5 Best Money Saving Apps in 2024

Creating a savings balance and effectively managing income and expenses can be tricky, but did you know that your phone can do it for you? Online financial management tools and mobile money-saving apps can take the way we handle money to a fundamentally new level. The main idea of these programs is to provide a convenient, easy, and even fun way to save money. Whether you’re an experienced saver or just starting to take control of your finances, the money-saving apps are here to help you increase your savings.

Each application uses unique tools, strategies, and methods, but they all make managing your finances much easier. In this article, we’ll examine five of the best mobile apps to save money, chosen for their cutting-edge functionality and robust algorithms.

So, what is the best app to save money? Keep reading to find a money-saving tool that’s right for you!

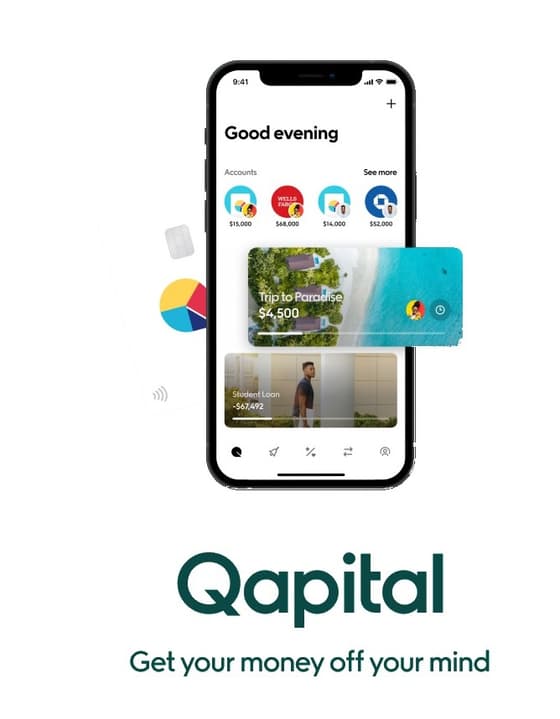

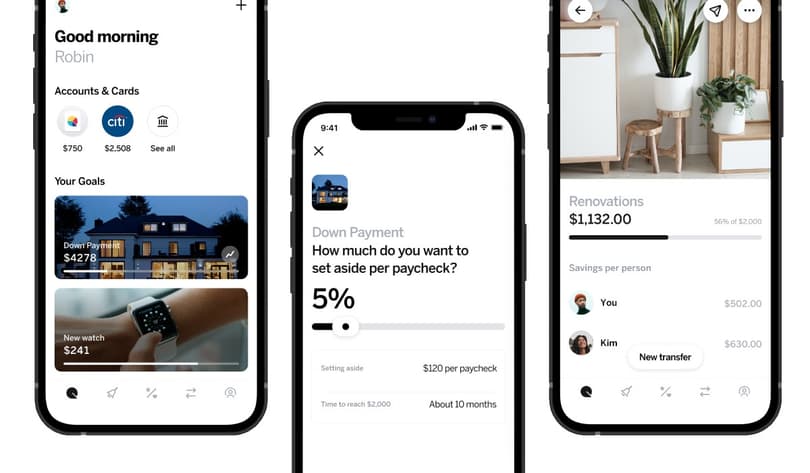

Qapital

This is one of the best apps to save money and set financial goals. Qapital utilizes the strategy of rounding up the account balance and converting it to savings. According to the developers, this smart money app helps users achieve their short-term and long-term financial plans without significantly changing their lifestyles. The users can create their own money-saving goals, and the app will provide them with reminders as well as some motivational quotes to make the whole process a bit more bearable.

The app has a strong visual side, allowing you to add pictures or photos to your financial goals. You can also share your goals with friends, partners, or relatives to add an extra bit of social motivation.

The main disadvantages of Qapital are the relatively high monthly service fee, limited investing options, and the low-interest rate—the associated savings account brings almost no interest. In addition, the Qapital website is not very user-friendly.

Qapital presents users with a free trial for the first month, but after that, you’ll have to choose from three available membership levels, which cost $3, $6, or $12 per month, respectively. The cheapest plan offers basic functionality, while with other tariffs, you’ll get access to more advanced features.

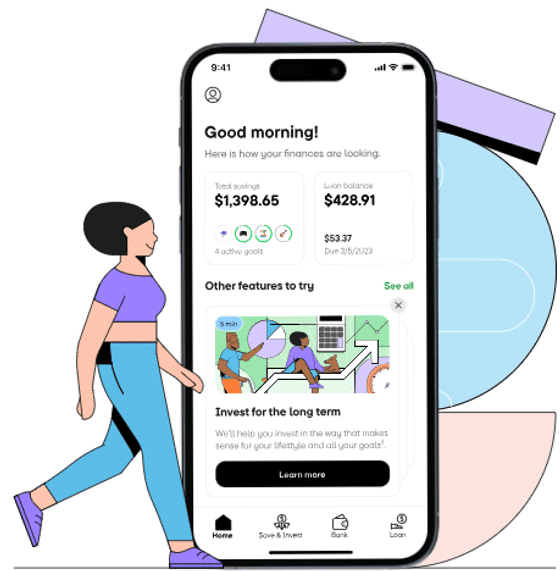

Oportun

Oportun (formerly Digit) is by far the best option if you’re looking for simplicity. The application uses artificial intelligence and automatically analyzes the transactions on your account—based on your expenses and income, it calculates the amount you can save without disrupting your daily life. If Oportun concludes that you cannot afford to save money, it does not transfer anything to savings. While you can set savings limits, you can’t fully control the amount the money-saving app transfers each day.

With Oportun, you can save without thinking, spend money wisely, plan your budget carefully, invest at your own pace, and manage your finances intelligently. The program learns your spending habits, making budgeting easier, tracking your progress, and helping you gradually reach your savings goals without affecting your spendings all that much. In addition, Oportun also has a dedicated credit card debt payment function.

Among the service’s shortcomings are the lack of a free version, a low-interest rate on savings, no savings transfer between the established goals, and limited user control. Also, Oportun has mixed reviews—many customers had reported encountering billing issues.

This money-saving app offers users a bonus system, accumulating 0.1% per year and paying it out every three months. You can use these bonuses to pay part of the subscription price. The program has a free trial period, and after that, it will cost you $5 per month.

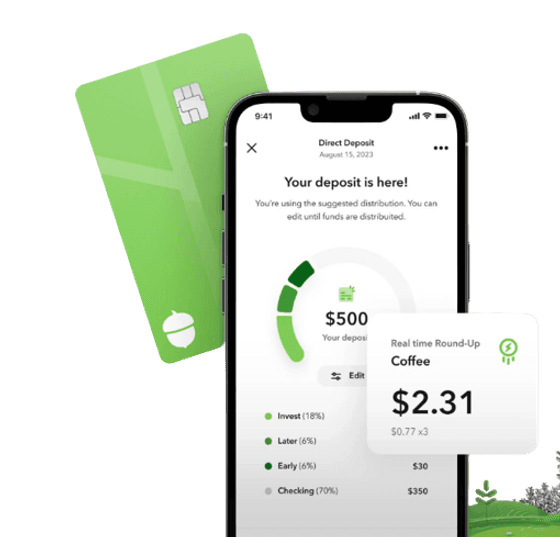

Acorns

Acorns is among the best apps to help save money if you’re into investing. It enables you to both increase your savings and invest change automatically. The program rounds up your debit or credit card purchases and also allows you to set up recurring payments.

Among the main advantages of Acorns are full investment automation (withdrawals on the card are rounded to the nearest dollar) and absolute ease of use. In addition, the application provides you with automatic portfolio rebalancing and has several account types to choose from.

Despite its strong suite benefits, this app for saving money still has room for improvement. Major disadvantages include high fees, checking account access fees, lack of access to human consultants, relatively limited planning tools, and lack of a tax strategy feature.

Acorns offers simple rates and clear pricing, charging a flat monthly fee for each tier. The program provides three subscription options—Personal, Personal Plus, and Premium, priced at $3, $6, and $12, respectively.

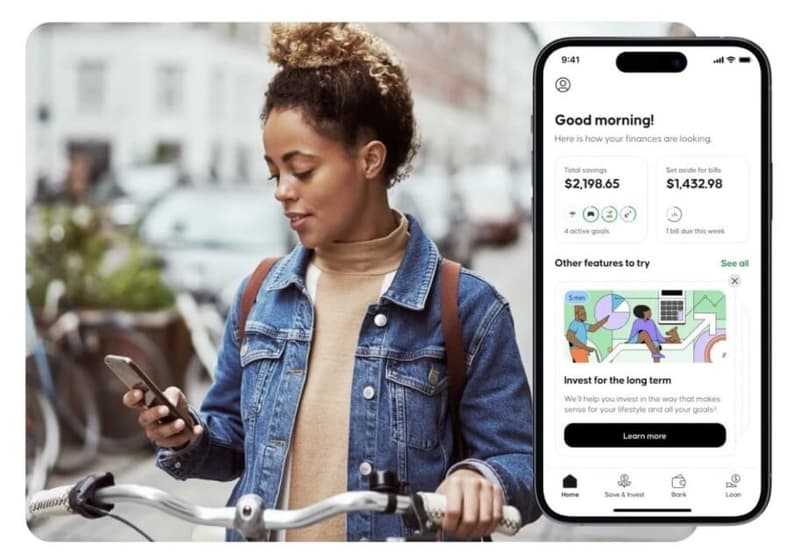

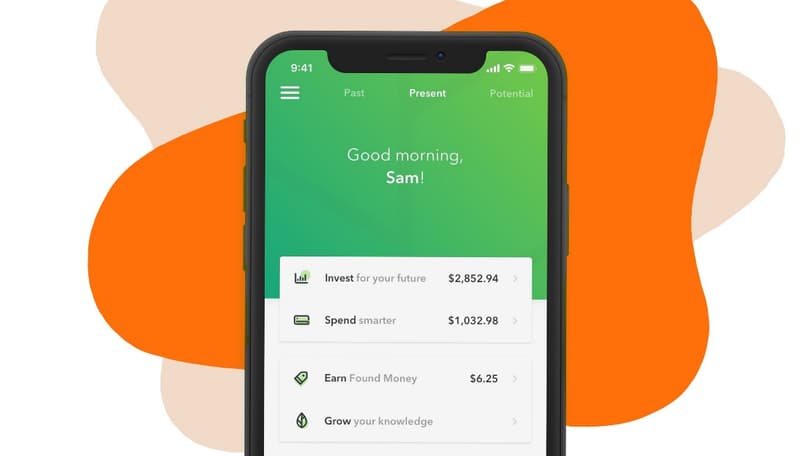

Chime

Chime allows you to save money by simply using banking services. This digital bank provides a highly profitable savings account with some automation added into the mix. One of the features allows you to save on spending by rounding up purchases and transferring saved cents to a savings account. Another feature enables the users to automatically save a fixed amount of money when a salary is credited to the account, transferring up to 10% of the amount.

Chime pays its customers a fixed percentage of their savings, making this program one of the most profitable and overall best apps for saving money on the market. In addition, the service can also pay salaries a couple of days earlier, borrowing a small amount of money before it actually enters the account. Another undeniable advantage of Chime is that the application does not charge commissions for maintenance and services provided—the company receives profit not from customers but from Visa and is paid by the point of sale.

The main weaknesses of Chime are related to the lack of branches for personal service, payment for cash deposits or withdrawals at ATMs, limits on cash withdrawals and purchases, lack of multi-currency account options, as well as geographic restrictions—the application is only available to US residents.

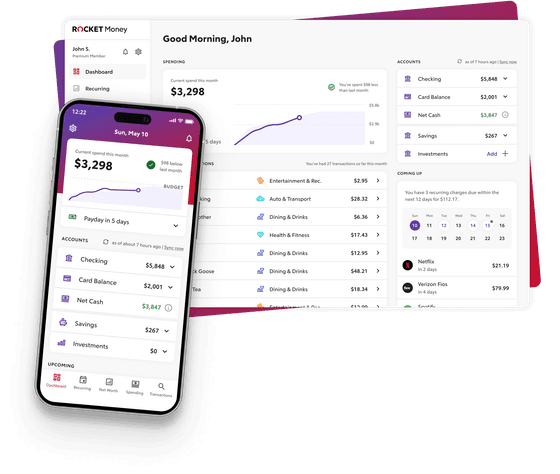

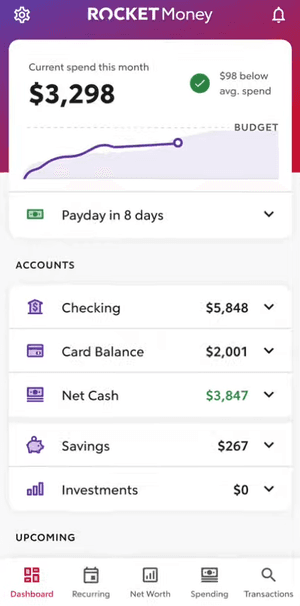

Rocket Money

Last but not least, Rocket Money is quite a useful little application. It has a range of features and tools, including automatic savings, track spending, alerts about upcoming charges, and more. The app is not only convenient but also safe, as it has bank-grade security.

Rocket Money is particularly well-suited for subscription management. Once you have the app and your bank account linked, you can view all your subscriptions in one dashboard. Being aware of how much money you spend and on what is the core of saving apps, and this one takes it a step further. If there are subscriptions you are no longer interested in, it’s about time you cancel them.

Another unique feature of this app (although available only for subscribers) is bill negotiation. The way it works is that you can add a bill copy to the app to see whether you can get the same service at a lower cost.

You can use Rocket Money for free, but you should keep in mind that you’ll be limited to just the basic features. If you want access to the spectrum of what the app has to offer, you can choose a plan for $6 or $12 a month.

Conclusion

It is often difficult for us to start saving money, but it is just a habit that needs to be developed. Fortunately, there are special digital tools that can help you with this. The best apps for saving money allow you to increase your budget without much effort and remove the need to track your cash manually.

So, which app is best to save money? It depends on your needs, preferences, and habits, so it’s best to try different ones. Choose the solution that suits your lifestyle, get into the habit of saving some money regularly, and you’ll see your balance accumulate and grow. Use money-saving tools to enter the rhythm of savings and, eventually, achieve your long- and short-term financial goals.