What is PayPal, and How Does it Work?

Contents

It’s hard to imagine our world without online banking. Despite the technology being only a few decades old, whole industries are now completely dependent on their clients' ability to send money without leaving the comfort of their homes. PayPal is one of the leading players in this market, providing users worldwide with an almost indispensable tool for managing their finances.

Whether you want to purchase a product in an online store, receive compensation for your work as a freelancer, or send the money you owe to a friend, PayPal can do it all and more. The service has been around for years and is known for its reliability.

Join us as we explore PayPal in more nuance. What is it, and how does it work? In this guide, we’ll cover all you need to know about this payment platform.

What is PayPal?

The PayPal payment platform is a digital service that handles online payments for individuals and businesses. It is accessible via a website and a dedicated mobile app, and its main advantage is that you won’t have to share bank or card details every time you make a transaction. The platform was created to make online payments faster, safer, and easier, and has achieved notable success in fulfilling this lofty goal. With over 438 million active accounts, PayPal stands out as one of the most trusted online payment systems. It boasts advanced encryption, two-factor authentication, strong purchase protection policies, and reliable fraud prevention tools.

How Does PayPal Work?

On a basic level, PayPal functions as a digital wallet and acts as an intermediary between your bank account and that of the recipient. While it may seem like an unnecessary extra step, there are quite a few benefits associated with having this extra middleman in place. PayPal offers a host of additional features such as invoicing, integration with e-commerce platforms, and more. The service also has a protection program for both buyers and sellers, and has gained quite a popularity as a payment processor because of that.

To start sending and shopping with PayPal, you’ll need to set up an account and connect it to a debit or credit card or a bank account. Actually, you don’t have to keep money in your PayPal, as the service can simply pull funds from your bank or card whenever needed. However, when someone sends you funds or you receive payments for goods and services, the money will be deposited directly into your PayPal balance.

Another good thing about PayPal is that it offers currency conversion, making it even more suited for online shopping. Just stay mindful of the fees it charges! There may also be situations when you need to know how to cancel a PayPal payment to get your money back, which we discussed in a separate article. But for now, let's go deeper into the main question: what is a PayPal account, and how does it work?

What are the different PayPal accounts?

Basically, PayPal offers only two account types, including personal and business accounts, with some subtypes inside each broader category.

Personal Account

This is the most common type of account designed for online purchases, money transfers in PayPal Friends and Family, and receiving payments from abroad.

What is a PayPal Premier account? It’s an upgraded version of the standard one, with a number of additional features, such as the ability to accept payments from any source (e.g., credit cards) rather than just other PayPal accounts. As such, it’s a great option for managing low-volume online stores without having to maintain a full-scale business account. Though still supported for existing Premier users, this account type is currently being discontinued and is no longer available for purchase.

Business Account

This type of account is specifically meant for online merchants, enabling them to receive payments under a business name, use invoicing tools, integrate with e-commerce platforms, and analyze their performance.

Nonprofits registering with PayPal and confirming their status will get access to perks like donation buttons, fundraising tools, and fee-free transfers.

Once you learn more about PayPal limits, it will be easier for you to control your expenses.

How does paying with PayPal work?

Now that you have a basic idea of how PayPal functions, you probably wonder how you can start using the service. It’s quite easy, and can be done in just a few simple steps:

Create a PayPal Account

First, let's take a detailed overview of how to create a PayPal account.

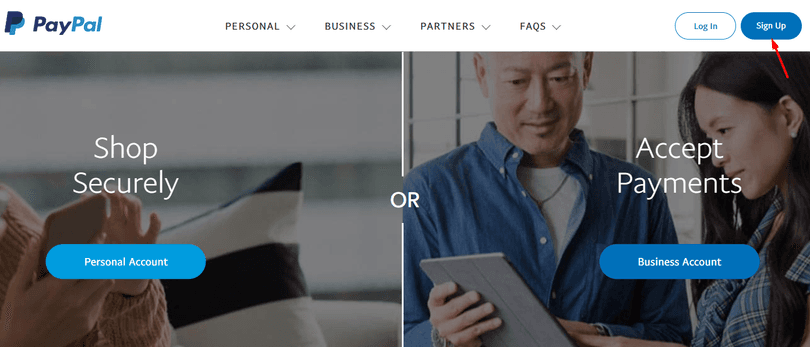

- Visit the PayPal website and click on "Sign Up" or "Create Account."

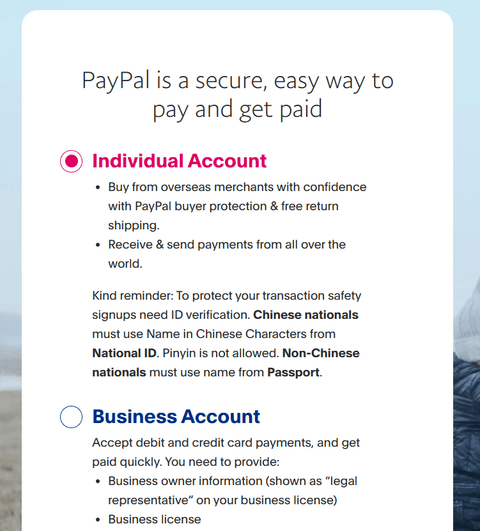

- Select the account type (Personal or Business) and enter your personal information as prompted.

- Select your country and enter all the personal data required (email, phone number, and address).

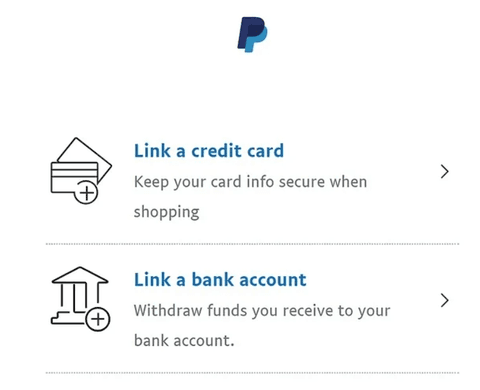

- Link your bank account, credit card, or debit card to your PayPal account.

Select PayPal as the Payment Method

- When making a purchase on a website or in an app, proceed to the checkout page.

- If the merchant accepts PayPal, you can set it as your preferred method of payment.

Confirm the Payment Details

- Check all the transaction details — the sum, shipping address, and don’t forget about PayPal fees.

- Once you’re sure the information is accurate, click "Continue" or "Pay Now."

Choose a Funding Source

- If you have several payment methods (bank account, credit card, etc.) linked to your PayPal, you’ll be asked to choose which one will fund the payment.

Complete the Payment

- After reviewing all the transaction details, click "Continue" or "Pay Now" to finalize the payment.

- PayPal will process the payment and send a notification to the merchant, confirming the transaction.

Confirmation and Receipt

- Once your transaction is processed, you will receive an SMS or email confirmation from PayPal.

- The merchant will also provide a receipt or confirmation of your purchase.

PayPal Transaction Fees and Costs

Online purchases and domestic PayPal online payments to family and friends are free as long as you use your PayPal balance or a linked bank account. The same is true for receiving money from individuals domestically. However, most other PayPal transactions entail fees that the service uses to cover operational costs. Those fees differ by country and region, account type, and transaction type.

Let’s take a look at the most common PayPal fees and charges for the US market.

Transaction type | Fee | Details |

|---|---|---|

Sending money to family and friends domestically | Free | If you’re using a PayPal balance or a bank account |

2.90% + fixed fee | If using a debit or credit card | |

Sending money to family and friends internationally | 5% | This is charged in addition to the applicable domestic transaction fees |

Receiving money for goods and services | 2.99% | For domestic transactions |

2.99% + 1.50% | For international transactions | |

Standard transfer from PayPal balance to a bank account or card | Free | 1–3 business days |

Instant transfer | 1.75% | min $.025 and max $25.00 |

Currency conversion | 3–4% | Depending on the transaction |

Comparison of PayPal with Alternative Payment Systems

What is PayPal known for? As one of the biggest names in the industry, the service is renowned for its wide reach, strong security features, and ease of use. Let’s see how it compares to other popular payment services. Stripe, Square, and Payoneer are the most successful PayPal competitors at the moment. There are more PayPal alternatives for business, but we’re gonna focus on just these three.

PayPal vs. Stripe

Stripe and PayPal are both popular online payment systems, but they are designed with different audiences in mind.

PayPal has an established reputation; it offers a user-friendly interface, global reach, and a good range of payment options. This system is widely recognized and trusted by customers worldwide.

Stripe, on the other hand, focuses on providing developers and businesses with a robust set of tools and APIs for payment integration. It has extensive customization options and is known for its developer-friendly features.

While PayPal is great for smaller businesses, occasional online sellers, and freelancers, Stripe is ideal for developers, growing e-commerce businesses, startups, or global operations that require customization and scalability.

PayPal vs. Square

The main difference between PayPal and Square is that the latter focuses more on the physical side of things, going as far as offering businesses dedicated hardware.

PayPal, being an established payment giant, offers a comprehensive range of features, including invoicing, international transactions, and integration with popular e-commerce platforms. However, PayPal international fees are on the higher end of the typical price range.

Square specializes in providing payment solutions for small businesses and entrepreneurs, particularly those dealing with a lot of in-person transactions. Square offers hardware options like card readers and point-of-sale systems, which is great for businesses that rely on face-to-face payments.

While choosing between PayPal and Square, consider the nature of the business: whether it operates primarily online or has a physical presence.

PayPal vs. Payoneer

Both Payoneer and PayPal offer global payments, but cater to different user needs.

PayPal focuses on providing a wide range of payment solutions, buyer/seller protection, and integration options for online transactions. It is recognized worldwide and offers a user-friendly experience.

Payoneer specializes in cross-border payments and provides services for freelancers, e-commerce sellers, and global businesses. It offers lower transaction fees, competitive exchange rates, and convenient withdrawal options for local bank accounts. Payoneer's strength lies in its dedicated solutions for specific user groups and its strong customer support.

Stay with PayPal for smaller, simpler, occasional payments. Go for Payoneer if you are a freelancer, contractor, or business receiving frequent international payments in different currencies.

Conclusion

Now that we've answered the questions of ‘What is PayPal and how does it work?’ it is time to sum things up. PayPal has emerged as the dominant force in the modern digital world, revolutionizing the way we conduct online transactions. With its convenience, global accessibility, and support for both individuals and businesses, PayPal has become an integral part of the digital environment as it is today.

As the digital landscape continues to evolve, PayPal remains at the forefront, adapting to new technologies and offering innovative features to meet the changing needs of its users. With its commitment to security, convenience, and seamless integration, PayPal continues to shape the future of online financial transactions. Why use PayPal instead of a similar service? It all depends on your needs, but the platform is undoubtedly a great choice for personal use.

Consider Rates as Your Trusted Partner

Rates.fm is a financial tool that allows users to compare the exchange rates of various organizations. Our user-friendly website dynamically updates information and provides users with a selection of exchange rates for their location.

By choosing us, you get:

- Comparability: compare financial products from different companies and find the best deal.

- Transparency: get clear and concise information about each financial company to make an informed decision.

- Convenience: seamless navigation and a set of handy tools make it easy to find the best deals on the market.

Don't waste your money on pricey exchangers; visit Rates and find the one that suit your needs.

FAQ

What is PayPal, and how do I use it?

PayPal is a widely known online payment platform for sending, receiving, and managing finances. To use PayPal, you must create an account and link it to your bank account or a credit/debit card. Then, you can make online purchases, receive payments, and send money almost anywhere in the world.

What is a PayPal account?

A PayPal account is an online financial account that allows users to send, receive, and manage their funds. It serves as a digital wallet, and can be connected to bank accounts, credit cards, and debit cards.

What is a PayPal account for?

A PayPal account is used for secure online transactions. With a PayPal account, you can make online purchases, receive payments in PayPal Goods and Services, send money to other users, and transfer funds to your linked bank account or cards.

What type of account should I use for my PayPal?

Consider your financial needs. If you only need to send and receive money from friends and relatives, the Personal account will be more than enough. If you’re a business owner or a freelancer, consider opening a Business or Premier account, as they provide more analytical and management features.

What is my PayPal credit account number?

Your PayPal account doesn't have any IDs or credit numbers. Instead, the platform uses your Email address as an identifier, and that's all you need to provide the sender to receive money from them.