Top 3 Online Payment Gateway Providers in 2023: Navigating the Digital Economy

Every year, the advancement of technology in the financial sector is happening faster. More and more people are embracing online banking, payment terminals, mobile payment systems, e-wallets, and other digitization opportunities.

Thanks to these advancements, anyone can instantly pay for various services and conduct different financial transactions without leaving home. It's no wonder that the digital payment market is proliferating.

According to Research and Markets, the global digital payment market will grow from $96.19 billion in 2022 to $111.11 billion by the end of 2023 and $197.87 billion in 2027, with a compound annual growth rate (CAGR) of 15.5%.

Source: Research and Markets

The market's sustainable development is facilitated by the increasing share of smartphones that enable contactless payment for goods and services, as well as the growing penetration of the Internet. Additionally, online trading platforms are gaining popularity.

An integral part of online transactions is payment gateways. These payment processors act as a bridge between the seller and the customer. They allow for quick and convenient payments and ensure the encryption of confidential financial information and protection against fraud.

There is a vast number of online payment gateway service providers. In this article, we will take a detailed look at the three most popular ones in 2023:

- PayPal

- Stripe

- 2Checkout

PayPal

PayPal is a highly sought-after payment processing provider available in 200 countries worldwide. It lets users send and receive money from bank cards in dozens of popular currencies. According to Similar Web, PayPal ranks 69th in the "Banking Credit and Lending" category and holds a 31.48% market share in payment systems.

Key features of this payment solution include:

- Accepting transfers and payments from around the world.

- A user-friendly and convenient online payment process that eliminates the need to enter credit card details.

- High transaction speed.

- The ability to send invoices for payment and accept recurring payments.

- Integration possibilities with CMS platforms, POS systems, financial accounting software, and more.

When transactions are conducted through PayPal, neither the sender nor the recipient can see any credit card or bank account information. This means you can make online purchases without worrying about your data falling into the hands of fraudsters.

The system offers two types of accounts: personal and business. Personal PayPal accounts are primarily used by individuals who enjoy shopping online or need to split bills among multiple people. Business accounts are designed for entrepreneurs and offer additional features and analytic tools for their funds.

In 2023, many online payment system providers underwent changes, and PayPal is no exception. Here are some updates:

- Additional payment options were introduced when sending invoices through PayPal, including Venmo, Pay Later, and credit or debit card payments.

- PayPal Invoicing requests sent via email now include additional information about the seller, such as the company logo (if available) and transaction history.

- Small businesses now have the option to use Apple Pay as a payment method within the online transaction system.

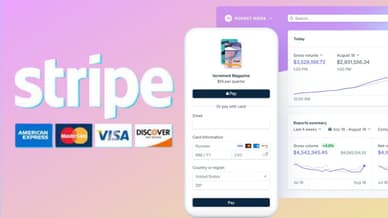

Stripe

Stripe is a highly secure international payment system with many options, primarily designed for businesses and e-commerce. It offers maximum convenience for both sellers and buyers.

The solutions implemented by Stripe exceed industry security standards, enabling efficient online payments, processing recurring transactions, and providing other subscription services. This makes it one of the best payment systems for online businesses.

You can use Stripe to accept payments from major credit cards, including Visa, MasterCard, American Express, Discover, and others. It also supports mobile wallets like Google and Apple Pay. Additionally, Stripe, like most credit card payment gateway providers, processes various foreign currencies and converts them without additional fees.

Some key advantages of the Stripe payment system include:

- Reliable acceptance of international payments.

- Instant access to funds.

- Ability to create payment links.

- Ready-to-use order templates.

- Unified management panel for iOS and Android devices.

- Extensive integration capabilities with various services.

- Data security.

- 24/7 customer support via email, phone, or chat.

Stripe adheres to international security standards and holds PCI Level 1 certification, the highest certification level available in the payment industry.

In 2023, Stripe introduced some updates:

- Users can now set up automatic tax calculations.

- The payment solution exports your data to storage more quickly. This process takes 12 hours for new users, while existing users experience a 9-hour export time from the moment of creation.

2Checkout

2Checkout is an electronic payment processing service designed for companies that sell physical goods or digital products online, such as software. It provides an extensive set of tools and enables international transactions.

2Checkout helps businesses receive online payments from bank cards in 200 countries. In addition to payment processing, the service offers customers access to over 120 shopping cart integrations for convenient checkout. The comprehensive 2Monetize pricing plan includes additional features such as account management, assistance with tax compliance, conversion optimization tools, and over 45 payment methods.

The platform offers two flexible payment models: the registered seller model and the payment service provider model. In the registered seller model, 2Checkout takes financial responsibility for processing your business transactions. They also handle sales tax management, invoicing, compliance, and more. On the other hand, with the payment service provider model, you are responsible for managing the payments yourself.

Like other payment system gateway providers, 2Checkout has its advantages:

- Fast international payments.

- Choice of a shopping cart.

- Convenient subscription management.

- Analytics capabilities.

- Financial assistance.

- Risk management and regulatory compliance.

- Seller and buyer support.

Similar to Stripe, 2Checkout holds PCI Level 1 certification. The gateway developers have a three-tiered protection strategy to detect fraud in real-time. The goal is to identify illicit activity before it occurs.

In 2023, 2Checkout experienced some updates:

- New card expiration fields.

- An updated list of License Change Notification (LCN) parameters in the seller control panel.

- The ability to display pricing parameters (if previously set in the control panel) for recommended products in Convert Plus.

Conclusion

Digital payment systems are a convenient tool for online payments and receiving funds from anywhere in the world. Such platforms save time, facilitate communication between companies and customers, and simplify international transactions.

All payment gateway providers have their advantages and disadvantages. The preferred option will be the one that aligns with your personal preferences or your business goals. That is, if you need an online payment service provider, you should look to PayPal, Stripe more suitable for businesses in various fields, and SaaS companies can significantly benefit from 2Checkout.

FAQ

What is an e-commerce payment gateway?

An e-commerce payment gateway is a service that provides simple and secure processing of online payments for online stores and other e-commerce businesses. It acts as a bridge between the customer, the seller's website, and the financial institutions involved in the transaction.

Which online payment providers are best?

The choice among online payment gateway providers depends on various factors. The best option will be the one that aligns with your specific preferences and business needs:

- PayPal if you need a secure system for international payments;

- Stripe provides numerous advantages for businesses, including an easily implemented API;

- 2Checkout will be a great choice for startup traders.

Is PayPal an online payment gateway?

Yes, PayPal is a gateway designed for accepting online payments. The system is suitable for both person-to-person transactions and receiving business payments.