GoHenry Debit Card Reviews: What You Need to Know

Contents

Only 33% of the world’s population is financially literate, leaving approximately 3.5 billion people struggling to manage their budgets effectively. This often results in challenges like rising credit card debt and insufficient savings. How can we address this? A key solution lies in starting financial education early—ideally when children begin managing their own pocket money. Thus, tools like the GoHenry app and its associated debit card offer a practical way to instill financial literacy from a young age.

What is a GoHenry card? It is a debit card paired with a financial management app designed for children aged 6 to 18, naturally, with parental involvement. But how exactly does it teach children financial skills? In this GoHenry review, we’ll explore how the card works and the opportunities it provides to young users.

GoHenry Card Review: How It Teaches Financial Literacy

The GoHenry app offers numerous opportunities for children and teenagers to learn financial literacy. The service has been on the market since 2012 and has established itself as a trusted financial partner for parents in the United States and the United Kingdom.

Here are some key features of the service:

Flexible Top-Up Options

Parents can top up their child’s GoHenry account manually at any time, or set up automatic debiting of a certain amount from their card weekly or monthly. GoHenry top-up can also be performed by third parties, such as relatives or friends. This is very convenient when, for example, you need to congratulate a child on their birthday.

Visa Card Issuance

GoHenry offers its clients the opportunity to obtain a Visa debit card, which can also be personalized with a unique design. If desired, you can put the kid’s name on it and any image from over 45 available ones.

The card works for online and offline in-store purchases and allows cash withdrawals from ATMs with no additional fees.

Robust Parental Controls

While GoHenry provides children with some degree of financial independence, parents retain oversight. They can:

- Set spending limits;

- Specify the places where the card can be used;

- Receive real-time notifications of their children’s purchases;

- Block or unblock the card as needed;

- Manage up to four child accounts from a single parent profile.

Opportunities for Learning and Saving

The service goes beyond simply receiving money and making purchases. Among its functions are numerous features that encourage financial education and saving:

- Savings Goals: Children can allocate a portion of their pocket money toward specific goals.

- Donations: Kids can make charitable contributions, such as donating to the NSPCC (National Society for the Prevention of Cruelty to Children).

- Apple Pay: For users aged 13 and older, the card can be linked to Apple Pay for convenient smartphone transactions.

- Allowance and Chores: The “allowance-and-chores” feature allows parents to assign tasks to kids, who earn additional money upon completion.

- Educational Content: The platform offers users educational videos, quizzes, and stories tailored by the GoHenry card age group (6–11, 12–14, or 15–18, making financial literacy engaging and accessible.

The digital solution’s extensive capabilities and user-friendly interface have led to positive GoHenry reviews and widespread praise, and solidified its reputation as a go-to tool for teaching kids about money. However, when choosing to use it with your family, remember that this app is not free.

GoHenry Debit Card Fees

GoHenry provides two tailored versions for US and UK audiences. Naturally, the tariffs and terms of their use will differ.

For UK customers, GoHenry offers a free one-month trial period. After this, you can choose between two tariff plans: Everyday (£3.99/month per child) and Plus (£5.99/month per child).

The distinction between these plans lies in their functionality:

| Everyday | Plus |

|---|---|---|

Earning on Savings | Not provided | 4.50% |

Cashback | Not accrued | Accrued on all purchases in stores |

Account Top-Up | Free once a month, 50 pence for other transactions | Free unlimited times |

In other respects, the functions of the tool for users of both packages are the same.

In addition to the monthly fee, GoHenry has the following tariffs:

- Card Issuance: Free for standard cards; £4.99 for custom designs.

- ATM Withdrawals: Free.

- Foreign Transactions: No additional fees.

In the US, GoHenry also provides a free one-month trial period. However, the tariff plans differ slightly from those in the UK. The monthly service fee is $4.99 per child, but families with four children can create accounts for all of them for a total of $9.98 per month.

Issuance of a standard Visa card is free for US users. If you prefer a custom-designed card, there’s a $4.99 fee. Other services, including international transactions, ATM withdrawals, and card re-issuance, come with no additional charges.

(Note: Pricing about GoHenry service tariffs is accurate as of November 2024.)

Getting Started with GoHenry

According to positive GoHenry card reviews, membership in the GoHenry community is simple and easy. To do this, you need to follow a few steps:

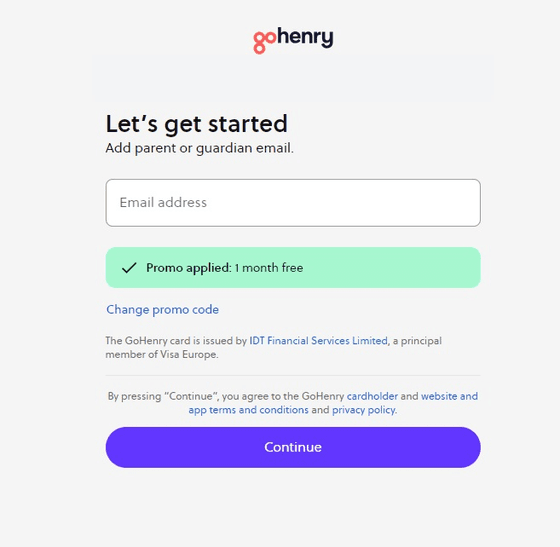

Step 1. Register an Account on the Platform

To do this, click the “Start free trial” button and enter your email address. Then, follow the instructions to register your account.

Step 2. Activate Your Account

Once registered, log into your account and click on Activate Account at the top of the screen. Follow the instructions to set it up. After this, you’ll receive all the necessary details to operate the account: the PIN code for your child’s card and the login/password to access their account.

Step 3. Activate the Child’s Card

Approximately seven days after registration, you’ll receive a debit plastic card by mail. You need to activate it. To do this, log into your account and click the Activate Card button. Follow the on-screen prompts and ensure you have the card on hand, as you’ll need to input specific details, such as the last few digits of the card number.

Step 4. Top Up the Parent Account

To ensure funds for completed tasks, pocket money, and savings interest are credited to your child’s accounts on time, the parent account balance must always remain positive. You can manually top up the parent account or set up automatic top-ups for convenience.

Step 5. Complete the Final Settings

Now, you can set up your child’s card: set withdrawal limits, restrict where the card can be used, and automate monthly or weekly top-ups from the parent account. Once these settings are complete, you can explore additional features, such as assigning tasks to children, setting fees, and earning interest on savings.

If you have any questions or issues while using the service, GoHenry offers 24/7 customer support via phone or email.

Final Thoughts

GoHenry has been empowering children and teenagers to build financial literacy, save, and earn for over a decade. Combining an “allowance-and-chores” app with a debit card provides practical tools for managing money that can be used for online and offline purchases and cash withdrawals from ATMs. The service’s flexible parental control, tailored tariff plans, and consistently positive GoHenry debit card reviews make it a valuable resource for families looking to teach financial responsibility. GoHenry is undoubtedly worth trying!