6 Best & Most Popular Peer-To-Peer Payment Apps

Today, peer-to-peer payment apps have already become a necessity. It is hard to imagine financial transactions without the convenience and speed offered by these apps. Whether you are paying bills, returning a debt, or sending money to a family member — you can easily do this using your smartphone.

However, with so many options available, the choice of a suitable P2P app may feel overwhelming. So in this guide, we compiled a top P2P apps list to help you choose the right one just for you.

Factors to Consider When Choosing a P2P App

Let’s begin by breaking down the points you should pay attention to.

Security and Privacy Features

Look for P2P payment solutions that prioritize security, offering features like encryption, two-factor authentication, and fraud protection. Ensure that your financial information and transactions are safe. Pay attention to whether it has measures that restrict other people from using your digital wallet, such as the verification stage. It is better not to worry about financial safety, right?

User Interface and Ease of Use

A user-friendly interface is essential for a seamless experience. Just try an app, and you will notice whether your intuition can lead you toward the desired results. A quality design should provide users with easy navigation. The best P2P payment apps should help you send and receive money without any complications.

Supported Currencies and Countries

Consider the app's availability in your country and whether it supports the banking cards and currencies you frequently use. Consider whether it enables international transactions if you need them.

Transaction Limits and Fees

Review the transaction limits and fee structures of the P2P app. Ensure that it aligns with your transaction needs and offers competitive fees for your usage patterns.

Special Offerings

Some P2P solutions offer additional services, such as bill splitting, group payments, or cashback rewards. Have you ever felt the need for one of those? Choose an option that provides whatever will make your life easier. Additional features and services may enhance your overall financial experience.

Top 6 Peer-to-Peer Payment Apps

Here is the list of the most popular P2P payment apps:

- PayPal;

- Venmo;

- Cash App;

- Zelle;

- Google Pay;

- Apple Pay.

But before settling on any of them, you should consider the pros and cons of each and pick the one that can fulfill your personal requirements.

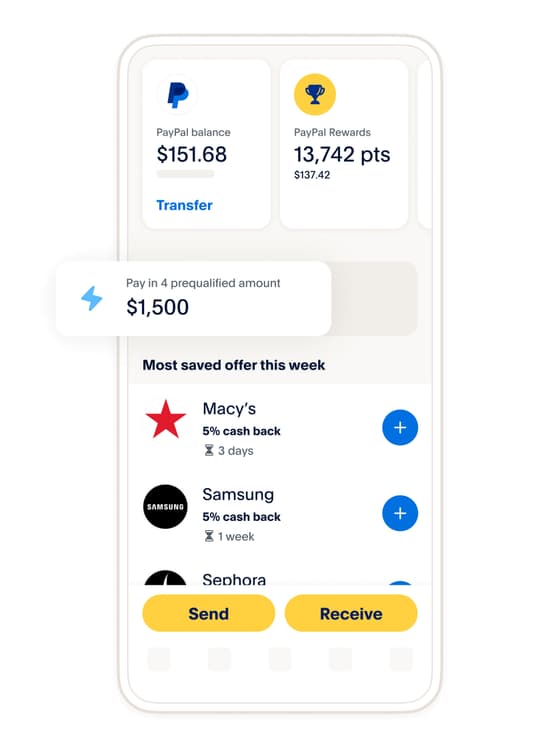

PayPal

PayPal is a widely recognized and trusted P2P payment app with extensive global reach. It offers secure transactions, seller protection, and the option to link multiple funding sources.

Pros:

- wide acceptance;

- global accessibility;

- extensive security measures;

- cryptocurrency support.

Cons:

- higher currency conversion and transaction fees for certain types of payments compared to other apps.

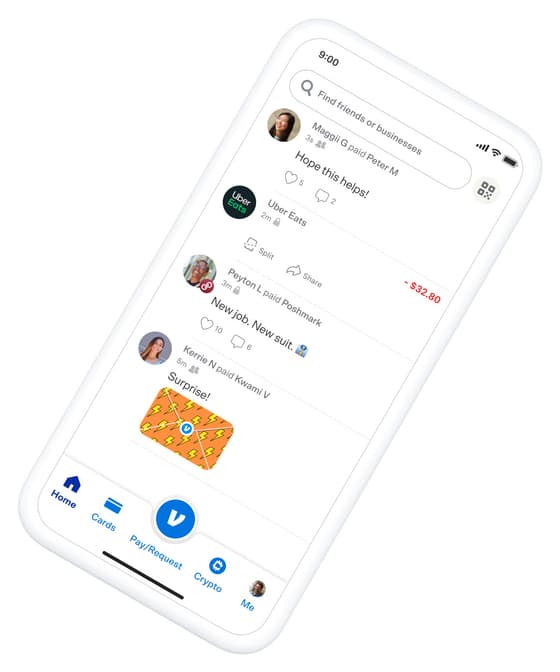

Venmo

Venmo is one of the most popular Peer-to-Peer payment apps, known for its social features, such as adding comments and emojis to payments. It was designed to be used by friends and family, mainly to split the check and share expenses as an effortless experience.

Unlike PayPal, Venmo has a no-fee option for payments made from debit cards.

Pros:

- user-friendly interface;

- social integration;

- instant transfers;

- cryptocurrency support.

Cons:

- accessible only for US residents;

- high transaction fees for credit card payments.

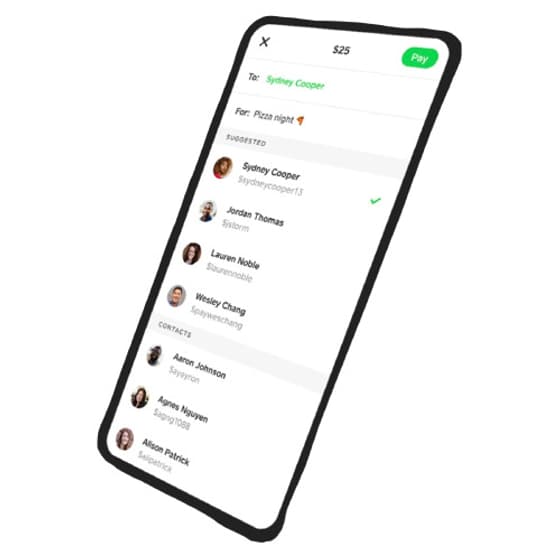

Cash App

Cash App is one of the more popular options among the top Peer-to-Peer payment apps that alleviates receiving and sending money. This one is popular for $cashtag, a username used to find a person easily to pay or receive money.

Pros:

- quick setup;

- Cash Card integration;

- stock trading;

- cryptocurrency support.

Cons:

- limited international availability;

- high fees for instant transfers.

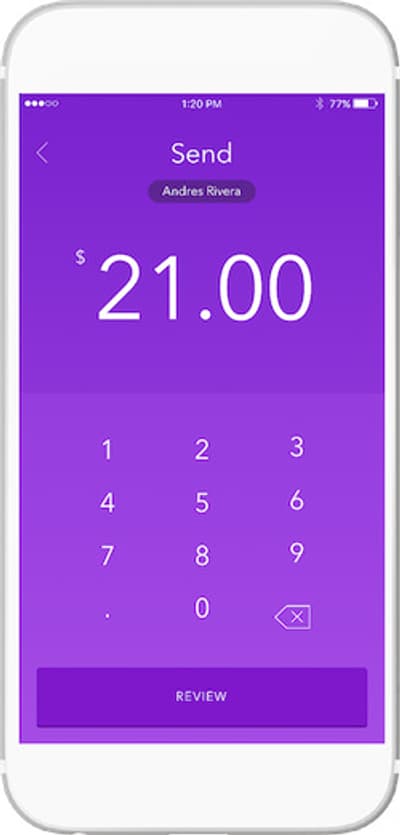

Zelle

Zelle is a P2P payment service integrated into many major bank’s mobile apps, allowing direct transfers between bank accounts. This service provides fast transactions for users within the same bank network.

Pros:

- seamless bank-to-bank transfers;

- no transaction fees.

Cons:

- limited to participating banks;

- lacks social features;

- no cryptocurrency support.

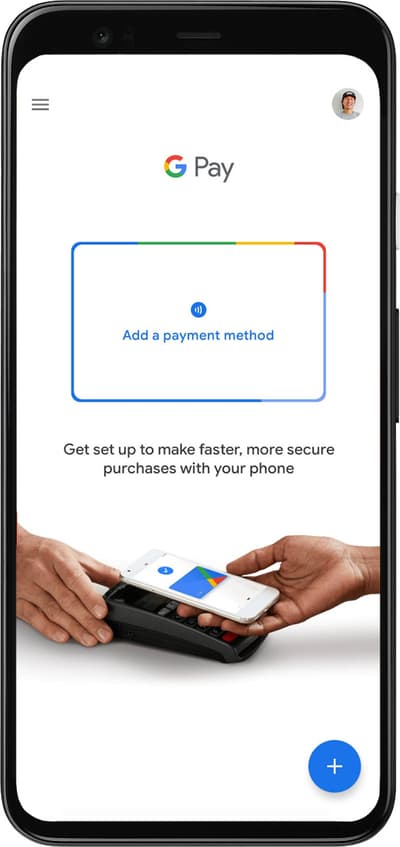

Google Pay

Google Pay is a solution that allows users to send and receive money using their Google account. One of the best features of this app is seamless integration with other Google services. Moreover, you can pay with your phone using NFC technology.

Pros:

- easy to use;

- integration with other Google services;

- contactless payments;

- no fees for debit card payments.

Cons:

- access is limited to users with a Google account;

- no cryptocurrency support.

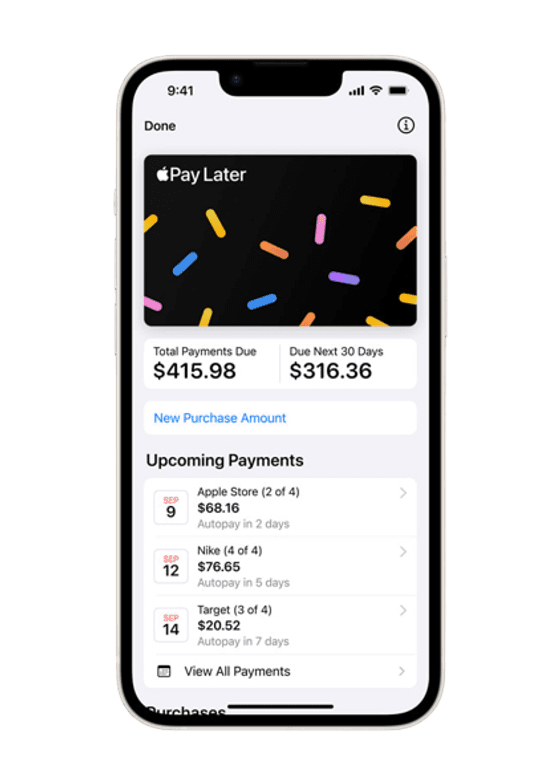

Apple Pay

Apple Pay somewhat resembles Google Pay, but this one is an exclusive option for Apple users. It conducts P2P transactions through its Messages app using Apple Cash. Apple Pay also supports contactless payments at physical stores using iPhones and Apple Watch.

Pros:

- convenience;

- security of private transactions;

- contactless payments.

Cons:

- access is limited to Apple devices;

- does not support cryptocurrency.

Conclusion

You may wonder which of the most popular P2P payment apps to choose. The fact is that the question “Which is the best Peer-to-Peer payment app?” makes as much sense as the question “What is the best color?” Only you can decide for yourself.

Only you can decide for yourself. Consider your personal needs and use a platform that can meet them. Pay attention to each app's benefits and drawbacks. Weigh the pluses and minuses and compare a few options available to pick the one that will match your expectations and set you up for hassle-free and convenient personal payments.

FAQ

What are the basic features of a P2P payment app?

Every P2P should include every feature required for successful transactions between users. That is, sending and receiving money (obviously!), user registration, linking your bank cards, and security measures for funds protection.

What are the platforms for P2P payments?

Some platforms for P2P payments are:

- Mobile apps (Apple Pay and Google Pay);

- Messaging apps (WhatsApp and Facebook);

- Web applications;

- Digital wallets (PayPal and Venmo);

- Social media apps (Snapchat).

Do P2P payment apps charge fees?

There is a variety of fees that these apps charge for different transactions. It is important to remember that for the best P2P payment experience, you need to choose a solution that has a low or no fee for the transaction you will use the most frequently.

Do P2P payment apps support cryptocurrency transactions?

Some of the best Peer-to-Peer apps allow users to conduct cryptocurrency transactions. They are Venmo, PayPal, and Cash App. Such apps as Zelle, Google Pay, and Apple Pay do not have this feature.

Can I use multiple P2P payment apps simultaneously?

If you find it convenient to combine the functionality of the best P2P apps, you can use more than one, just like you can have multiple bank accounts.

Which safety and privacy features are not included in a P2P app or service?

P2P payment apps normally have a high-security level and a number of embedded protective functions. However, they still may lack some features, though they do not compromise overall transactional security too much. These are representation calls for payment confirmation, user PINs, privacy controls, data sharing opt-outs, payment verification amounts before completing a transaction, and device security.