What is Google Pay and How Does it Work?: A Full Guide

While it will probably take years, digital wallets seem on their way to someday replace physical credit or debit cards. Nowadays, many people switch to using mobile payment solutions, but you may still wonder—what is Google Pay, and how does it work? With the help of Google Pay, you can make payments both in online and offline stores, and that makes it so convenient.

If you are interested in how GPay works, you will learn about its features, advantages, and demerits here and discover steps to get started.

GOOGLE PAY: HOW DOES IT WORK?

Nowadays, there is rarely a user who is unfamiliar with Google Pay and does not know what it is. However, some simply aren't interested in financial technology. So, let’s start with the Google Pay definition. So, Google Pay: What is it?

Google Pay is a multifunctional platform that combines a payment aggregator, digital wallet, and money transfer service. The latter feature is available in a few regions (India and the USA), but it's being tested in Europe and several other countries.

The advantages of Google Pay include:

- High level of payment transaction security.

- Encryption of payment data (replacing card numbers with virtual ones).

- Support for NFC (Near Field Communication).

- Integration of loyalty cards, transportation cards, discount programs, and more.

- Ability to transfer funds through QR codes, NFC, email addresses, and phone numbers.

- Compatibility with all current devices and web platforms.

We could go on and on with examples of the benefits of using this solution, but today, let’s focus on understanding the main topic: “Google Pay: What is it, and how does it work?” We’ll move on to the basic settings to help you utilize the platform effectively.

Getting Started with Google Pay

So, how does GPay work? Unlike other popular payment platforms, Google Pay doesn't restrict you to specific systems or banks. This fintech solution operates in over 30 countries worldwide without limitations on the type of cards or their usage algorithms.

To get started, you need to follow a few simple steps:

- Create a Google account.

- Provide your personal information and phone number.

- Verify your data.

- Download the Google Pay app on your smartphone from the Google Play Store.

- Add your card.

The last step may raise some additional questions, so let's take a closer look at it and understand how paying with Google Pay works. To add your card:

- Log in to your banking app and navigate to the card menu (or just physically have your card nearby).

- In the Google Pay app, tap "Add" or the plus sign, and select the card type (in this case, it's a payment card).

- Next, you can manually enter your card details (card number, expiration date, and CVV/CVC code) or scan your card using your device's camera.

- Depending on the bank that issued your card, you may need to confirm your identity through an SMS or messenger code, a phone call, or the financial institution's app.

- Your payment method will appear in the app’s menu. Don’t forget to activate NFC if you use it for single purchases at POS terminals.

Now you know what Google Pay does and how to set up the system for mobile device usage. Next, we'll explore the platform's features and its additional capabilities.

How Google Pay Works

Given how Google Pay functions, you can use the platform in several typical scenarios. For example:

- Pay online in stores, services, or mobile apps.

- Conducting direct money transfers to friends or family.

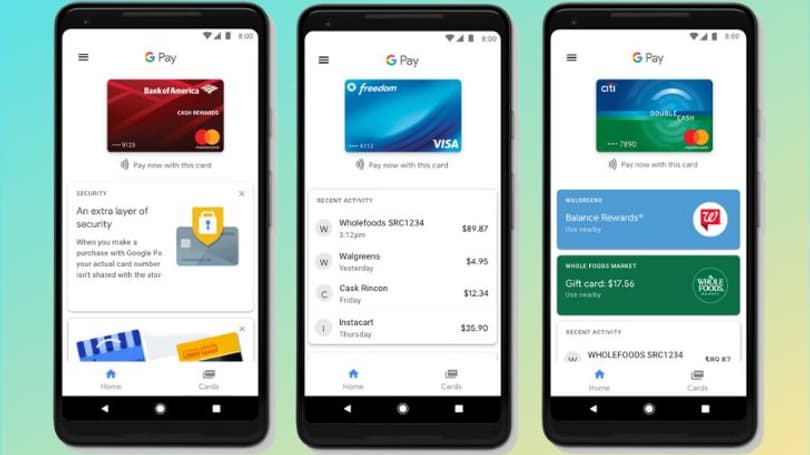

- Storing multiple payment methods in the app and switching between them as needed.

- Adding transportation cards, bonus codes, discount coupons, personal programs, and other types of cards.

- Automating payments for services or goods (subscription-based model).

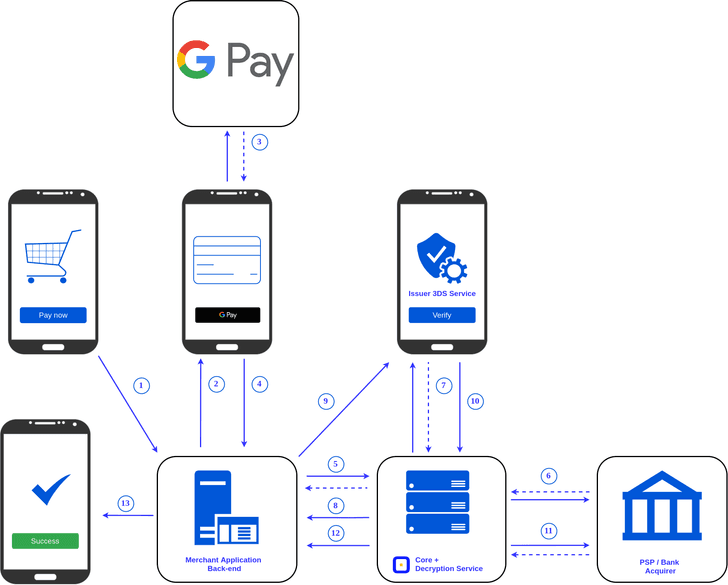

As for offline purchases, Google Pay provides a convenient way to pay for goods and services. By utilizing NFC technology, your smartphone establishes a secure peer-to-peer connection while simultaneously verifying the POS signature and validating the recipient of the funds. Consequently, if the authentication fails, the transaction is canceled.

The Google Pay app operates on up-to-date versions of Android (starting from version 9). It is available on the Google Play Store for all compatible devices. However, please note that you'll need an NFC module to fully utilize the app, which is not present in all models. HUAWEI (and Honor) devices do not support Google services, so Google Pay won't work on them either.

Security and Privacy

Now, it’s time to find out, “What does Google Pay do to protect your personal data?” In addition to the traditional KYC policies, 3D Secure algorithms, and recipient verification, Google Pay offers a range of effective solutions that further protect your finances from fraudsters. For example:

- The physical (or digital) card number is concealed, and an emulated set of digits is used instead.

- Secure protocols and encrypted communication channels are used for online payments, preventing interception of payment data.

- The NFC system (for offline payments) acts as a gateway and verifies the recipient of the funds.

- Additional authentication algorithms are employed for fund transfers, preventing unauthorized access to your finances.

- The system does not transmit bank account or credit card data to the recipient, reducing the risk of potential manipulation.

Furthermore, you can enhance transaction security by enabling two-factor authentication on the app and setting limits for card usage directly within your banking system.

Now, you have a better understanding of Google Pay and how it works. Let's explore its features and services.

Features and Services

Google is an international solution that supports most languages worldwide and works with all major platforms. Wherever you are, chances are you can avail yourself of the company's services:

- The ability to pay with cards at compatible POS terminals (with real-time currency conversion).

- Support for almost all major currencies and their conversion at the International Bank's current exchange rate.

- Interface translation into over 100 languages.

- Seamless integration with other Google products and systems.

- Support for digital cards issued by mobile banks or other financial providers.

Therefore, regardless of where you reside or travel, you will always have access to your primary payment method.

Conclusion

Now that you know the answer to the question, "How does Google Pay work?" you understand why this system is so widely adopted worldwide. Reliability, convenience, and multifunctionality are the key advantages of Google Pay that set it apart from other modern payment systems.

Whether you want to make purchases in stores, pay online, or send money to acquaintances, install and set up Google Pay to forget the hassle of dealing with multiple third-party apps for different tasks.

FAQ

How do I use Google Pay?

Register an account, install the app on your mobile device, and add your payment card. Sync the data, enable NFC, and enjoy fast and secure purchases.

How does the Google Pay payment system work?

You add your card details to the app, which encrypts them and relies on virtual information for transactions. It utilizes both standard protocols and algorithms, as well as external systems.

Is Google Pay like PayPal?

No, not exactly. The system’s purpose is to facilitate direct payment for goods or services. The money transfer service is a secondary feature currently being actively tested.

Can I use Google Pay without a bank account?

You don't need a bank account to use Google Pay. However, you will need a payment card; obtaining one without a bank is nearly impossible. So technically, you don't need an account, but practically, it is indeed necessary.

What is GPay, and how does it work?

A Google Pay account is your account for all the services within the platform. It allows you to authenticate on resources and make payments for goods or services.