How to Choose the Best Credit Card for Travel (2024)

Whether you're traveling for business or leisure, travel credit cards can be a game-changer. They come with cool perks, rewards, privileges, bonus offers, and additional travel benefits like free flights.

But what about the annual fees, high credit score requirements, and other potential hassles? Are travel credit cards really worth it? The answer is definitely yes. Keep reading to find out why. Here, you’ll learn everything you need to know to pick your best credit card for traveling, including what factors to take into account when comparing options.

Ideal Travel Credit Card: Key Aspects

The world of travel credit cards is diverse, so there are several important factors to keep in mind when picking the best credit card for travel, ensuring you find your win-win solution.

Match between card terms and your travel goals

First and foremost, you should go for a card with terms that align with your travel preferences and expectations. Depending on what you're looking for, you might want to check out, for example, credit cards tied to a specific airline or hotel chain. Airline cards allow you to rack up miles through their loyalty program, which you can redeem for flights, while hotel chain cards give you points that you can trade in for stays in hotels of a particular chain.

Annual fees

Many travel cards come with annual fees. In most cases, a card with a fee will offer more perks, rewards, and bonuses, but you’ll want to make sure the rewards you earn make up for the cost.

If you're looking for a card that's truly worth it, you might want to consider the best credit cards for travel with high earning potential, low APR, or no annual fee. For example, with a Bank of America Travel Rewards credit card, you won’t have to worry about an annual fee.

Added Edge

With so many options available on the market today, you’re sure to find the best travel credit card for your needs. So, first of all, start by making sure the card offers the travel perks and protections you care about, and then look at extra benefits like free luggage, travel insurance, lounge access, and other services. Some cards even offer a generous welcome bonus right after your first travel purchase. For example, with the AAdvantage Aviator Red World Elite Mastercard, you can earn 60,000 miles after paying the annual fee and making just one purchase.

Remember, your ideal travel card should fit your financial habits, travel preferences, and lifestyle perfectly.

Selecting the Perfect Travel Credit Card

What’s the best travel credit card? It can be tough to decide just based on descriptions. When comparing cards, you’ll need to factor in things like your credit score, annual fee, welcome bonus, international transaction fees, rewards programs, and other perks.

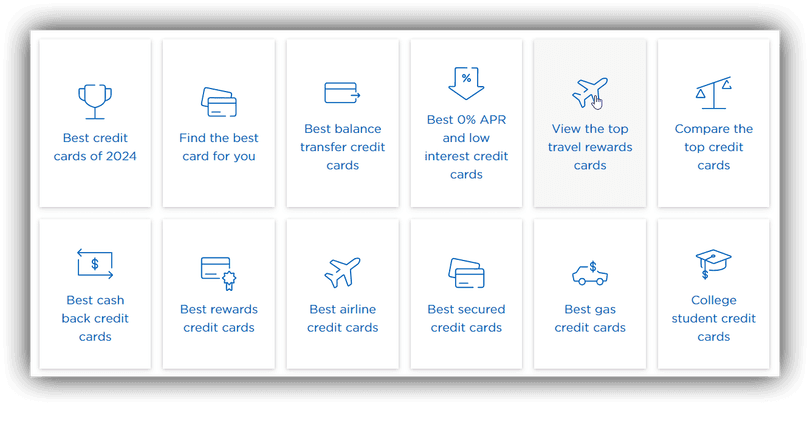

To streamline the comparison process, you can use specialized tools that make it easy to compare travel credit cards with minimal effort and maximum accuracy.

U.S. News & World Report

This tool allows you to select and compare up to three credit cards, ranking their best features, offers, terms and conditions, and more. Just pick the cards that best suit your needs or those that are most frequently compared, and check how well they stack up against each other and your needs.

NerdWallet

This tool allows you to run a side-by-side comparison of up to three credit cards based on key criteria—annual fees, bonus offers, rewards rates, and more. All you have to do is determine the parameters that matter most to you, select two or three cards to compare, and then choose the best option for your needs.

Final Thoughts

For anyone who travels frequently, travel credit cards are not just a convenient way to book and pay for trips; they also offer valuable rewards that can offset expenses and provide extra benefits. There are no best credit cards to earn travel points for everyone; you can definitely find an option that suits your specific needs. To make the most out of a travel credit card, you’ll want to choose one that matches your travel goals, financial habits, and lifestyle.

- Decide on your key goals, needs, and preferences.

- Look for cards with terms that match your expectations and offer the right travel rewards program for you.

- Calculate the earning potential and make sure the annual fee is worth it, considering the perks, rewards, and benefits.

- Check out additional benefits as well as sign-up bonuses.

- Use comparison tools to evaluate two or three best travel credit cards to find the perfect one for you.