Venmo vs. PayPal: Choosing the Best Payment App for Your Needs

Contents

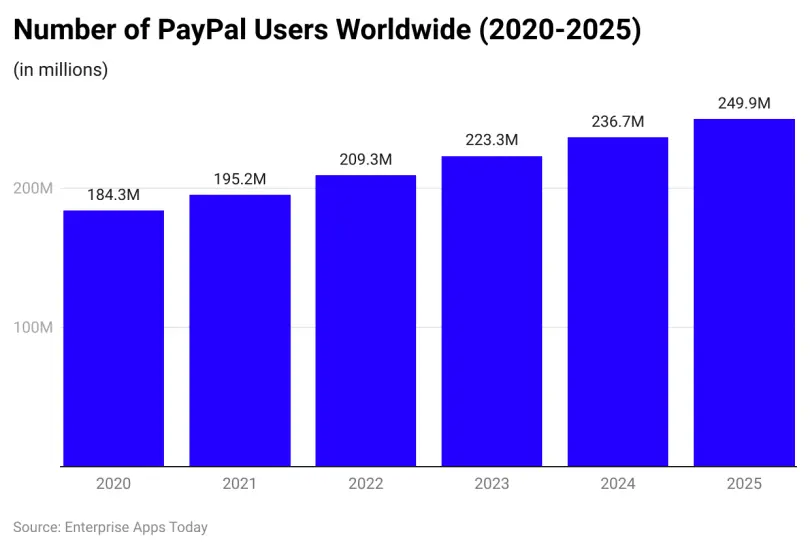

Venmo and PayPal are two payment processor/digital wallet hybrids you’re most likely to come across online. Does PayPal own Venmo? Yes, PayPal took over this mobile payment service in 2013. Are Venmo and PayPal the same company? Technically, no, but in practical terms, they are both part of the same business entity.

In this review, we’ll break down the differences between Venmo and PayPal, helping you figure out which platform fits your lifestyle or business needs.

Venmo vs. PayPal: A Side-by-Side Comparison

Is Venmo the same as PayPal? Before we dive into the difference between Venmo and PayPal in detail, let’s take a quick look at how these two systems stack up in major aspects.

Aspect | Venmo | PayPal |

|---|---|---|

Ownership | Owned by PayPal since 2013 | Holding, publicly traded under the PYPL symbol after its separation from eBay in 2015 |

Primary Use Cases | P2P payments | P2P payments, online shopping, business transactions, and international transfers |

Availability | Available to US residents only | Available globally, supports multiple currencies |

Transfer Limits | Unverified Users: $299.99 per week; Verified Users: Up to $7,000 combined limit per week on purchases. $60,000 weekly for P2P transactions; Instant Transfers: Up to $5,000 per transfer. | Unverified Users: $4,000; Verified Users: No limit on the total amount, with a $60,000 per transaction; Instant Transfers: Up to $25,000 per transaction, depending on the type of account. |

Instant Transfers | Available | Available |

Fees | Free for standard bank transfers; Instant transfers to your bank cost 1.75% (minimum fee of $0.25 and a maximum of $25); 3% fee for payments funded by credit cards. | Free for transfers to a bank account (standard time); 1.75% fee for instant transfers (up to $25 maximum); 2.9% + $0.30 fee for receiving money from goods and services transactions within the US; Additional fees apply for international transfers and currency conversion. |

Security Features | Strong encryption and 2FA. | Strong encryption and 2FA; Purchase Protection and Seller Protection. |

Social Features | Available | No social sharing |

Business Capabilities | Good for smaller businesses | Extensive features for all types of businesses |

Debit Card | Venmo debit card supported by Mastercard | PayPal debit card supported by Mastercard |

Cryptocurrency Support | Available | Available |

Accessibility | App-based platform with limited functionality on its website | Available via mobile app and fully functional on the web |

Venmo: a Payment Service With a Social Aspect

Venmo is a peer-to-peer payment service primarily meant for mobile use. As a quick and convenient way to exchange funds, the app has caught on with younger users, prioritizing mobile devices for personal transactions. We recommend that you check out how Venmo works, how to use it, and how to install Venmo on our website.

Venmo Features and Benefits

Venmo has a few tricks up its sleeve that make it a preferred choice for millions of users.

- Ease of Use: With just a few taps, you can send out funds to friends, family, or businesses. It’s also easy to add cash to Venmo and carry out transactions.

- Social Aspect: One of the key benefits of Venmo is its feed. This social network feature adds a fun and interactive element to the app.

- Low Fees: Another reason why users go for Venmo is its affordable processing fees, which are on the lower end compared to other P2P systems. Venmo rates for business are also particularly important.

- Splitting Bills: Whether it’s splitting dinner at a restaurant, sharing rent with roommates, or pooling money for a group gift, Venmo’s split feature is a convenient way to divvy up expenses.

- Payment History: The service keeps a detailed record of past transactions, offering users an intuitive way to track spending and look back on payment history for both individuals and businesses.

- Venmo Card: In collaboration with Mastercard, Venmo has rolled out its branded debit card, which allows users to spend their balance in-store and online.

Venmo Limitations

As with any other system, Venmo has its downsides and limitations, including the possibility of scams in the Venmo payment system.

- No International Payments: This system is only available in the US.

- Default Publicity: With the default settings, your transactions, along with comments, will be visible to everyone, including your direct contacts. To keep your operations private, you should change the security settings.

- Transfer Limits: Venmo sets limits on how much a user can send and receive, which can be restrictive for high-volume transactions or larger payments.

PayPal: A Worldwide Leader

PayPal is among the market veterans. Comparing PayPal versus Venmo, the first major difference you’ll run into is that while Venmo is a P2P provider, PayPal is a global online wallet.

PayPal Features and Benefits

Now that you’ve gone through Venmo’s standout features let’s check out what PayPal brings to the table.

- Global Availability: PayPal is accepted by online merchants and businesses across the globe, making it a convenient payment option for international transactions.

- Buyer and Seller Protection: Buyer protection policies look after customers against unauthorized access and item-not-received cases, while sellers are protected against fraudulent chargebacks and account theft.

- Integration with E-commerce Platforms: PayPal integrates smoothly with popular e-commerce platforms such as Shopify, WooCommerce, and Magento.

- Convenient Payment Processing: PayPal makes it easy for users to send over money, request payments, and manage various transactions from their desktop or mobile devices.

- PayPal Cards and Credit Products: PayPal debit cards from Mastercard give you access to your funds and offer lucrative cashback for purchases.

PayPal Limitations

Despite all its perks, PayPal has a few drawbacks:

- Hold Funds: PayPal may hold onto received funds on temporary hold, especially for new accounts or transactions considered high-risk.

- Account Limitations: PayPal may place restrictions on account activity, such as withdrawing, sending, or receiving funds. This can happen due to suspected fraud or non-compliance with PayPal’s Use Policy.

- Currency Conversion Fees: When making international payments that involve currency conversion, PayPal charges exchange rate fees.

Venmo or PayPal: How Do You Choose Between the Two Platforms?

Before you make up your mind on whether to go with Venmo or PayPal, let’s see how these systems stack up at some crucial aspects we normally consider when choosing an online payment processor.

Venmo vs. PayPal: Similarities

- Both have desktop and mobile versions;

- Both can sync up your contacts with the app;

- Both allow for linking a bank account, debit, or credit card for payments;

- Both allow for sending, receiving, and requesting money or transferring the balance to your bank account;

- Both are suitable for individual and business use;

- Both have certain transaction limits.

What Is the Difference Between PayPal and Venmo?

- PayPal is available globally, while Venmo is limited to the US and USD.

- Sending money with Venmo from your linked bank account, debit card, or Venmo account is free of charge. Meanwhile, PayPal charges 2.90% plus a fixed fee depending on the payment’s currency.

- Credit card payments are charged at 3% and 2.90% for Venmo and PayPal, accordingly.

- For peer-to-peer transfers, PayPal sets no limits on total payments but caps the maximum sum of a single transaction at $60,000. Venmo allows verified users to send up to $60,000 per week.

Final Thought

So, which is better, Venmo or PayPal? As you’ve probably figured out by now, it depends from a design and functionality perspective; it’s definitely not so. Affordable fees and a user-friendly app make Venmo a great option for peer-to-peer payments. PayPal, on the other hand, stands out with its smart payment solutions for merchants and growing businesses. The choice of whether to use Venmo or PayPal ultimately comes down to your financial needs.