Top Online Payment Gateway Providers in 2024

Contents

Every year, the advancement of technology in the financial sector is happening faster. More and more people are embracing online banking, payment terminals, mobile payment systems, e-wallets, and other digitization opportunities. The market’s sustainable development is facilitated by the increasing share of smartphones that enable contactless payment for goods and services, as well as the growing penetration of the Internet.

Payment gateways are an integral part of online transactions. These payment processors act as a bridge between the seller and the customer. With their help, you can securely and quickly pay for goods and services from your favorite device, wherever you are.

But what exactly do payment processing companies worldwide offer? In this article, we will discuss three of the most prominent payment solution providers as well as their features and relevant updates. Here’s everything you should know about PayPal, Stripe, and Verifone.

PayPal

PayPal is a highly sought-after payment processing provider available in 200 countries and regions. It lets users send and receive money from bank cards in dozens of popular currencies. PayPal holds a 38.31% market share in payment systems.

Key features of this payment solution include:

- Accepting transfers and payments from around the world.

- A user-friendly and convenient online payment process that eliminates the need to enter credit card details.

- High transaction speed.

- The ability to send invoices for payment and accept recurring payments.

- Integration possibilities with CMS platforms, POS systems, financial accounting software, and more.

When transactions are conducted through PayPal, neither the sender nor the recipient can see any credit card or bank account information. This means you can make online purchases without worrying about your data falling into the hands of fraudsters.

The system offers two types of accounts: personal and business. Personal PayPal accounts are primarily used by individuals who enjoy shopping online or need to split bills among multiple people. Business accounts are designed for entrepreneurs and offer additional features and analytic tools for their funds.

In 2024, many online payment system providers underwent changes, and PayPal is no exception. Here are some updates:

- PayPal introduced smart receipts, with the help of which users can now track the items they buy.

- Another new convenient feature is called Fastlane. Merchants will now be able to offer one-click checkout to buyers, as there will be no need to enter additional information or password.

- Users will now also have access to personalized cashback from various PayPal partners, including Uber, Walmart, and more. Thanks to AI, the offers will be personalized.

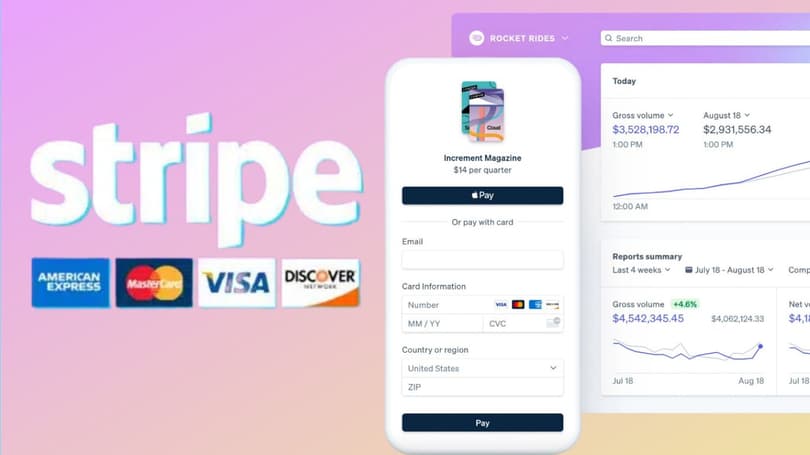

Stripe

Stripe is on the list of secure online payment gateway providers. It is primarily designed for businesses and e-commerce and offers maximum convenience for both sellers and buyers.

The solutions implemented by Stripe exceed industry security standards, enabling efficient online payments, processing recurring transactions, and providing other subscription services. This makes it one of the best payment systems for online businesses.

You can use Stripe to accept payments from major credit cards, including Visa, MasterCard, American Express, Discover, and others. It also supports mobile wallets like Google and Apple Pay. Additionally, Stripe, like most credit card payment gateway providers, processes various foreign currencies and converts them without additional fees.

Some key advantages of the Stripe payment system include:

- Reliable acceptance of international payments.

- Instant access to funds.

- Ability to create payment links.

- Ready-to-use order templates.

- Unified management panel for iOS and Android devices.

- Extensive integration capabilities with various services.

- Data security.

- 24/7 customer support via email, phone, or chat.

Stripe adheres to international security standards and holds PCI Level 1 certification, the highest certification level available in the payment industry.

In 2024, Stripe introduced some updates:

- Stripe now offers more than 100 payment methods, including ZIP, TWINT, Amazon Pay, Swish, and others.

- Stripe currently supports the collection of tax in 57 countries.

- It is now also possible to import transaction data from Apple, Google, and more to conveniently consolidate revenue recognition with Stripe.

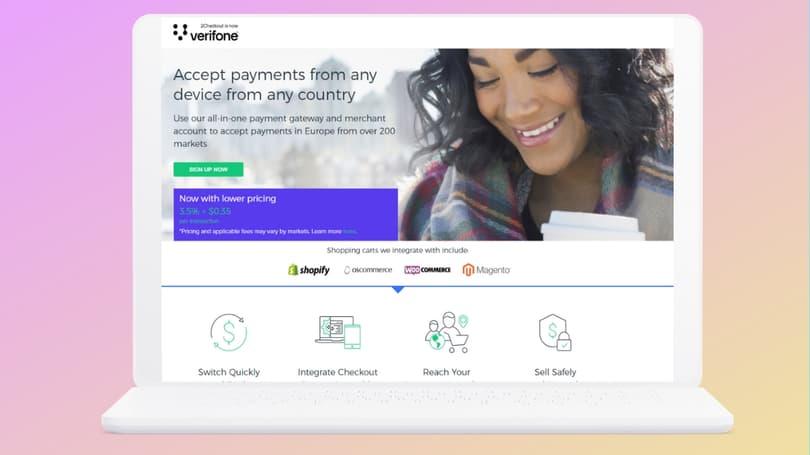

VERIFONE

Verifone (formerly 2CHECKOUT) is an electronic payment processing service designed for companies that sell physical goods or digital products online, such as software. It provides an extensive set of tools and enables international transactions.

Verifone helps businesses receive online payments from bank cards in 200 countries and territories. In addition to payment processing, the service offers customers access to numerous shopping cart integrations for convenient checkout. The comprehensive 2Monetize pricing plan includes additional features such as account management, assistance with tax compliance, conversion optimization tools, and over 45 payment methods.

The platform offers two flexible payment models: the registered seller model and the payment service provider model. In the registered seller model, Verifone takes financial responsibility for processing your business transactions. They also handle sales tax management, invoicing, compliance, and more. On the other hand, with the payment service provider model, you are responsible for managing the payments yourself.

Like other payment system gateway providers, Verifone has its advantages:

- Fast international payments.

- Choice of a shopping cart.

- Convenient subscription management.

- Analytics capabilities.

- Financial assistance.

- Risk management and regulatory compliance.

- Seller and buyer support.

Similar to Stripe, Verifone holds PCI Level 1 certification. The gateway developers have a three-tiered protection strategy to detect fraud in real time. The goal is to identify illicit activity before it occurs.

In 2024, Verifone experienced some updates:

- Verifone now supports Google Pay Wallet through API v6.

- Now, users can unsubscribe from all marketing and commercial emails sent to them by Verifone in one click.

- Merchants can also add surcharges to payments. This surcharge configuration is available via Verifone Central.

Conclusion

Modern global payment gateway providers allow users to send and receive funds internationally with reasonable fees and excellent security features. Thanks to their high level of convenience, they are used by both businesses and individuals. All online payment providers have their advantages and disadvantages. The preferred option will be the one that aligns with your personal preferences or your business goals.

- If you need an online payment service provider, you should look to PayPal.

- Stripe is suitable for businesses in various fields.

- SaaS companies can significantly benefit from Verifone.

![Afterpay for Amazon: A Complete Guide [2025]](https://rates.fm/static/content/thumbs/385x210/c/12/d67j2j---c11x6x50px50p--38b1a98a741b6c488aa919434f8ea12c.jpg)

![Pros and Cons of Using Venmo [2025]](https://rates.fm/static/content/thumbs/385x210/2/b4/m5l4zf---c11x6x50px50p--7fd1eb762b71d2f2a7c7a4c016fa0b42.jpg)