What is BNPL (Buy Now, Pay Later): A Complete Guide

Contents

While shopping online, you may have encountered the term BNPL, which refers to a specific way of buying goods. BNPL stands for buy now, pay later. This type of short-term financing allows shoppers to purchase a product online even when they don’t have enough money to make a full payment right away. Along with digital shopping in general, it’s already apparent that the BNPL trend is here to stay.

In this article, you will learn about the BNPL meaning in detail so you know exactly what to expect. This complete guide also includes information on the biggest global vendors, how this type of payment is performed, its advantages, and potential risks.

What is Buy Now, Pay Later (BNPL)?

The pandemic, inflation, and continuing Russia’s war on Ukraine hit the global economy hard. Millions of people faced a critical shortage of income and savings. So, the buy now, pay later alternative became a lifesaver.

What is buy now, pay later? BNPL vendors offer you mostly interest-free short-term loans. You receive a product without paying the full amount upfront but will repay it over time in equal installments.

What does BNPL mean in simple words? The buy now, pay later definition is basically what the name suggests—get it now, pay for it later.

The buy now, pay later credit is still borrowing, but slightly differs from traditional credit cards. BNPL loans usually come without interest fees, unlike usual credits, where you pay interest monthly. However, a necessary condition to avoid fees and charges in BNPL is to pay back the borrowed sum on a date scheduled in an agreement with your provider. Plus, third parties carry out your BNPL plan, not your bank or retailer, but the remaining installments will be charged from your card or bank account.

Top 5 BNPL Service Vendors Globally

1. Klarna (Sweden)

One of the BNPL pioneers that works with 150M+ customers and 500K retail partners globally. It offers four payment plans with flexible conditions. The late payment fee is up to $7. Hard credit score checks are possible for big loans.

2. Afterpay / Clearpay (Australia)

Another BNPL pioneer owned by Square (Block). Partners with 100k+ retailers and operates globally under the pay-in-4 interest-free plan you must complete in 6 weeks. Late fees can hit up to 25% per each item’s price.

3. Affirm (US)

An AI-powered BNPL vendor that partners with giants like Amazon and Walmart, among other 235K retailers. Serves 31M+ US consumers with pay-in-4 biweekly plans and interest-free monthly installments. No prepayment or late payment fees. By the way, the answer to the question can I use Afterpay on Amazon is yes, and you can learn more in our article about it.

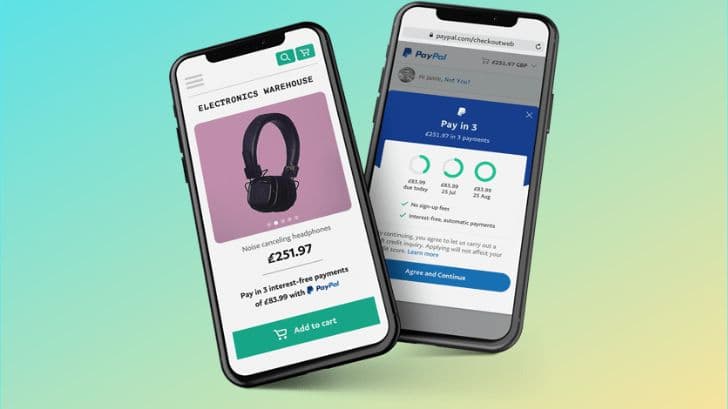

4. PayPal (US)

Partners with 30M+ merchants and offers proprietary interest-free loan service Pay in 4 and monthly payment plans. There are no late payment fees. Six, 12, and 24 timeframes come with 9.99% to 29.99% APR.

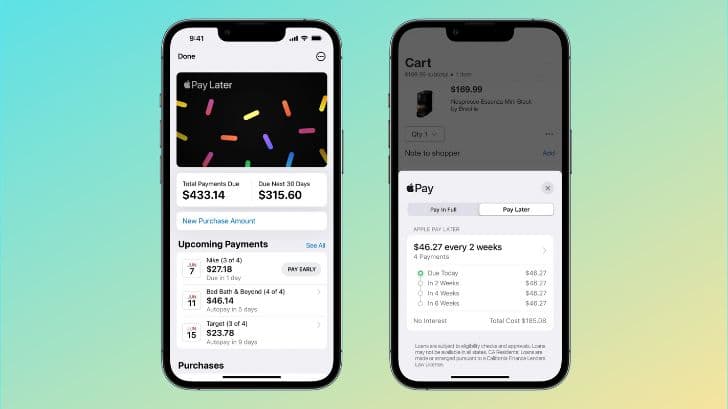

5. Apple Pay Later (US)

Works online and via the Wallet app as a part of the Apple Pay service. The pay-in-4 plan has no interest or fees if you pay it off over six weeks. You also must be 18+ years old and link an Apple Pay Later plan to your debit card.

Now, how does BNPL work in real life? Let’s see.

How Buy Now, Pay Later Works in 5 Steps

Using the best buy now pay later apps you always know your fixed installment schedule, credit limits, and payment amounts in advance. What else is there? BNPL: How does it work for customers and retailers?

1. Register with a BNPL company

Check what vendors offer their services to your chosen store and prepare your account beforehand. Another option is to proceed with the registration at checkout.

2. Select the buy now, pay later option

Choose to pay with BNPL in the payment methods. You’ll be redirected to your vendor's resource to register or log in. Link your credit or debit card to the buy now, pay later service or request a virtual card.

3. Pick an installment plan

Select a BNPL repayment plan and complete the purchase by agreeing to the terms and conditions. Next, the provider will run a credit history check on you with approval criteria varying from firm to firm.

4. Receive your loan

Once approved, you get your BNPL credit. Make sure you have enough money to make the first small installment instantly. Meanwhile, your merchant receives the total sum upfront from the BNPL company minus any applicable fees.

5. Repay the debt

Keep up with your payment schedule and transfer regular installments to your buy now, pay later company. Sometimes, you can ask for prolongation if you need more time to pay off, which usually results in interest fees.

3 Key Advantages of Buy Now, Pay Later for Businesses and Consumers

Most common pros of using BNPL for customers:

- Ability to split high prices into smaller installments. You sleep better when you know how regularly you must pay. Also, with BNPL loans, you can buy multiple products urgently.

- Interest-free and custom payment plans. As long as you pay on time, there are no fees, and you can select a tailored payment plan that suits your goals.

- Instantly approved loans. With softer credit history checks, you can make purchases immediately, even with stores’ POS.

Potential Risks and Challenges of BNPL

A coin always has two sides. Here is another one:

- Vague laws and regulations. The BNPL market is mostly unregulated, so you should expect low customer protection. We recommend checking the repayment terms and stores’ return policies before using loans.

- Missed payment deadlines. BNPL vendors might approve your credit even when you can’t afford it. So, be extra careful to avoid overspending. All late payments are recorded, so set your calendar reminders to control payment deadlines.

- Effect on your credit score. If you fail to pay for over 90 days, you’re reported to lenders and credit bureaus and may face a ‘default’ that will affect your credit history for six years. If a BNPL vendor doesn’t report your successful loan to credit companies, it won’t help you improve your credit history either.

Conclusion

So, we've answered the question, "Buy now, pay later: how does it work?" It's another form of short-term credit with more appealing yet imperfect conditions for consumers and merchants alike. What's next for the BNPL market? Kaleido Intelligence forecasts global BNPL spending to hit $760 billion in 2025. The sector will be under scrutiny in terms of international regulatory policies, but it's here to stay since it offers a smooth checkout experience and financial inclusivity. What it means for retailers is that if you don't provide BNPL options to your customers, your competitors will.

FAQ

Why is BNPL risky?

Loans are risky even if you borrow from a friend. BNPL is unsafe and costly because you can quickly get into too many credits you can’t afford to pay off on time. This debt-related issue will damage your credit score. The other reason is that your buy now, pay later purchase isn’t protected by the FCA.

Is PayPal a BNPL company?

Yes, PayPal is an example of a BNPL that stands out. It’s one of the most popular vendors globally. The Ascent’s report says 53% of users name PayPal as their go-to BNPL service. PP is convenient and affordable, but coupled with the fee-free buy now, pay later payment method, it just wins the market.

How do I choose the best buy now, pay later provider?

In the “What is BNPL?” section of this guide, we explained that it’s a loan you must repay in a limited time. So, when selecting a vendor, study all terms and conditions offered to you as a consumer or a merchant. Check how it works, what the consequences of failing to pay are, and what fees or charges you face.