What is PayPal and How Does it Work?

Welcome to the world of online payments, where accessible and convenient online shopping and money transfers are possible. PayPal is one of the leading players in this market, providing users worldwide with a convenient and almost indispensable tool for managing their finances.

Whether you want to purchase a product in an online store, receive money for your work as a freelancer, or send the money you owe to a friend, PayPal can be a single stop for all the mentioned situations. The service has been around for years and is known for its reliability and safety.

Join us as we explore PayPal — what is it, and how does it work? In our what is PayPal guide, we’ll cover the basics of what you need to know about this payment platform.

What is PayPal?

PayPal, what is it exactly? It is a secure payment platform that enables payments between people and businesses via a website or mobile app. With over two decades of experience, it has become widely recognized in the digital payment industry.

But what is so special about PayPal?

How does PayPal Work?

PayPal acts as an intermediary, allowing people to securely send digital payments and transfer money between individuals and businesses. It provides a user-friendly platform, robust security measures, and additional features such as invoicing, integration with e-commerce platforms, and much more. Another good thing about PayPal is that it offers a currency conversion service, but you should be aware of fees before using the feature. There may also be situations when you need to know how to cancel a paypal payment to get your money back. But now, let's go deeper into the question, "What is a PayPal account, and how does it work?"

What are the different types of PayPal accounts?

To start working with PayPal, you need to create an account — a sort of online wallet. Depending on your needs and preferences, you can choose from several types of different PayPal accounts:

Personal Account

This is the most common type of account designed for people to make online purchases, conduct money transfers in paypal friends and family, and receive payments. It allows users to link their bank accounts, credit cards, or debit cards to their PayPal accounts.

Business Account

PayPal account, what is it offering for businesses? Using this type of account, you can receive payments under a business name, access invoicing tools, integrate with e-commerce platforms, and analyze your finance activities more deeply.

Premier Account

Some people interested in the payment service may also wonder, ‘What is a PayPal premier account?’ To put it simply, it is an upgraded version of the standard account. Because of the number of convenient features, such as the ability to accept payments from any source (e.g., credit cards), not just another PayPal, a premier account is suitable for those who own a small business or sell services or products on a regular basis, making shopping with paypal convenient and easy.

PayPal for Nonprofits

According to PayPal, nonprofit organizations deserve special attention. This type of account can be of use to eligible nonprofit organizations with donation buttons, fundraising tools, and discounted transaction fees.

PayPal for Students

What does PayPal do for students to make their financial life more convenient? Well, despite being called “for students”, this type of account is designed for parents or other family members to set spending paypal limits and monitor transactions for their student account holders.

How does paying with PayPal work?

Now that you have a basic idea about PayPal, you probably wonder how you can start using the service. There are only a few simple steps that you need to take:

Create a PayPal Account

First, let's take a detailed overview on how to create paypal account.

- Visit the PayPal website and click on "Sign Up" or "Create Account."

- Select the account type (Personal, Business, etc.) and follow the prompts to enter your personal information.

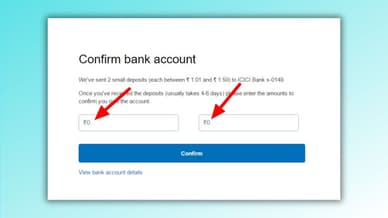

- Link your payment information, such as your bank account, credit card, or debit card, to your PayPal account.

Select PayPal as the Payment Method

- When making a purchase on a website or app, proceed to the checkout page.

- Look for the payment options and choose PayPal as your preferred method of payment.

Confirm the Payment Details

- Check all the transaction details — the amount of money, shipping address, and paypal fees.

- Ensure the information is accurate and click on "Continue" or "Pay Now."

Choose a Funding Source

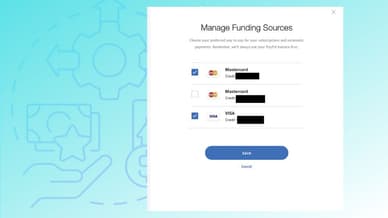

- If you have multiple linked payment methods (bank account, credit card, etc.), select the desired source for funding the payment.

Complete the Payment

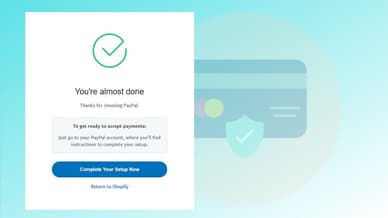

- When you finish adding all the transaction details, click "Continue" or "Pay Now" to finalize the payment.

- PayPal will process the payment and send a notification to the merchant, confirming the transaction.

Confirmation and Receipt

- After the transaction is finished, you will receive an SMS or email message from PayPal.

- The merchant will also provide a receipt or confirmation of your purchase.

Comparison of PayPal with Alternative Payment Systems

Now that we have the answer to ‘What is PayPal known for?’, it is also a good idea to compare it with several other widely used payment services. Some well-known competitors of PayPal include Stripe, Square, and Payoneer. Below you can find these main paypal alternatives for business that you can use for your own purposes.

PayPal vs. Stripe:

Stripe and PayPal are both popular online payment systems, but they have distinct features and serve different user needs.

PayPal has an established reputation; it offers a user-friendly interface, global reach, and a range of payment options. This system is widely recognized and trusted by customers worldwide.

Stripe, on the other hand, focuses on providing developers and businesses with a robust set of tools and APIs for seamless payment integration. It offers extensive customization options and is known for its developer-friendly features.

The choice between PayPal and Stripe depends on factors such as the level of customization required, the target audience, and the specific needs of the business or website.

PayPal vs. Square:

When comparing PayPal and Square, both platforms offer online payment solutions, but they have different focuses and strengths.

PayPal, being an established payment giant, offers a comprehensive range of features, including invoicing, international transactions, and integration with popular e-commerce platforms. You need to understand that paypal international fees depends on the country of the sender and recipient. It is suitable for businesses of various sizes and industries.

Square specializes in providing payment solutions for small businesses and entrepreneurs, particularly those with in-person transactions. Square offers hardware options like card readers and point-of-sale systems, making it convenient for businesses that require face-to-face payments.

While choosing between PayPal and Square, consider the nature of the business, whether it is primarily online or has a physical presence, and the specific payment needs.

PayPal vs. Payoneer:

Payoneer and PayPal cater to different aspects of global payments.

PayPal focuses on providing a wide range of payment solutions, buyer/seller protection, and integration options for online transactions. It is recognized worldwide and offers a user-friendly experience.

Payoneer specializes in cross-border payments and provides services for freelancers, e-commerce sellers, and global businesses. It offers lower transaction fees, competitive exchange rates, and convenient withdrawal options for local bank accounts. Payoneer's strength lies in its dedicated solutions for specific user groups and its strong customer support.

The choice between PayPal and Payoneer depends on factors such as the type of business, the need for cross-border transactions, and the level of integration and customer support required.

Conclusion

Now that we've answered the questions of ‘What is PayPal and how does it work?’ it is time to sum things up. PayPal has emerged as a dominant force in the digital world, revolutionizing the way we conduct online transactions. With its ability to facilitate secure and convenient payments, global accessibility, and support for both individuals and businesses, PayPal has become an integral part of the modern digital environment.

It empowers businesses and consumers with a trusted and efficient payment solution. As the digital landscape continues to evolve, PayPal remains at the forefront, adapting to new technologies and offering innovative features to meet the changing needs of its users. With its commitment to security, convenience, and seamless integration, PayPal continues to shape the future of online financial transactions. So when you ask yourself why use paypal for your needs, and whether it's worth it, the answer is obvious.

Consider Rates as Your Trusted Partner

Rates.fm is a financial tool that allows users to compare the exchange rates of various organizations. Our user-friendly website dynamically updates information and provides users with a selection of exchange rates depending on the city.

By choosing us, you get:

- Comparability: compare financial products from different companies and find the best deal.

- Transparency: get clear and concise information about each financial company to make an informed decision.

- Convenience: seamless navigation and a set of handy tools make it easy to choose between the exchangers to find the best deal on the market.

Don't waste your money on pricey exchangers; visit Rates and find the ones that suit your needs.

FAQ

What is PayPal, and how do I use it?

PayPal is a widely known online payment platform for sending, receiving, and managing users' finances. To use PayPal, you create an account and link it to your bank account or cards. Then, you can make online purchases, receive payments, and send money to others through email or mobile numbers.

What is a PayPal account?

A PayPal account is an online financial account that allows users to send, receive, and manage money securely over the Internet. It serves as a digital wallet, connecting to bank accounts, credit cards, and debit cards.

What is a PayPal account for?

A PayPal account is used for secure online transactions. With a PayPal account, you can make online purchases, receive payments in paypal goods and services, send money to others, and transfer funds to your linked bank account or cards.

What type of account should I use for my PayPal?

You should consider your needs. If you only need to send and receive money from friends and relatives, the Personal account will be more than enough. If your needs go beyond that — you're a business owner or a freelancer, consider opening a Business or Premier account, as they provide more analytical and managing features.

What is my PayPal credit account number?

Your PayPal account doesn't have any IDs or credit numbers. Instead, the platform uses your Email address as an identifier, and that's all you need to provide the sender to receive money from them.