What is the APR on a Credit Card? [How Does it Work?]

Contents

Whether you plan to get a new credit card or are confused about the conditions of your existing one, it’s crucial to understand the annual percentage rate (APR). What is APR for credit cards, and why is it important? Since APR includes both the interest rate and additional fees, it influences how much money you will have to pay back to the bank for borrowing money. Read on to learn about the concept of APR, the main types, the calculation formula, and the factors that influence it.

Understanding APR for Credit Cards: What It Is and How It Works

Before answering the question “How does APR work on a credit card?”, we should clarify that the term “interest rate” refers to the amount you pay for borrowing money from a provider. So what’s the catch? Here’s the APR meaning on a credit card explained.

APR is the annual percentage rate that reflects the total price you pay for borrowing from your credit vendor yearly. The APR for a credit card combines all annual charges, including the provider’s interest rates and other standard fees.

What Is ApR for a Credit Card, and Why Is It Important?

Understanding APRs allows you to compare credit cards quickly, calculate how much a card will cost you to use one on a daily and monthly basis, and determine whether your APR is based on the prime rate. It also helps you avoid tricky pitfalls like overspending on interest or overlooking fees included in the APR.

How Does Apr Work for Credit Cards?

What does APR mean on a credit card in practice? Each time you borrow money, you may carry a balance that is subject to this percentage rate, added to the amount you owe from month to month. If you don’t pay it off in full according to your credit schedule, you will be paying it back with APR.

When wondering, “What is the APR on a credit card?”, remember that every balance has its own interest rate. And if you carry an additional unpaid balance from previous months, the new percentage rate will be added to it.

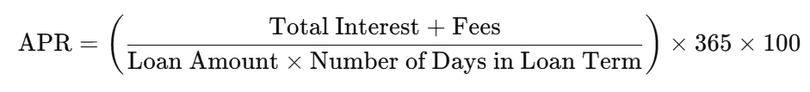

Calculating APR: What Is the Formula?

Do you wonder how you can calculate your APR for specific loan amounts and durations? Now that you understand how APR works on credit cards, let’s look at how to determine your APR. For this, we use the following formula:

For example, let’s say you have a yearly loan of $1,000 and the total interest and fees amount to $200. The loan term is 365. By placing the numbers into the formula, you get a 20% APR.

The higher the percentage you receive, the more money you will have to return for borrowing credit. Generally, for a person with a good credit score, an optimal APR is under 20-22%.

Types of APR Explained

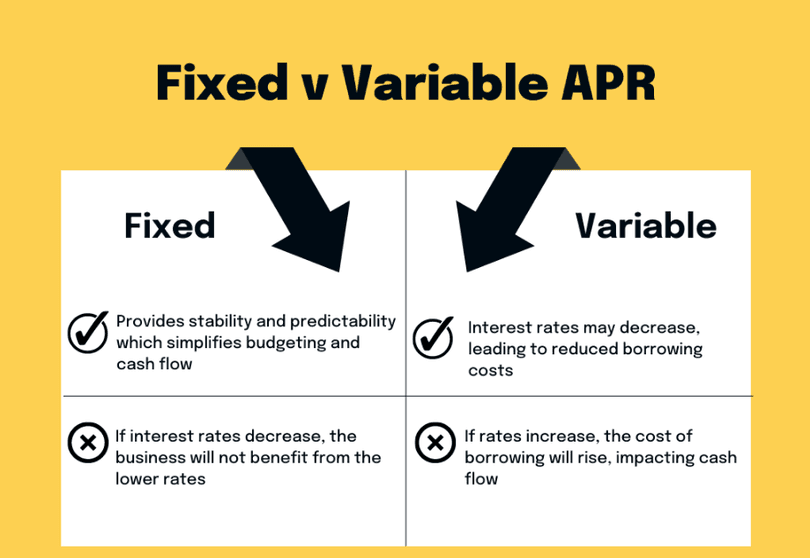

Another thing to keep in mind is that APR differs depending on the type of card you hold and the credit you apply for. That is, your vendor might offer several APRs. Generally, it’s all about whether the annual percentage rate applied to transactions is fixed or variable.

Fixed APR

Your APR remains constant and shouldn't fluctuate significantly with changes in the prime rate. This allows you to plan your purchases and payments easily. However, nothing is permanent, so remember that this APR stays fixed only for a time period. If you miss your payment calendar or violate your credit card agreement, your APR may increase. Your card issuer can also raise a fixed rate at its own discretion with prior notice.

Variable APR

In this case, you clearly understand from the start that your APR will vary in sync with all sudden movements of the underlying index rate. The calculation is transparent as well: the new rate is simply the index plus a market margin or percentage set by your card issuer. Although the variable APR is unpredictable, it can sometimes work in your favor and allow you to pay less than expected when the index drops.

However, these are just the two main APR categories. In practice, there are several additional types of annual percentage rates you may encounter.

1. Purchase APR

This APR applies to all your credit card purchases, whether made online, in-store, or over the phone. It’s the rate most cardholders interact with daily because it affects every regular transaction.

2. Balance Transfer APR

This rate is charged when you transfer a balance from one credit account to another. If you are moving the balance to a new card, make sure to check whether it offers an introductory 0% rate and how long that period lasts. Missing the deadline can result in a sudden jump to the card’s standard APR.

3. Cash Advance APR

This applies when you withdraw cash, buy lottery tickets or casino chips, or exchange foreign currency using your credit card. Cash advances typically come with a noticeably higher APR because they have no grace period. Interest starts accumulating from the moment you withdraw the money, which makes this type of transaction particularly expensive.

4. Introductory/Promotional APR

This type of APR is available for new cardholders but only for specific types of transactions and only for a limited promotional period (usually between 6 and 18 months). It may be significantly lower than the standard APR, and sometimes even as low as 0%. Once the promotional period ends, your regular purchase APR will apply to the remaining balance.

5. Penalty APR

This is the highest APR your issuer can apply. It activates when you miss payment deadlines, exceed your credit limit, or violate the card agreement. Each issuer has different requirements for how long the penalty APR lasts and what you must do to remove it. To avoid triggering this rate, always try to pay your balance or at least the required minimum by the end of each billing cycle.

3 Crucial Factors that Affect Your Credit Card APR

Besides understanding the question “How does credit card APR work?”, there are a few key factors that influence the rate you receive to keep in mind:

1. Credit History

Maintaining a positive credit history and paying your balances on time is essential. Lenders use your credit reports to evaluate your financial behavior. Spoiler alert: a stronger payment history almost always leads to more favorable APR offers.

2. Credit Scores

Your credit score reflects your overall creditworthiness. A higher score shows responsible financial habits and typically earns you a lower APR. Conversely, a low score signals higher risk to the lender, resulting in more expensive borrowing conditions.

3. Card Type

Different credit cards come with different APR structures. Rewards and cashback cards, for instance, often have higher APRs because of the extra benefits they provide. Carrying a balance on such cards can become very costly over time.

Final Thoughts

APR is one of the first factors you should examine when choosing a credit card. It reveals the true cost of borrowing from a financial institution because it includes both interest charges and additional fees. Understanding the different types of APR helps you select the card that best aligns with your spending habits and financial goals. Keep in mind that your credit history, card type, and overall financial profile will all influence your APR. Comparing several credit card offers before applying can help you avoid unexpected charges and choose a credit product that supports your long-term financial well-being.