PayPal International Fees: A Complete Guide to Foreign Transaction Costs

Contents

Sending or receiving money across borders has never been easier, thanks to platforms like PayPal. However, convenience comes at a price, and with international payments, that price can add up fast if you're not careful. While PayPal provides a fast and secure way to move money globally, many users might be caught off guard by the costs attached to international transfers. These fees can quietly eat into your budget, especially if you make frequent cross-border payments or run a business with global clients. That’s why understanding the PayPal foreign transaction fee mechanics is essential to effectively manage your costs and optimize your financial operations.

In this guide, we’ll give you a clear and complete understanding of what PayPal transaction fees for international payments are, how they’re calculated, when they apply, and how you can reduce them.

Why PayPal Fees Matter in Global Transfers

PayPal plays a pivotal role in global commerce. With over 432 million active accounts across nearly 200 markets, it’s a go-to payment method for cross-border transactions. For businesses, PayPal facilitates quick and secure payments from international customers without the hassle of traditional wire transfers. For individuals, it provides a reliable way to send money globally using just a mobile phone.

Does PayPal charge foreign transaction fees, though? The answer is yes, and it’s something you can’t afford to ignore. You may not think of yourself as someone who frequently makes international transfers until you do. Here are common situations where PayPal fees for international payments can apply, especially when converting currency or sending funds to a recipient in another country:

- Freelancers or remote workers receiving payments from clients abroad.

- Small businesses selling to international customers through online marketplaces.

- Travelers or expats transferring funds to family or between personal accounts.

- Online shoppers purchasing from foreign websites in different currencies.

- Friends or family members sharing expenses or sending gifts across borders.

While PayPal’s base service might seem low-cost or even free, the reality is more complex. Depending on the nature of your transaction, you may incur several fees:

- Currency conversion fees (typically 3–4%).

- Cross-border transfer fees.

- Recipient fees (especially for commercial transactions).

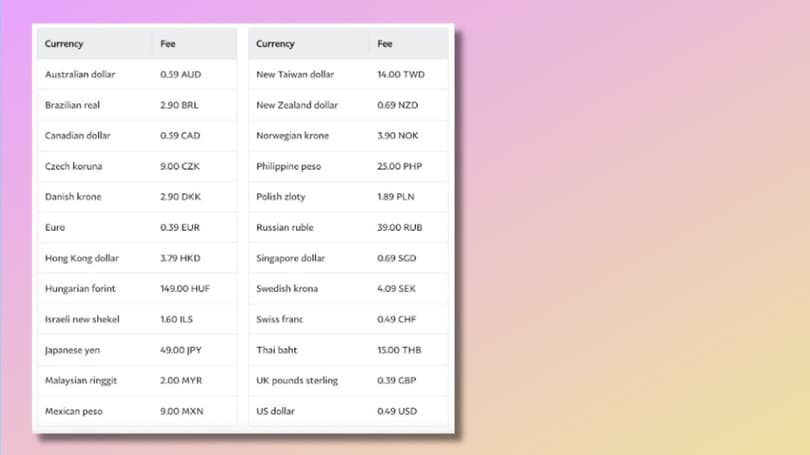

- Fixed fees based on the recipient’s country and currency.

Whether you’re handling a one-time payment or managing frequent international transfers, being fee-aware will help you protect your budget and ensure your money goes further.

Everything You Need to Know About PayPal Fees for International Transactions

Now that we’ve answered “Does PayPal charge international fees?” let’s break down how those fees are structured.

Currency Conversion Fee

If you're making a payment in a currency different from your primary one, PayPal will automatically handle the conversion. However, PayPal typically adds a 3% to 4% markup on top of the base exchange rate, depending on the transaction type and currency. For example, if you're converting $1,000 into a foreign currency, you might end up paying an additional $30–40 in hidden conversion fees.

Tips to get better currency conversion rates:

- Use multi-currency accounts like Wise or Revolut to exchange currencies before transferring through PayPal.

- If you’re checking out with PayPal on a foreign site, opt to pay in the merchant’s currency and let your bank/card handle the conversion.

- Always review PayPal’s exchange rate on the confirmation screen. If it looks uncompetitive, consider alternatives like direct bank transfers or third-party services.

Sending and Receiving Fees

Beyond currency exchange, PayPal also applies fees depending on how the money is sent and received. A PayPal international transfer fee when using a PayPal balance, a linked bank account, or a bank card for cross-border payments is 5% of the transaction amount, with a minimum fee of $0.99 and a maximum of $4.99. You can check the current rates and flat fees that will be charged on the official PayPal website.

For nonprofit organizations, the international transaction fee PayPal charges for receiving international donations is 1.50% above an applicable domestic fee of 2.89% plus a fixed fee based on the payment currency, which is deducted by the platform before the funds are deposited into the account. Likewise, for receiving charity transactions, the service charges 1.50% above a domestic fee of 1.99% plus a currency-specific fixed rate.

Fee Limits and Transaction Caps

PayPal imposes certain fee limits and transaction limits, which can vary based on factors such as account type, country, and verification status. As we've already explained the PayPal international transaction fee structure, now let's break down the limitations:

Fee limits: It sets limits on the minimum and maximum fees it charges for different types of transactions. These limits define the amount you can be charged for a specific transaction or within a specific timeframe:

- For instant bank and card transfers, PayPal charges for international payments are $0.25–25.00.

- For international transfers, fees range from $0.99 to $4.99.

Maximum transaction limits: PayPal also sets maximum transaction limits to help ensure security and compliance. These limits define the maximum amount of money you can send or receive within a given timeframe.

- The default limitation for unverified accounts is up to $4,000 per single transaction.

- For verified accounts, the user can send up to $60,000 per transaction, with individual transaction limits possibly capped at $10,000.

How to Reduce PayPal Fees

While PayPal is one of the most convenient and trusted platforms for sending and receiving money worldwide, PayPal fees for receiving money internationally can erode your earnings, especially if you’re a freelancer, small business owner, and nonprofit receiving payments from abroad. Fortunately, there are several ways to reduce these costs.

Smart Practices to Cut Costs

- Verify your account: A good first step is to verify your account. Your verification status allows for lower processing costs for international transactions compared to debit or credit cards. Additionally, verified accounts have increased transaction limits.

- Price-in PayPal fees: Consider factoring PayPal fees into your pricing model. This approach will save a lot if you face frequent or large transactions. In this case, it doesn’t matter what PayPal fees for receiving international payments are, at least to some degree.

- Consolidate payments: Considering the fixed fees mentioned earlier in this article, it's better to make one big transaction than several smaller ones to minimize fixed fees.

- Choose favorable currencies: Whenever possible, request payments in currencies that have more favorable fee structures.

Tax Considerations for Businesses

If you operate as a registered business or sole proprietor, you can legally deduct PayPal transaction fees from your taxable income. These costs can be listed as business expenses under "payment processing fees" or "merchant fees" in your accounting system. While this won't reduce the fees, it can help recover some costs through tax deductions.

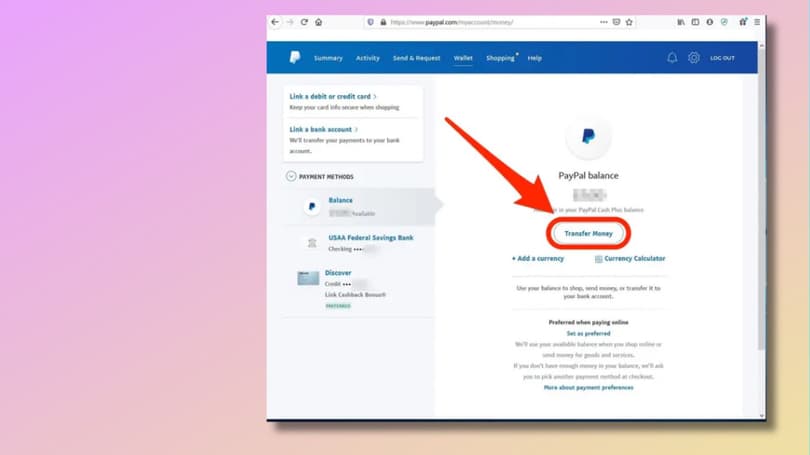

Funding Your PayPal Account: Additional Fees to Consider

There are several common methods of adding money to your PayPal account. Whether topping up your balance to make a purchase, send money, or simply keep some digital cash handy, it’s important to understand where extra fees might sneak in.

Bank Transfer: You can fund your PayPal account by transferring money from your linked bank account. This transfer is free, provided both your bank and PayPal accounts are in the same currency. However, if the currencies differ, currency conversion fees will apply. Additionally, be also mindful of potential bank-side charges, particularly when transferring from a foreign bank.

Credit and Debit Cards: Using a credit or debit card to fund your PayPal account is a quick and convenient option, especially if you need to make a payment immediately. The money is added to your balance within seconds. However, you’ll incur payment processing fees when funding a transaction via card, which can add up over time.

PayPal Cash: For U.S. users, PayPal Cash or PayPal Cash Plus accounts allow you to load funds through retail stores or via direct deposits from payrolls or government benefits. While convenient, cash top-ups in stores come with an additional fee ranging from $3.74 to $3.95.

Receiving Money from Others: When someone sends you money, it effectively serves as a way to fund your PayPal account. However, if the funds are sent in a currency different from your PayPal account’s primary currency, currency conversion fees may apply before the money is fully available to you.

Conclusion

Hopefully, this guide has been helpful for those asking, “Does PayPal charge a foreign transaction fee?” Navigating PayPal’s fees for international transactions can seem complex at first, but understanding how these charges work is essential for using the platform efficiently. This is especially true when dealing with cross-border payments, currency conversions, or funding your account in different ways. By staying informed and being intentional with how you use PayPal internationally, you’ll ensure that more of your money stays in your pocket.