll be notified via email once verified.

Key Features of Payoneer

Here are the features that reviews on Payoneer highlight as the platform’s main selling points.

Global Payment Solutions

How does Payoneer work in terms of online payments? One of the significant advantages of this platform is its ease of sending and receiving payments worldwide. Payoneer provides global payment services, enabling clients to accept payments in various currencies. The platform supports EUR, USD, GBP, AUD, JPY, CNH, and CAD. Funds received in other currencies will be converted to USD.

Currency Conversion and Exchange Rates

In addition to international transactions, Payoneer offers currency conversion and exchange services. Currency conversion fee is 0.5% when using the ‘Manage Currencies’ feature. However, conversion fees for card payments or bank withdrawals can be higher (up to 3.5%). All rates are transparent with no hidden charges, so you see the exact sum you’ll be receiving right away.

Receiving Payments From Marketplaces

One of Payoneer’s most practical features is its integration with leading marketplaces and freelance platforms, such as Amazon, Walmart, eBay, PeoplePerHour, Upwork, Toobla, Booking.com, and more.

You can link your account directly to multiple marketplaces to centralize your earnings, avoid costly bank fees, and receive payments faster, no matter where your clients or buyers are located. Then, you can use your balance to pay suppliers, withdraw to your local bank, or spend via the Payoneer MasterCard.

Payment Request and Invoicing

With Payoneer, you can create customizable invoices to meet the diverse requirements of your clients. This functionality is made possible through Payoneer’s integration with the Free Invoice Builder, enabling you to send professional payment requests with ease.

Mass Payouts for Business

Payoneer offers businesses the ability to set up Mass Payouts accounts. With this feature, marketplaces and companies can send funds in over 70 currencies to more than 200 countries and territories. According to Payoneer, you can process payments to up to 500 recipients simultaneously, streamlining global payouts efficiently.

Integration With Bank Accounts and Cards

Payoneer integrates seamlessly with your local financial ecosystem. You can:

- Withdraw funds to your local bank account in your preferred currency.

- Link multiple bank accounts for personal or business purposes.

- Use the Payoneer Prepaid MasterCard (available in select countries) to shop online, make in-store purchases, or withdraw cash from ATMs.

This flexibility ensures you’re never left waiting for funds or paying extra to transfer money between systems.

Payoneer Fees and Security

Payoneer: How does it work? Understanding the platform isn’t complete without covering its fee structure and security measures.

- Receiving payments from other Payoneer users is typically free, but cross-border payments may incur a fee of up to 1% (minimum $4).

- A 3.99% fee is applied to credit card transactions regardless of the chosen currency.

- A 1% fee is charged for ACH bank debit transactions.

- A $4 flat fee is applied to USD/GBP/EUR transfers to Payoneer recipients in your country. If a recipient is not in your country, a 1% fee (with a minimum of $4) is applied.

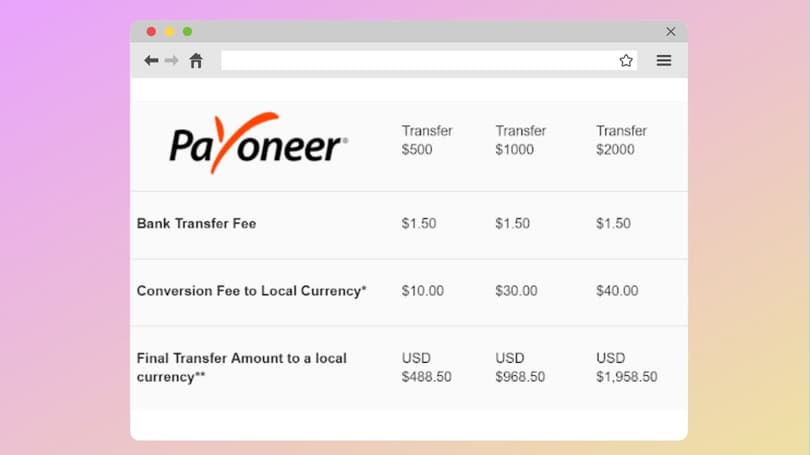

- Transferring funds from your Payoneer account to a bank account in the local currency will incur a $1.50 transaction fee, provided your monthly withdrawal amount remains below $50,000. Once you reach this threshold, each transaction will entail a 0.5% fee plus 3% for non-local currency transactions.

- The fees for marketplaces (Upwork, Airbnb, etc.) vary depending on the platform.

What is a Payoneer payment fee for account use? At the moment, an inactivity fee of $29.95 applies to the accounts that receive less than $2,000 per 12 months. If you haven't used this payment system for a long time and don't plan to use it, you should delete Payoneer account. Payoneer card fees include a $3.15 ATM withdrawal fee and a $1 balance inquiry fee.

Is Payoneer safe? The payment system operates under an e-money license in the European Union and holds corresponding licenses in various US states. The platform is regulated similarly to a traditional bank and employs robust security measures, including two-step verification, RSA adaptive authentication, and advanced encryption protocols. These features ensure your funds and data are protected at all times.

Conclusion

We hope that our series of Payoneer reviews has provided a clear answer to the question: “How does a Payoneer account work?” What sets this system apart is its focus on international usability. Each feature is designed to eliminate the pain points of working or selling across borders. Whether you’re a freelancer, seller, startup, or growing business, Payoneer is built to help you operate with confidence in the global marketplace.

FAQ

What fee does Payoneer charge?

There are no monthly fees with Payoneer for users receiving over $2,000 annually. However, the platform applies a flat $4 fee for sending funds to other Payoneer accounts within your country or 1% (with a minimum of $4) for transfers to Payoneer accounts in other countries. The fee for ACH bank credit payments is 1%, while Payoneer credit card fees depend on the operation but are generally 3.99%.

Is it safe to have money on Payoneer?

Payoneer is a well-regulated platform holding all the necessary licenses in the countries and states where it operates. From a legal standpoint, Payoneer functions similarly to a traditional bank, with robust security protocols in place to protect user funds.

How much does Payoneer charge for credit card transactions compared to PayPal?

The key difference between PayPal and Payoneer is in their fee structure. Sending payments from a credit card to a PayPal account typically incurs a 3.4% fee and a fixed fee based on region. Payoneer, on the other hand, charges up to 3.99% with a fixed rate of $0.49 applied in some countries.

Does Payoneer have an affiliate program?

Yes. Payoneer currently offers an affiliate program where users can earn commissions by sharing unique registration links via their websites, blogs, or social media platforms. Account holders are rewarded for every new customer who signs up through their links.