Zelle Scams: How to Use the Payment App Safely and Securely

Using a mobile app to send and receive money from friends and family or to pay for products and services online has become second nature for most of us today. Online payment services like Zelle have gained immense popularity thanks to their unmatched convenience. However, having your finances at your fingertips also increases the risk of scams and fraudulent activities. For instance, as Zelle has grown in popularity, various criminal activities on the platform have unfortunately followed.

How safe is Zelle? In this guide, we’ll shed light on the potential risks associated with using the service and offer practical tips and steps to help you safeguard against the dangers of using Zelle.

Most Common Zelle Scams

Zelle scams are deceptive tactics fraudsters use to trick users into sending money through the payment app. Scams through Zelle often employ loopholes in Zelle’s transaction process or prey on users’ trust.

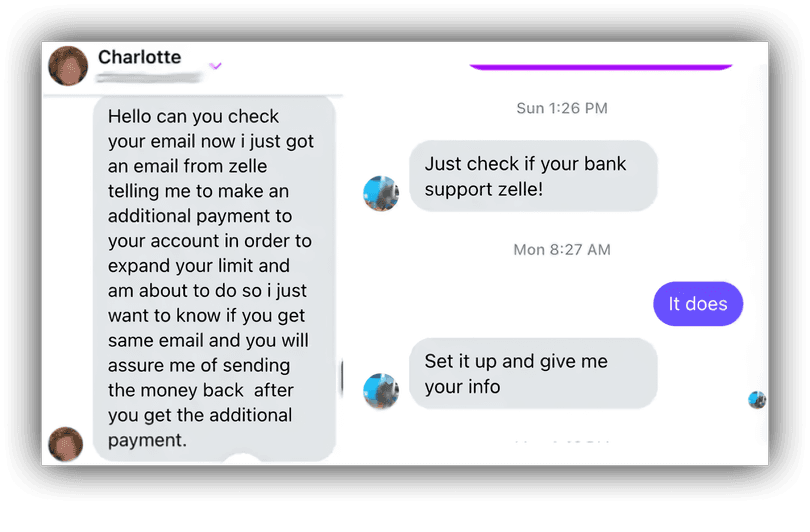

Can someone hack Zelle? Fraudsters tend to take advantage of Zelle's features, including instant transfer features, user-to-user operations, and the perceived security associated with bank-affiliated payment systems. Scammers often create a sense of urgency or credibility to pressure users into making quick decisions.

Besides, scammers frequently impersonate legitimate entities or leverage social engineering tactics to build trust with their targets. They fabricate convincing stories or assume false identities to trick users into parting with their savings.

A key risk is that Zelle transactions are irreversible, which amplifies the risk and severity of financial losses in case of fraud. Plus, the anonymous nature of these transactions makes it really tough to track down scammers or recover stolen funds, with no guaranteed Zelle scam refund in place.

How safe is Zelle to use, though? Here are some of the most common Zelle payment scams to watch out for:

1. Fake Purchase or Sale

Scammers pose as legitimate sellers on online marketplaces, social media platforms, or ad websites. They offer tempting deals on items such as electronics, tickets, or other high-demand products. Once a buyer expresses interest, the scammer pushes for payment via Zelle, citing convenience or a need for immediate funds in the full amount. After the buyer makes a payment, the fake seller disappears without delivering the promised item.

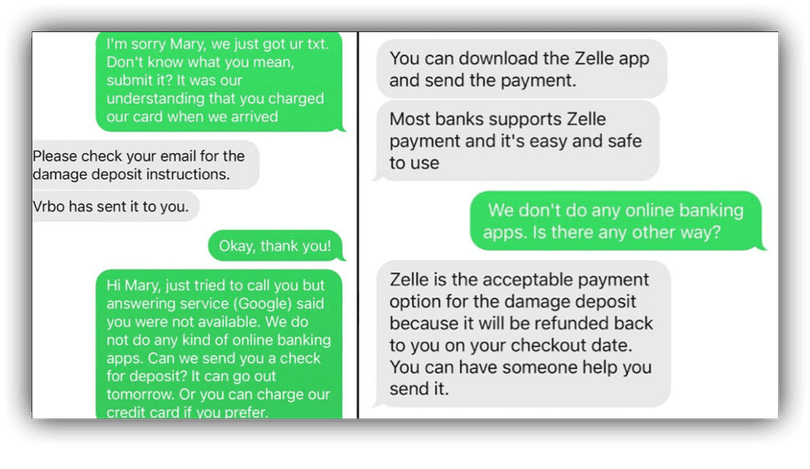

2. Rental Scams

Impostors often target individuals searching for rental properties. Using stolen photos and descriptions, they post fake listings on rental websites or online marketplaces. After gaining the victim’s trust, the scammer requests a deposit or advance rent payment through Zelle. Subsequently, the victim later discovers that the rental property either doesn’t exist or is not owned by the scammer.

3. Phishing Scams

Phishing attacks involve fake messages or emails that appear to come from the Zelle service. They typically request users to provide sensitive information, such as login credentials or verification codes, under the guise of account security or verification purposes. Once the scammer obtains the data, they can access the victim’s Zelle account and withdraw their funds.

4. Romance Scams

Scammers set up fake profiles on dating sites or social media to spark up romantic connections with unsuspecting victims. As the swindler builds trust and gets closer to the victim, they cook up a story about a financial emergency or hardship, asking for help via Zelle safe payment. Once the funds are sent, the scammer vanishes, leaving the victim emotionally and financially drained.

How to Avoid Zelle Scams: Tips for Safe Use

On reading the previous section, you might be wondering, “Is Zelle safe to use?” While no payment system is entirely fraud-proof, Zelle remains a safe and reliable payment service, provided you use it wisely. Not to get scammed, it’s important to stay on guard and prioritize security. By digging into how scammers operate and getting familiar with common schemes, you can steer away from falling into their traps. Here are a few practical tips that can help you dodge potentially risky situations.

- Verify Recipient Information: Always double-check the recipient’s identity to avoid sending cash to the wrong person. Likewise, verify the identity and legitimacy of anyone who contacts you for payments.

- Use Trusted Contacts: Whenever possible, limit Zelle transactions to trusted contacts such as friends, family, or reputable businesses. Try to stay away from unfamiliar individuals or entities.

- Activate Two-Factor Zelle Authentication (2FA): Many banks and financial institutions offer 2FA options for Zelle transactions. Enable this feature to better secure your Zelle account.

- Watch for Phishing Attempts: Be cautious of unexpected messages or emails asking for your personal or financial information. Real companies will not request sensitive details this way.

- Educate Yourself: Stay informed about common fraud tactics targeting Zelle users. Knowledge is your best defense against scammers.

If you encounter any issues or suspect fraudulent activity on your Zelle account, report it immediately to Zelle or your bank support team to protect your funds and report safety issues.

Conclusion

Is Zelle safe? While the platform rolls out robust security and protection features to safeguard users’ financial information and transactions, it’s not entirely free from online threats and fraudulent schemes. Therefore, be cautious and use it responsibly to ensure the most secure experience possible. Remember, any payment system is only as protected as you are careful when handling it.