Venmo Taxes: What Are the Rules?

Whether you're new to Venmo or have been using it for a while, there are a few important things you can't overlook. Do you have to pay taxes on Venmo? Does Venmo report to the IRS? The simple short is yes. If you’re selling goods or providing services and receiving money via Venmo, you need to take care of your taxes properly to avoid potential penalties. The 1099-K form was designed just for that, and there are specific reporting rules you should be aware of.

Keep reading to learn about the form, deductible expenses, and how to avoid taxes on Venmo if you’re using the app for personal transactions.

If you’re unfamiliar with the platform, it helps to understand what is a Venmo account before diving into tax-reporting rules.

1099-K Form: Who Needs It and How to File It

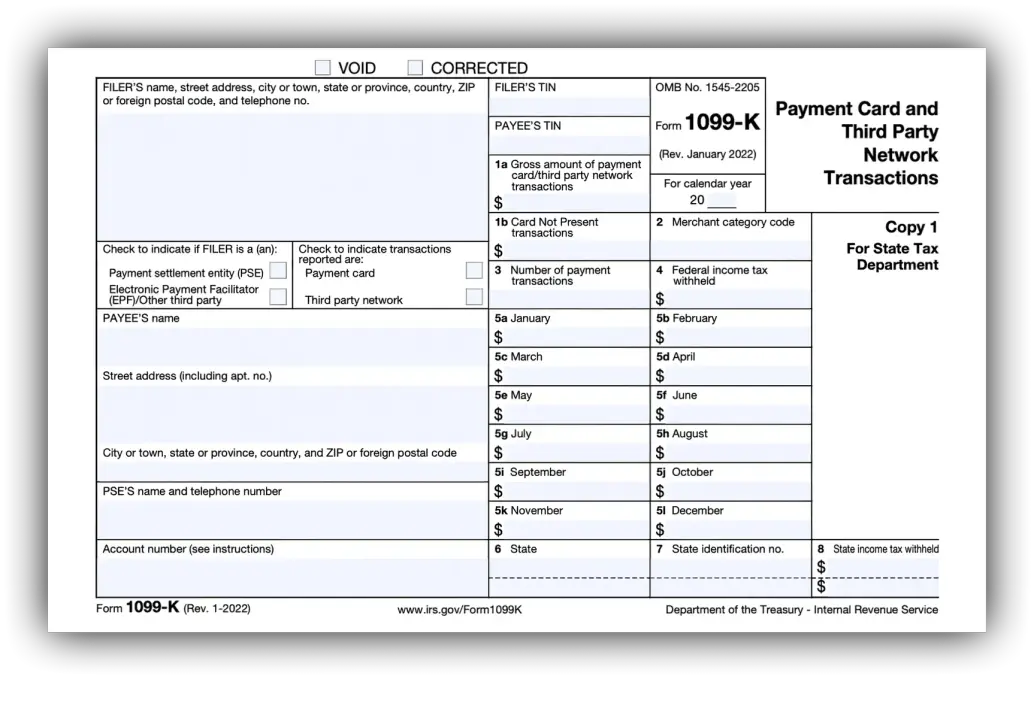

1099-K is an official IRS document used to report payments received through apps, online platforms, and payment processors like Venmo.

The key thing to keep in mind is that Venmo tax reporting is constantly evolving. For instance, in 2023, you were required to report transactions totaling over $20,000 and provide additional details if you made more than 200 transactions in a year.

Also, many users check the current Venmo transfer limit when considering business use of the app.

The IRS plans to gradually lower the taxable threshold to as little as $600, which has already been rolled out in certain states. However, this change won’t happen overnight across the board. For the 2024 tax year, the threshold is set at $5,000 to prevent confusion among taxpayers and minimize instances where non-taxable payments get included by mistake.

Here’s the main information you’ll need to fill out on the 1099-K form for Venmo tax reporting:

- Payee’s/Filer’s taxpayer identification number;

- Payee’s/Filer’s personal information (name, address, etc.);

- Gross payment amount;

- Number of payment transactions;

- Merchant category code;

- Federal income tax withheld;

- State income tax withheld.

You can download the 1099-K directly from the official IRS website.

Reporting Venmo Income: What You Should Know

As Venmo is used for both business and personal transactions, it’s essential to separate the two, as Venmo taxes can get confusing.

Business transactions that fall under the “goods and services” category on Venmo are taxable. If the transaction is flagged as such, Venmo also applies an additional fee of 1.9% plus 10 cents. A good example of such a transaction would be selling a product and receiving payment for it.

Does Venmo report to the IRS for personal use? An example of a non-taxable or personal transaction would be receiving money as a gift or receiving money from a friend when you split dinner costs. Another non-taxable scenario would be selling an item for less than what you originally paid for it.

Some payers and sellers also compare Zelle vs Venmo to decide which app better fits their payment and reporting needs.

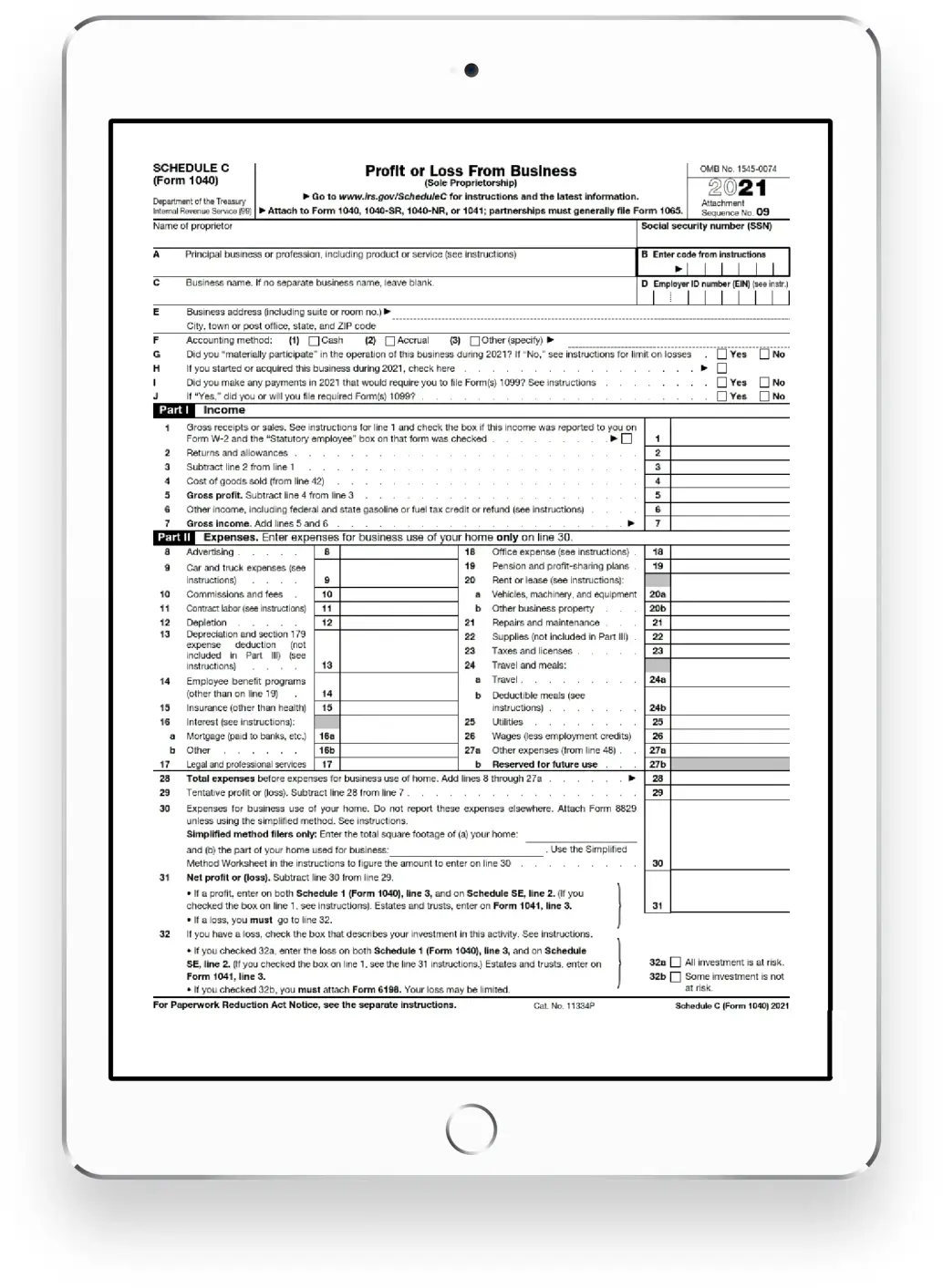

If you are a self-employed individual or a single-member LLC using Venmo for business, you’ll need to fill out Form 1040 and Schedule C. You can download Schedule C from the IRS website. The information you need to provide includes

- Receipts from business-related expenses;

- Business income statements;

- Inventory details;

- Information on vehicle-related expenses (if applicable).

This document is required for annual income tax filings if you are not a W-2 employee.

You might also weigh the pros and cons of Venmo if you’re deciding whether to use it for personal or business payments.

How to Avoid Venmo Tax: Deductible Business Expenses

If you’re using Venmo for more than just receiving payments from clients, you’ll want to make sure your expenses are properly documented.

For example, if you’re paying a contractor for office renovation, you can use Venmo for business purposes. However, to make sure you can prove this happened, you’ll also need a receipt or invoice from the contractor to back up the transaction.

Deducting business expenses is an important part of tax filing, so you need to know about the types of expenses they apply to. Schedule C has a dedicated section you can fill out to deduct your business-related expenses. Common deductible expenses include but are not limited to:

- Contract labor;

- Advertising;

- Insurance;

- Supplies;

- Commission and fees;

- Legal and professional services.

Make sure the expenses you deduct are considered ordinary and necessary for your business. Just enter the amounts into the relevant sections of Schedule C.

Another practical topic is how to add money to Venmo, especially when you rely on the app for customer payments.

Common Tax Mistakes and How to Avoid Penalties

Underreporting your Venmo revenue in your form can lead to hefty penalties. If you misrepresent your income due to negligence, the penalty is 20% of the underpaid tax amount. What is more, interest may also be charged on the penalty, and the starting date for interest can vary based on the type of penalty.

When reporting your Venmo taxes, you need to be extra careful, as even accidental mistakes in numbers and calculations can result in a fine. To avoid triggering a tax audit, you need to:

- Double-check all the calculations in your form and any other numbers, such as your SSN, TIN, etc.

- Include Schedule C if it applies to your situation.

- Be cautious when claiming home office deductions—don’t claim more than what’s reasonable for your income.

- Avoid excessive charitable donations beyond what’s typical for your income bracket.

- Don’t forget to sign your form, as missing a signature is a surefire way to prompt an audit.

For organizations accepting donations, a Venmo for nonprofits guide may explain how reporting and receipts differ from regular transactions.

Final Thought

Venmo is an excellent app for sending and receiving money, so it’s no surprise that it’s widely used for both personal and business transactions. To avoid any issues with the IRS, make sure you’re correctly reporting any income you earn through the platform. Although the paperwork isn’t too extensive, being careful to only report taxable transactions will save you a lot of trouble in the long run.