Exploring Tax Deductions and Breaks: What You Need to Know

For most of us, navigating the complex world of taxes feels overwhelming. However, getting the hang of tax deductions and breaks will help you potentially increase your earnings. By subtracting certain expenses from your gross income, you can lower your taxable income and cut down your payable tax amount. In contrast, if you overlook or neglect available exemptions when filing your tax return with the IRS, you miss valuable refunds.

Our guide will take you through the intricacies of tax write-offs and explain what can be deducted from taxes to minimize your tax liability and maximize your financial health.

Most Common Tax Deductions Types

The tax-deductible expenses list is approved by the IRS service. It’s reviewed annually, and you can find a current complete list on the IRS website. Before diving in, take a moment to determine whether you will opt for standard deductions or choose to itemize. Broadly, standard write-off and itemization are the two major types of tax exemptions.

Standard Deduction

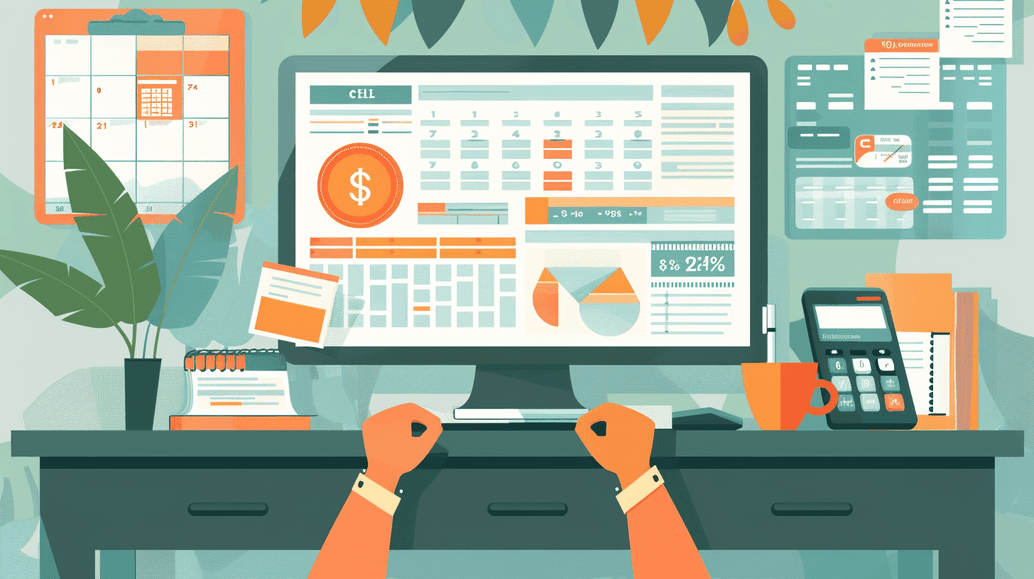

The standard deduction stands as an immovable sum that lowers the income subject to taxation. Simplifying the process of filing, this option is automatically available to all taxpayers who don’t itemize their write-offs. The amount to deduct depends on your filing status and is annually adjusted by the IRS for inflation.

Filing Status | Standard Deduction for 2023 | Standard Deduction for 2024 |

|---|---|---|

Single or married filing separately | $13,850 | $14,600 |

Head of household | $20,800 | $21,900 |

Married spouses filing jointly or qualifying widow(er) | $27,700 | $29,200 |

This type of deduction is beneficial for the majority of taxpayers, reducing taxable income substantially. It is especially advantageous for taxpayers with straightforward financial situations and fewer deductible expenses and for filers with lower income, greatly reducing their tax liability.

Using a backdoor Roth IRA maximize tax can savings and make your refund go further.

Itemized Deductions

This type allows taxpayers to list specific expenses that could be written off from their gross income. It could prove more advantageous for individuals with substantial deductible expenses surpassing the standard deduction. Just remember that you should provide documentary proof for each itemized expense to qualify for exemption.

Common itemized tax deduction examples include:

- Medical and dental expenses that exceed 7.5% of your adjusted gross income (AGI);

- State and local taxes (SALT), including income, sales, and property taxes, subject to a cap;

- Interest on a mortgage for your primary residence;

- Charitable contributions and donations in cash up to 60% of AGI to qualified charitable organizations and causes;

- Losses from federally declared disasters;

- Gambling losses;

- Bad debts, including business and non-business debts;

- Miscellaneous expenses including student loan interest (up to $2,500), federal estate tax on earnings from inherited items, etc.

To understand which are the best tax deductions for you, it’s important to evaluate your financial situation annually and determine which option is the best for you.

If you’re unsure how the deduction works in practice, here’s a refresher on what is standard deduction and how it applies.

Tax Deductions and Tax Credits: How They Stack up

Along with an extensive tax deductions list, you can also come across the notion of tax credits. These credits reduce the total sum you owe on a dollar-for-dollar basis. Unlike deductions, which decrease your taxable income, credits directly diminish your tax liability.

Your eligibility for these credits will depend on several factors, such as your income, family status, and financial assets. There are two types: non-refundable and refundable.

Non-refundable credits can bring your tax liability down to zero, but they cannot lead to a refund. Refundable credits, however, can reduce your tax liability to below zero, leading to a refund and offering a chance for extra savings.

Tax Deductions | Tax Credits |

|---|---|

|

|

Notably, taxpayers can often benefit from both exemption options. However, to balance the best tax write-offs and credits on your IRS Form 1040, you should understand how they differ and closely evaluate both options.

Understanding tax brackets federal income tax is key to planning how much you’ll owe or get back.

Tax Deductions and Breaks Qualification Criteria

Eligibility for the best tax write-offs varies based on individual circumstances, types of expenses, and compliance with IRS rules. While you can always consult with a professional to ensure compliance with all requirements, let’s look into the qualification criteria for the most common tax deductions.

Personal and Dependent Exemptions

These exemptions refer to set amounts taxpayers can deduct from their gross income for themselves and their dependents claimed on their returns. It’s worth noting, though, that these exemptions were suspended from 2018 to 2025 under the Tax Cuts and Jobs Act (TCJA) in 2017. Currently, they are not available. Yet, before 2017, they were available to all taxpayers, no matter their expenses.

For Parents

- Child care credit is available for families with teens below 17 and annual income below $200,000 (or $400,000 on a joint return). In 2023, it was $2,000 per child.

- Child or dependent care credit is provided to cover daily care expenses for a child below 13 and any other family member incapable of self-care. These people should live with you no less than half a year.

- Adoption tax credit is accessible for children below 18 and physically or mentally incapable adults. It’s meant to offset adoption fees and other related expenses. Though it’s a non-refundable break, the unused credit is transferable within 5 years.

For Homeowners

- Mortgage interest deduction of up to $750,000 for loans taken after December 15, 2017, or up to $1 million for older loans.

- Property tax deduction of up to $10,000 ($5,000 if married filing separately) for combined state and local property levies and either income or sales duties.

- Self-employed individuals who use a part of their home exclusively and regularly for business can claim the home office deduction.

- Solar energy tax credit is given for energy-wise home improvements and allows you to refund up to 30% of the solar system installation cost for the installations made between 2022 and 2032.

For Students

- Student loan interest deduction enables borrowers to exempt up to $2,500 of interest paid on the student loan. The exact amount will depend on your income level, and the credit may phase out for higher-income earners.

- American Opportunity Tax credit is available to individuals earning up to $80,000 ($160,000 for joint filings of married couples). The maximum amount is $2,500 per eligible student.

- The lifetime learning credit enables you to claim up to $2,000 per tax return for qualified tuition and related expenses for post-secondary education, excluding living and transportation costs.

For Pensioners

- IRA contribution deduction depends on your income level and whether you or your spouse have a retirement plan at work.

- Saver’s credit is non-refundable and provided for contributions to retirement accounts such as IRAs and 401(k)s. The rate ranges from 10% to 50% of contributions, based on your AGI.

- Tax-free withdrawals from IRAs for qualified medical expenses exceeding 7.5% of AGI for taxpayers 65 and older.

If you’re trying to estimate when will I receive my tax refunds, make sure you’ve filed all documents correctly.

The Most Overlooked Tax Breaks

Taxpayers frequently overlook valuable deductions because they are unaware of them or forget to include them when filing their returns. A few commonly overlooked tax deductions include:

- State sales taxes: Many individuals forget about the option to deduct state sales duties instead of state income levies. It’s a great alternative for those living in states with no state income levy or for those who made significant purchases, such as a car or major home renovation.

- Non-cash Donations: While deducting cash donations to charity, many overlook other forms of charitable contributions such as clothing and household goods, supplies, mileage, etc.

Conclusion

Understanding your tax deduction options and how to take full advantage of the best tax write-offs is essential, whether you file taxes on your own or rely on professional assistance. This knowledge will empower you to make the most of your financial situation, cut down on expenses, and optimize your earnings.