How Much Are Venmo Transfer Fees: A Complete Guide

If you’re looking for a secure way to transfer money with no fees, Venmo might be just the thing. It’s a peer-to-peer payment system designed to make sending money and splitting bills easy and convenient. It’s owned by PayPal and is used by more than 90 million people.

Unlike most digital wallets, Venmo doesn't charge you for holding an account or sending money to a bank. Now you might wonder, “Does Venmo have a transaction fee?” In this guide, we’ll explain what fees Venmo has, how to calculate them, and whether it is possible to avoid them altogether.

How Venmo Transfer Fees Work

In our previous articles, we’ve already covered some topics on the subject, like what Venmo is and how it works, how to use it, and how to set up your Venmo account. Now, let’s break down the service’s fee structure.

You can make Venmo payments using your bank account, personal Venmo balance, debit card, or credit card. The fees applied depend on the payment method you choose, as well as other factors unique to the service.

Let’s see what types of transfers are available and what fees they entail:

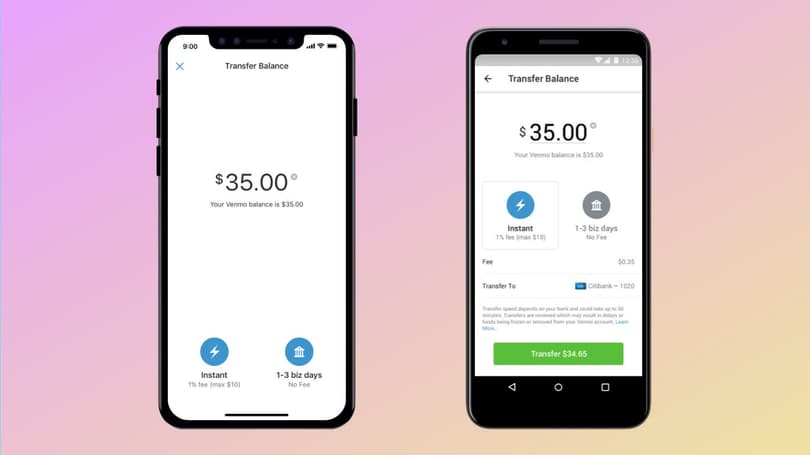

- Instant transfers – 1.75% (minimum fee: $0.25; maximum fee: $25).

- Transfers from a Credit Card to Another User – 3%.

- Standard bank transfers are free, but can take up to 1–3 business days to register.

- Instant Electronic Withdrawals – 1.75% (minimum fee: $0.25; maximum fee: $25).

For transactions involving cryptocurrencies, the fees are based on the amount you purchase or sale. Here’s what you can expect:

Transaction Amount | Venmo Service Fee |

|---|---|

$1–4.99 | 2.2% |

$5–24.99 | 2.2% |

$25–74.99 | 2.2% |

$75–200 | 2% |

$200.01–1,000 | 1.8% |

Over $1,000 | 1.5% |

Venmo prides itself on transparency, so you won’t encounter any hidden fees while using the platform. When any fees are present, users are provided with all the details upfront. The app also offers charge-free basic transactions, including sending and receiving money from your bank account or debit card.

We also have articles on topics like is there a limit on Venmo and how to put money in Venmo on our website.

How to Calculate Venmo Transfer Fees

There are several Venmo transaction fee calculators available for free. If you regularly send money to different accounts or cards, these tools will surely come in handy.

To use a fee calculator, simply input the following details:

- Transaction Type;

- Transfer Amount.

After you’ve entered the necessary data, the calculator will give you the exact sum you’ll be charged for the transaction. As a bonus point, calculating fees in advance will help you stay mindful of your financial life. And if you feel like that side of your life needs more safeguarding, you can read our article on the service’s security measures and find out if people can hack your Venmo.

Strategies to Minimize Venmo Transfer Fees

Looking to minimize your expenses? Take advantage of the proven ways to save on Venmo fees to send money for free.

Avoid Using a Credit Card

The service charges a 3% fee for transactions made with credit cards. Avoid paying interest by using your personal Venmo balance, debit card, or bank account instead.

Use Instant Transfers Only when Necessary

The app charges 1.75% of the total amount for instant transactions, while the usual electronic transfers are processed without fees. Only use instant transfers in emergencies, as this feature can eat up a lot of funds in no time.

Typically, a free transfer takes between one and three business days. IF you opt for an instant transfer, you’ll be charged $0.25–$25 depending on the transaction amount. If you plan to use the service as a payment provider, learn how much does Venmo charge for business.

Cash Checks with the “In 10 Days” Option

Venmo allows you to cash a check by simply taking a photo. There are two options to receive the money into your account:

- Instant deposit (fee applies).

- Deposit within 10 days (free).

Please note that Venmo may decline checks for security reasons. For example, if the check has a recipient other than you or the sum in question exceeds $5,000. In such cases, no fees are charged, since the money will not be credited to your account.

Final Thought

Venmo can be virtually free if you use it wisely. To save money, consider using your Venmo balance, bank account, or debit card for P2P payments, and then cash out with a regular bank transfer, which is typically free but takes a few days. If possible, avoid using a credit card to fund Venmo, and use instant transfers only in emergencies.

Stay mindful of the fees when making business payments. Before confirming a payment, check the fee line on the checkout screen and review Venmo’s current fee table. Policies change, and even small details can affect how much you’ll have to pay.

FAQ

Does Venmo charge fees?

Although there are no Venmo fees to send money, you may be charged a 3% fee for sending a personal payment with a credit card. Also, if you want to cash a check instantly, you’ll be charged 1% for government and payroll checks, and 5% for all other acceptable checks, with a minimum of $5.

How much does Venmo charge for instant transfer?

Venmo instant transfers entail a 1.75% fee, ranging from $0.25 to $25, depending on the transfer amount. If you want to minimize your expenses, opt for a free standard transfer.

Are there Venmo fees to cash out?

You won’t face any Venmo fees when withdrawing your cash as long as you use MoneyPass ATMs. However, if you cash out at an out-of-network ATM, you’ll have to pay a $2.50 fee, plus an extra charge from the ATM’s owner. All non-US ATMs are automatically considered out-of-network. You’ll also have to pay $3 for every withdrawal at a bank counter.

How much can I Venmo at one time?

If you haven’t verified your account, your weekly spending limit is $299.99. You can send no more than this amount per transaction, or throughout the whole week. For verified accounts, you can send up to $5,000 at a time, with a total weekly limit of $60,000.

Can I cancel a personal Venmo payment after I send it?

In most cases, you won’t be able to cancel a Venmo payment, as they’re instant. Your best option is to ask the recipient to return the money and use the “Request” button. However, if the payment is pending and the recipient hasn't joined Venmo yet, you can cancel it from the payment details in the app.