Venmo Transfer Fees: What You Need to Know

The Venmo app is designed for quick social payments and is part of the PayPal ecosystem. The service is top-rated because it ensures the security of its users' data when sending and receiving money. Venmo’s user pool increased by a staggering 50% during the pandemic, which caused a great shift to online payments. Thus, the customer base extended from 41.5 million users in 2019 to 62.6 million in 2020. In 2023, this number exceeded 78 million and it keeps growing.

As such, Venmo has become a ubiquitous tool for peer-to-peer transactions, allowing users to make transactions with just a few taps on their smartphones. It offers its services both to individuals and businesses, providing various transaction options, including transfers to cryptocurrency accounts. However, as convenient as Venmo may be, it still charges various fees for using the platform. So, before starting, regardless of your purpose for using the app, you should explore its financial policies. This way, you can avoid unexpected expenses and other unpleasant situations.

In this article, we will consider how much Venmo charges for transferring money and look into the types of Venmo fees. We will also discuss how to calculate and minimize the cost of services for various transactions and manage your money effectively.

How Venmo Transfer Fees Work

For beginners, we've already explained what is venmo and how does it work, how to use it, and how do you set up venmo in our previous articles.

You can make payments on the Venmo platform using the following methods: bank account, personal Venmo account, and debit or credit cards. You may be charged a fee when transferring funds between your accounts or from one source to another. This may be a flat fee or a percentage of the total amount.

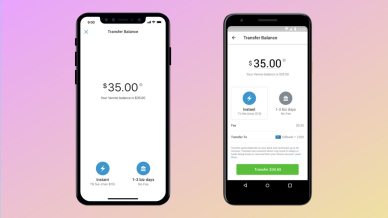

So, does Venmo charge a fee for money transfers? Let's see what types of transfers are available and what fees they entail:

- Instant transfers — 1.75%. The minimum fee is $0.25, and the maximum is $25.

- Transferring money from your own credit card to someone else's account — 3%.

- Electronic withdrawal of funds — 0%.

- Instant electronic funds withdrawal — 1.75%. The minimum fee is $0.25; the maximum fee is $25.

- The merchant fee is 1.9% of the transaction amount. An additional $0.10 is charged to receive funds for services/goods.

For operations with cryptocurrencies, the commission is calculated depending on the total sum of purchases or sales. Read the table to learn more:

Buy/sell sum | Venmo service fee |

$1 – $4.99 | $0.49 |

$5 – $24.99 | $0.99 |

$25 – $74.99 | $1.99 |

$75 – $200 | $2.49 |

$200.01 – $1,000 | 1.80% of the total amount |

$1,000 and more | 1.50% of the total amount |

This fintech app is focused on transparent cooperation with its users, so it charges zero percent for basic transactions, such as sending and receiving money from your bank account or debit card. In other cases, when Venmo transfer fees are mandatory, they are never hidden.

We have separate materials on is there a limit on venmo or how to put money in venmo on our website.

How to Calculate Venmo Transfer Fees

There are various transaction fee calculators with pretty simple functionality to help determine the cost of using Venmo for instant transfers. If you regularly send money to different accounts or cards, these tools allow you to avoid manual interest calculation, saving time.

The calculator has fields where you need to enter the following information:

- Type of transaction;

- Transfer amount.

Once you type the needed info, you will instantly receive an accurate result. Use the calculator to find out how much Venmo transfer fees are. Thus, you will be able to perform any transactions, be confident in the safety of your finances, and know exactly how much you should pay. And for those who are wondering can people hack your venmo, there is a separate article on our website.

Strategies to Minimize Venmo Transfer Fees

Want to minimize the cost of financial transactions made through the app? Take advantage of a few proven strategies to help you save on Venmo fees to send money.

Avoid using a credit card

The service charges a fee for transactions made only via credit card. Thus, you can avoid paying interest when transferring money from your personal Venmo balance, debit card, or bank account.

Use the instant transfers feature only in emergencies

How much does Venmo charge for instant transfers? The app charges 1.75% of the total amount for instant transaction services. But, standard electronic transfers of funds to your account are processed without fees. Use this method if you want to avoid a Venmo instant transfer fee and have the time to wait for your transaction to be processed.

Typically, a free transfer takes between one and three business days. Otherwise, you will have to pay fees ranging from 25 cents to $25 for instant sending and receiving money. Read more about how much does venmo charge for business in our separate article.

Cash checks by selecting the "in 10 days" option

The app allows you to cash your checks by capturing an image. There are two options to receive the money into your account:

- Instantly (in minutes), but with a fee.

- After a certain period (in 10 days) — free of charge.

Please note that for security reasons, Venmo may reject your check. For example, if it has someone else's name or if the amount exceeds $5,000. In such cases, no fees are charged since the money will not be credited to your account.

Conclusion

Venmo is a convenient and secure app for promptly managing your finances and cryptocurrencies. Venmo fees vary depending on the type of transaction. However, the app offers free services to its users. For example, sending and receiving money with a debit card or standard electronic transfers are available to customers without any fees. Depending on your goals, you can choose the most advantageous way to use this fintech solution.

By understanding when fees apply and how much they'll cost, you can make informed decisions about when to use Venmo and when to explore alternative payment methods. Keep an eye on any changes to Venmo's fee structure, and don't hesitate to reach out to Venmo's support team if you have any questions or concerns. Stay updated on the latest developments in the financial technology sector with Rates.

FAQ

What are the fees for using Venmo?

You can use Venmo's services and open your own account on the platform for free. There is also no mandatory monthly maintenance fee for the app. However, you will have to pay for transactions using your credit card or for instant transfers.

What is a seller transaction fee on Venmo?

A Venmo transaction fee for the payment made to your business profile has the standard rate of 1.9% plus $0.10 of the transaction amount.

Does Venmo provide debit cards?

Yes. The service, in cooperation with Mastercard, issues its own debit cards. To do this, you must apply on the official website and confirm your personal data. The card is available to all users completely free of charge. The physical counterpart is delivered to your home address within 10 business days.

What is the transaction fee for Venmo?

Depending on the type of transaction, different fees are assigned. For credit card transactions, it's 3%, and for transferring money instantly — 1.75%. There is no fee for standard transactions with a debit card or a personal account.