Zelle vs. Venmo: Which One is Better for You?

Zelle and Venmo are two of the most popular peer-to-peer payment systems, offering convenient, fast, and secure ways to send and receive money. Statistically, Venmo edges out Zelle in popularity by about 10%. At first glance, these services may seem quite similar; however, they’re actually tailored to different needs and user preferences. Understanding the key differences between these two services can help you figure out which one suits your financial habits better.

In this article, we’ll explore the difference between Zelle and Venmo to help you determine which platform lines up better with your needs.

Zelle and Venmo: What Do These Payment Services Offer?

Both Zelle and Venmo are digital payment services for sending and receiving money between friends and family members within the United States. Whether you want to return money to your colleague or split a bill at a restaurant, these apps are there for you.

On the surface level, it may seem that the two services operate similarly, making some people wonder, “Which is better Venmo or Zelle?” However, the apps are not the same, and each of them has some important distinctions.

One major difference between the services is that Venmo works like a digital wallet, letting you store funds within the app, whereas Zelle is purely a transfer service — money moves directly from one bank account to another. Another key point is that Venmo requires a separate app, while Zelle is often integrated right into your bank’s app, provided your bank supports it.

Difference Between Venmo and Zelle: In-Depth Comparison

Choosing between Zelle and Venmo can feel quite challenging because they both offer similar features at first glance. Let’s take a look at Zelle vs. Venmo in more detail.

Fees

Obviously, there is a notable difference in fees between the two. Zelle doesn’t charge any fees for transfers. When you send money using Venmo, on the other hand, there are no fees for standard transfers, which usually take some time. If you need to send money instantly, Venmo charges a 1.75% fee. Likewise, for sending money from your credit card, you’ll be charged a 3% fee. Venmo also has fees for business transactions, which vary slightly. You can also view Venmo business transaction fees, which are slightly different.

Transfer limits

If you decide to use Zelle, it is a good idea to find out about transfer limits beforehand, as they differ from one bank to another. For instance, if your bank doesn’t have a Zelle partnership, the weekly limit on sending money using the app is $500, though you can receive up to — $5,000.

Those with a fully verified Venmo account can send and receive up to $60,000 a week, while a combined limit on purchases is $7,000. So once you know how to add funds to Venmo, you can safely make transfers.

Availability

Neither Venmo nor Zelle can be used for international payments, so only those living in the United States can use these payment services. If you need an app to send money abroad, PayPal or other services might be a better fit.

Compatibility

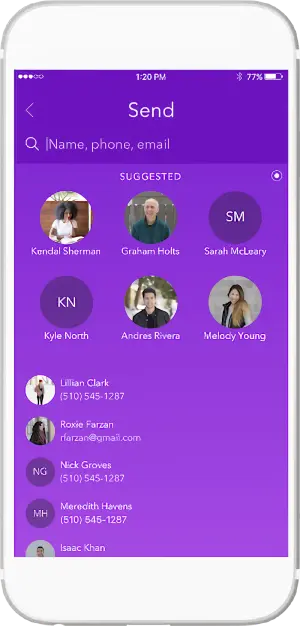

To install Venmo, you need to be an Android or iOS device user. Currently, there is no Windows app available.

Zelle, however, is already built into over 2,000 banking apps. All you have to do to check whether it works with your bank or credit union is search for its name on the official website’s list. You can also download a separate Zelle app for Android or iOS if needed.

Customer Service

Both Zelle and Venmo offer customer support that you can contact in different ways if you have questions or issues.

When using the Venmo app, you can go to the “Get Help” section and use a chat. In a browser, you can also go to the Venmo Help Center to fill out a form. Another option you have is to call (855) 812-4430 from 8 AM to 8 PM CT every day.

If you need to contact Zelle’s team, you can go to the Contact Us page on the official website and fill out a form. If you want your issue to be resolved quicker, you can call 1-844-428-8542 from 10 AM to 10 PM ET.

Venmo or Zelle: Advantages and Disadvantages

Now that you have a basic understanding of Venmo vs. Zelle discussion, let’s review the pros and cons of each platform.

Pros and Cons of Zelle

Zelle advantages:

- No fees for;

- Integrated with many banking apps;

- Instant money transfers;

- Strong security with encryption and fraud monitoring;

- FDIC insured.

Zelle disadvantages:

- No wallet function, meaning it’s impossible to store your money in the app;

- Payments cannot be canceled once sent unless the recipient is not enrolled;

Pros and Cons of Venmo

Venmo advantages:

- Easy-to-use interface with some social media-like features;

- An opportunity to get branded credit and debit cards with additional benefits;

- Can be used for both in-store and online purchases;

- Acts as a digital wallet to store funds.

Venmo disadvantages:

- 1.75% fee for instant transfers;

- Payments are public by default (though you can adjust privacy settings).

You should also keep in mind that Venmo hacked can be quite easily, so you should be careful and follow the rules.

We have already published articles on how to sign up for Venmo, how to use it, and what is a Venmo account on our website.

Final Thought

So, which is better — Zelle or Venmo? Both of the payment services are decently secure, have user-friendly interfaces, and allow you to conveniently send money. Zelle stands out from Venmo with its absence of instant transfer fees, but lacks the wallet feature. So, if you need a wallet function, you should go for Venmo. Ultimately, the right platform depends on your personal needs and how you plan to use it.