APR Explained: What It Is and How It Works for Credit Cards

One of the first things to check when selecting a credit card provider is the annual percentage rate (APR). But what is APR for credit cards? Are there many types of APR for a credit card? Understanding this metric and how it’s calculated will help you select the best card tailored to your needs. So, here’s everything you need to know about how APR works and its difference from the usual interest rate.

Understanding APR for Credit Cards: All the Whats and Whys

Before answering the question ‘What does APR mean?’ we should clarify that the term ‘interest rate’ defines the amount of fee you pay for borrowing money from a provider. What’s the catch? Let’s see.

APR for a credit card: Meaning

APR is the annual percentage rate that includes the total price you pay for borrowing costs from your credit vendor yearly. The APR for a credit card unites all annual charges under one dome, meaning the provider’s interest rates and other standard fees.

What is the credit card APR, and why is it important?

Knowing about APRs allows you to quickly compare credit cards and conditions, calculate how much it will cost you to use one, and identify whether your APR will be based on the prime rate or not. You’ll also be able to avoid tricky pitfalls like overspending on interest or missing fees included in the APR.

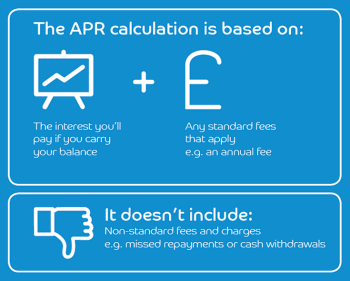

APR payment includes: The interest for unpaid balances + any standard fees applicable to your account. It excludes: Non-standard fees and charges (e.g., missed repayments or cash withdrawals). |  |

How does APR work for credit cards?

What does APR mean on a credit card in practice? Each time you borrow money, you might carry a balance subject to this percentage rate added to the amount you owe from month to month. If you don’t pay it off in full according to your credit schedule, you’ll be paying it back with APR.

When wondering, ‘What is APR on a credit card?’, remember that every balance has its own interest rate. And if you carry an additional unpaid balance from previous months, the new loan’s percentage rate will be added to it.

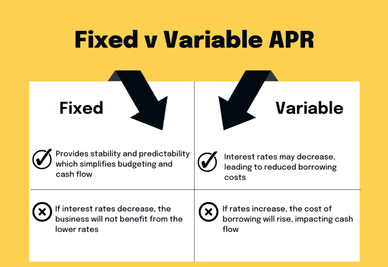

Another thing to keep in mind is that APR differs depending on the type of card you hold and the credit you apply for. So, your vendor might offer several APRs. Generally, it’s all about whether the annual percentage rate applied to every transaction is fixed or variable.

Let’s take a closer look at this difference.

Fixed APR

Your APR remains fixed and isn’t supposed to skyrocket or drop following the drastic changes in the prime rate. This means you can easily plan your purchases and credit payments. However, nothing stays forever, so remember that this APR stays fixed only for a time period. If you miss your payment calendar or violate your credit card agreement somehow, expect your APR to increase. Your card issuer can also raise a fixed rate at its own discretion, providing you with a simple notice.

Variable APR

In this case, you clearly understand from the start that your APR will vary in sync with all sudden movements of any underlying index rate. The calculation is transparent, too. The new rate will be an index plus some market margin/percentage. But even though the variable APR is unpredictable, it may enable you to pay less than expected.

Besides those two main ones, there are also other types of annual percentage rates you should consider:

1. Purchase APR

Applies to all your credit card purchases — online, in-store, or via phone.

2. Balance Transfer APR

Your provider charges it when you transfer your balance from one credit account to another. If you move it to a new card, check an introductory rate-free period to avoid missing the deadlines.

3. Cash advance APR

This applies when you borrow actual cash, buy lottery tickets or casino chips, and exchange currencies. Credit firms favor charging a higher percentage rate for cash advances due to the lack of a grace period. The interest steps into play immediately after you withdraw money.

4. Introductory/Promotional APR

Available for new card users, but only for specific transactions and a limited time (from 6 to 18 months). It might be lower than a standard APR on your account or even down to 0%. You must pay your account’s regular APR when the introductory period ends.

5. Penalty APR

This applies to your balance when you miss payment deadlines or violate the card agreement terms. Providers can have different conditions you’ll have to follow to remove a penalty rate.

3 Crucial Factors that Affect Your Credit Card APR

Besides knowing what APR for a credit card is, you should keep in mind a few factors that influence it:

1. Credit history

Make sure you maintain a positive credit history and pay off your balances on time because authorized companies will use your credit reports to calculate credit scores. Spoiler alert: It also affects the APR!

2. Credit scores

A good credit score results in better creditworthiness for you. It showcases your credit history and financial habits. The higher your score is, the better. This will usually get you a lower APR offer.

3. Card type

Different vendors offer different types of credit cards with varying APR. Rewards credit cards, for instance, typically have the highest interest rates, so carrying a balance on such cards will be expensive.

Final Thoughts

Now you know the APR meaning for a credit card and why it’s important to understand all the tips and tricks for the annual percentage rate. Navigating its types and limitations is essential to avoid overpaying for your purchases or credit cash withdrawals. Moreover, knowing what the credit card APR is can help you choose the best credit card provider that will meet all your needs without leaving you broke.

Key takeaways:

- APR is the total price of borrowing that includes yearly credit card interest rates and other standard fees.

- A good APR for a credit card typically ranges between 17% and 20%.

- When selecting a card issuer, check whether you’ll get a variable or fixed APR.

FAQ

How do I calculate the APR for credit cards?

Creditors use a common approach based on the Daily Periodic Rate (DPR) to calculate the interest charges the APR for a credit card brings. Although interest fees and conditions vary, the general formula looks like this:

[APR/365 = DPR, %] x [your billing cycle days] x [average daily balance] = your monthly interest.

What is the difference between the purchase APR and a credit card interest rate?

At first glance, these two may seem like the same thing. However, depending on the type of loan and transaction, the credit card interest rate can greatly vary from the annual percentage rate. In the purchase APR case, it can include not only your basic credit interest but all additional fees for a borrower, too.

How can I lower my credit card APR?

The best advice we can give you is to keep a good credit score, responsible credit activity, and shiny credit history since they significantly impact the APR offerings you get from creditors. Avoid late payments and don’t carry an unpaid balance for months. Only high scores and impressive creditworthiness will help you get a lower APR for a credit card.