Understanding 1099 Form Meaning and How It Works

You may not be officially employed and not receive a salary from an employer, but if you do receive any income, you still have to deal with tax paperwork. Whether you are a freelancer or an independent contractor, have rental income, or receive dividends, you must report the payments you receive to the Internal Revenue Service (IRS). This is where the 1099 Form comes in, serving as proof that someone has given or paid you money.

So, how does a 1099 work, and what is the purpose of a 1099 Form? Keep reading to learn everything you need to know about this tax document, its types, and its use cases.

What Is a 1099 Tax Form?

What is the 1099 Form meaning? A 1099 Form is an information return used to report payments of $600 or more made to you by someone other than an employer (for example, as an independent contractor) during the year. The payer (company or individual) must issue the form in duplicate — one copy to you and one to the IRS. The purpose of a 1099 Form is to report the non-employment income you received during the year, which must be included in your tax return.

The Purpose of a 1099 Form

So, what is a 1099 Form used for? This document plays a vital role in tax reporting. It records payments an individual received from sources other than an employer and helps the IRS ensure that all taxable income is properly reported. Form 1099 plays a key role in preparing annual tax returns — once you receive it, it’s your responsibility to include the information in your annual tax return.

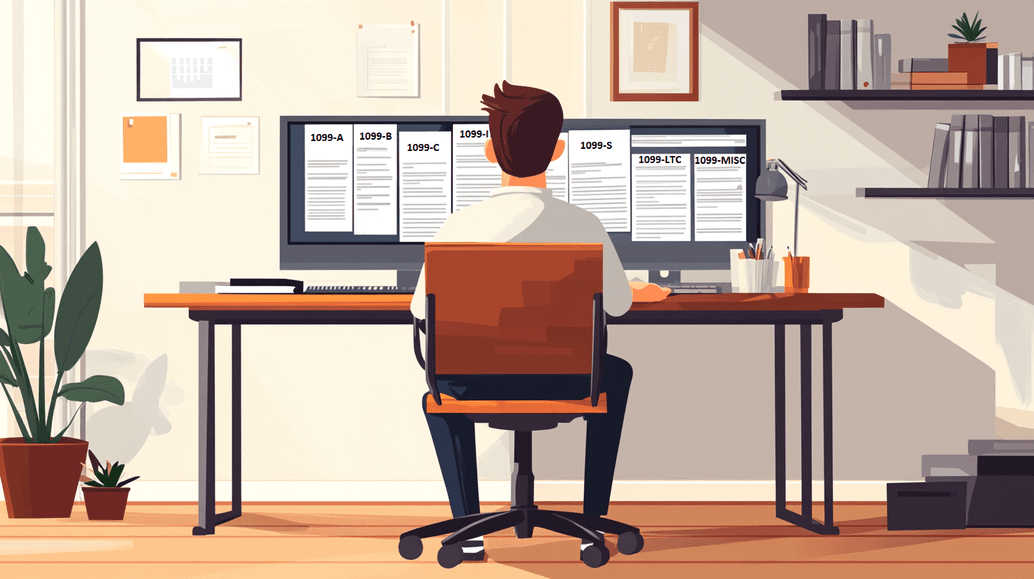

What Are the Types of 1099 Forms?

There are several 1099 types, each tailored to a specific kind of income. The ones you receive depend on the nature and sources of your income during the tax year.

Let’s explore some of the most common types of this tax document you may encounter.

1099-A

Form 1099‑A reports the acquisition or abandonment of secured property. You receive it if your lender acquires an interest in your secured property (for example, through foreclosure) or if you voluntarily surrender the property.

1099-B

Form 1099‑B reports proceeds from broker and barter exchange transactions, including sales of stocks, bonds, commodities, and other securities. If you sold investments through a broker during the year, you’ll receive a 1099‑B showing the gross proceeds from those sales.

1099-C

Form 1099‑C is issued when a creditor cancels or forgives $600 or more of debt you owe. The canceled debt is generally considered income and must be reported on your tax return, unless a specific exclusion applies.

1099-INT

Banks and other payers use Form 1099‑INT to report interest payments of $10 or more made to you during the year. Interest income is usually taxable and must be reported, although certain types of interest, like municipal bond interest, may be exempt.

1099-DIV

Form 1099‑DIV reports dividends and other distributions paid to shareholders. If you receive dividend income, including capital gains distributions, from stocks or mutual funds, it will be documented on Form 1099‑DIV.

1099-K

Form 1099‑K reports payments received through payment card transactions or third-party settlement networks (such as online marketplaces). For 2025, a payer must issue a 1099‑K if payments exceed $2,500 for the year. The threshold was $5,000 in 2024 and will drop to $600 in 2026.

1099-G

Form 1099‑G is issued by federal, state, and local agencies to report certain payments such as unemployment compensation, tax refunds, and other government-related disbursements.

1099-S

Form 1099‑S is used to report proceeds from the sale or exchange of real estate. You must report these sale proceeds on your tax return, even if the transaction does not result in a taxable gain.

1099-LTC

Form 1099‑LTC is used to report long-term care insurance benefits and certain accelerated death benefits under life insurance policies.

1099-MISC

Form 1099‑MISC reports miscellaneous income payments of $600 or more in categories such as rents, royalties, prizes, and awards, and other nonemployee compensation. For example, cash prizes or contest winnings of $600 or more are reported using this form.

Who Receives a 1099 Form?

Form 1099 is widely used and can be issued to a variety of recipients — all of whom receive income that is not considered traditional employment wages. This document is intended for freelancers, independent contractors, and others involved in non-traditional jobs, as well as landlords, investors, and individuals who receive passive income.

Here are a few examples of when you might receive a 1099 Form at the end of the tax year:

- Independent contractors: If you perform services as an independent contractor (not as an employee) and are paid $600 or more by a business or individual, you will receive Form 1099‑NEC reporting those payments.

- Interest income: If you earn $10 or more in interest during the year, you’ll receive 1099‑INT from a bank or other financial institution.

- Rental or royalty payments: If you receive $600 or more during the year, the payer should issue a 1099‑MISC reporting those amounts.

- State or local refunds: If you receive a state or local income tax refund, credit, or offset, you’ll get a 1099‑G from the government agency.

These are just a few scenarios. Overall, Form 1099 is a critical document for reporting any type of income outside of standard wages.

Is a 1099 Required When Filing Taxes?

Yes. Form 1099 is an informational return used to ensure that all taxable income is reported to the IRS. As the recipient, you must include any reportable income on your tax return, whether or not you actually receive a physical 1099.

You do not attach Form 1099 to your tax return. The issuing party submits it directly to the IRS and provides you with a copy for your records. Receiving this form simply means the IRS is aware of the payment. Whether it’s taxable depends on applicable tax law (some reported income may be tax-exempt).

Final Thoughts

Form 1099 plays an essential role in reporting non-employment income to the IRS. According to the 1099 Form definition, any person who receives any kind of reportable income — such as contract payments, investment returns, rental income, or royalties — you can expect to receive the corresponding Form 1099 so that all income is properly reported on tax returns.

Because non-traditional income can take many forms, there are various types of 1099s to match. Whether you’re working as an independent contractor or earning passive income from rentals or investments, make sure you keep track of all income sources and report them accurately when filing your tax return.